Free 4 Point Inspection PDF Form

Misconceptions

- Misconception 1: The 4 Point Inspection guarantees coverage.

- Misconception 2: Any inspector can complete the form.

- Misconception 3: The inspection is only about the roof.

- Misconception 4: Photos are optional.

- Misconception 5: The inspection is a warranty for system longevity.

- Misconception 6: All deficiencies must be fixed before the inspection.

- Misconception 7: The inspector can sign off on all sections regardless of expertise.

- Misconception 8: The inspection form is the only document needed for insurance applications.

- Misconception 9: The inspection process is quick and can be done in a few minutes.

This is incorrect. The inspection is a tool for assessing insurability but does not guarantee that coverage will be provided. Underwriting will evaluate the information but may still deny coverage based on other factors.

Only a Florida-licensed inspector can complete the 4 Point Inspection form. This requirement ensures that the evaluation is performed by a qualified professional familiar with local codes and standards.

The 4 Point Inspection covers four critical systems: roof, electrical, HVAC, and plumbing. Each system is evaluated for safety and functionality, not just the roof.

Photos are mandatory and must accompany the inspection form. They serve as visual documentation of the condition of each system and help support the findings of the inspector.

The inspection does not serve as a warranty or assurance of the longevity or fitness of any system. It merely documents the condition at the time of inspection.

While it is beneficial to address known issues, the inspection will note any existing deficiencies. This information is crucial for underwriting decisions.

An inspector can only sign off on the sections relevant to their specific trade. For example, an electrician can only certify the electrical system, not the plumbing or HVAC systems.

While the 4 Point Inspection form is essential, additional documentation may be required, depending on the insurer's policies and the property's condition.

The inspection requires thorough evaluation and documentation. Rushing through the process can lead to missed issues and inaccurate reporting.

What to Know About This Form

What is a 4 Point Inspection Form?

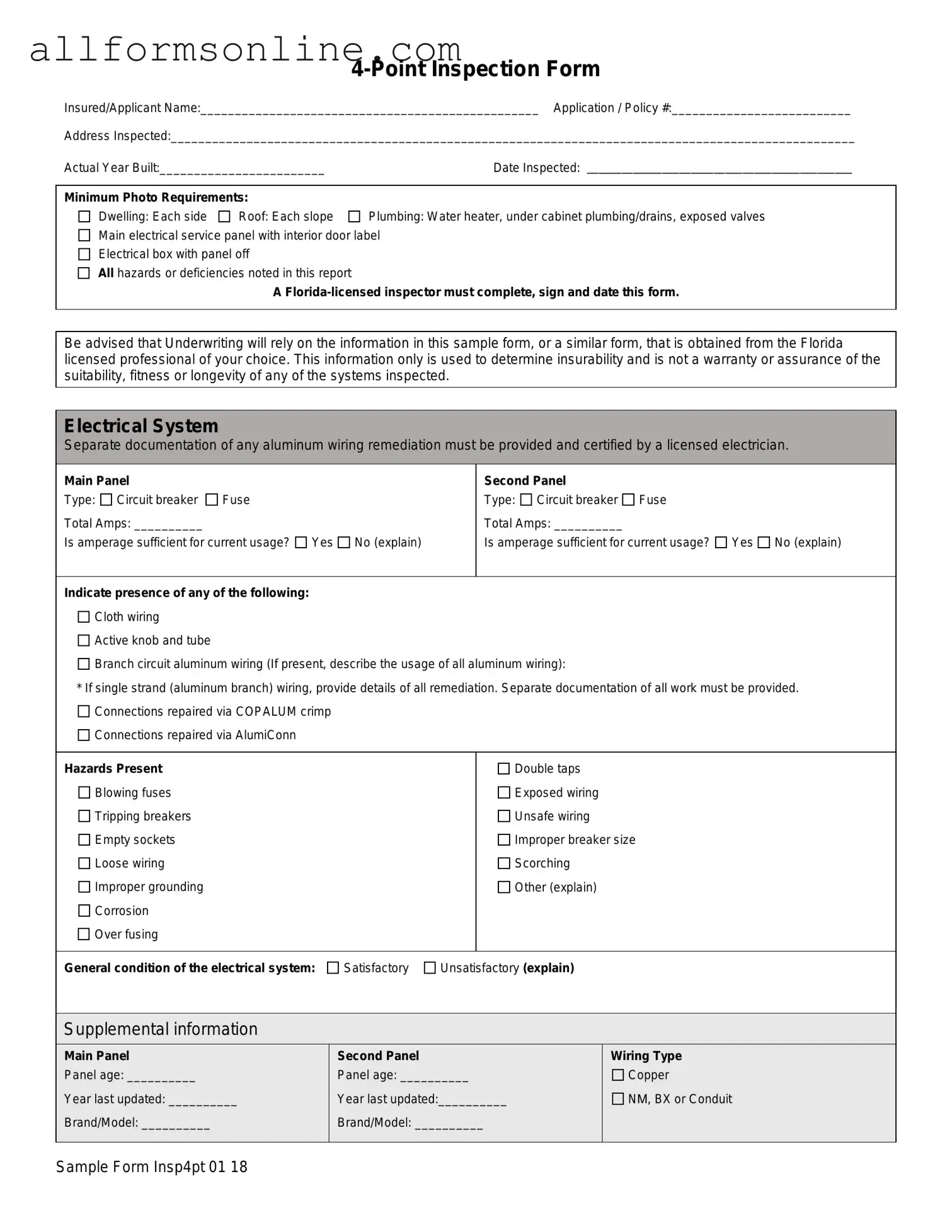

The 4 Point Inspection Form is a document used primarily in Florida to assess the condition of four key systems in a home: the roof, electrical, HVAC (heating, ventilation, and air conditioning), and plumbing. This form helps insurance companies determine whether a property is insurable based on the current state of these systems.

Who needs to complete the 4 Point Inspection Form?

A licensed inspector in Florida must complete, sign, and date the 4 Point Inspection Form. This inspector can be a general contractor, building code inspector, home inspector, or a trade-specific licensed professional, such as an electrician or plumber, who may only sign off on their respective sections.

What information is required on the form?

The form requires details such as the insured/applicant's name, application or policy number, address of the property, and the year it was built. Additionally, it includes sections for each system being inspected, along with specific questions about their condition and any visible hazards.

What are the minimum photo requirements?

Photos must accompany the 4 Point Inspection Form, showing each side of the dwelling, each slope of the roof, the water heater, under-cabinet plumbing, exposed valves, and the main electrical service panel. These images help verify the information provided in the inspection.

How does the inspection affect my insurance application?

Insurance companies use the information from the 4 Point Inspection Form to evaluate the insurability of a property. If any systems are found to be in poor condition or if there are visible hazards, it may impact your ability to obtain coverage.

What happens if the inspection reveals issues?

If the inspection identifies any deficiencies or hazards, it is important to address these issues before submitting your insurance application. The agent is responsible for ensuring that the application meets all requirements, including having systems in good working order.

Is the 4 Point Inspection Form mandatory for all insurance applications?

While the 4 Point Inspection Form is not the only acceptable document, it provides the minimum level of detail required for underwriting. Any alternative inspection report submitted must include similar information to be considered valid.

How often should I get a 4 Point Inspection?

It is advisable to have a 4 Point Inspection performed when applying for a new insurance policy, especially if the property is older or if significant renovations have been made. Regular inspections can help identify issues before they become serious problems.

What if I have additional comments or observations after the inspection?

The form includes a section for additional comments or observations. This space allows the inspector to note any updates made to the systems, visible hazards, or any systems that are not functioning properly. Detailed descriptions help provide a clearer picture of the property's condition.

Different PDF Forms

Australian Passport Application Form - Keep your passport secure to prevent unauthorized use.

For individuals seeking to ensure their wishes are respected, the guidance on crafting a Last Will and Testament is invaluable. This crucial document facilitates the organized distribution of assets and provides clarity on guardianship matters, ensuring peace of mind for both the individual and their loved ones.

Downloadable Free Printable Spanish Job Application Form - Indicate any times you are unavailable to help employers schedule shifts effectively.

Terminating Parental Rights in Sc - The form aims to clarify and solidify the rights of both biological parents.

How to Use 4 Point Inspection

Filling out the 4 Point Inspection form requires careful attention to detail. Each section must be completed accurately to ensure that the information provided is reliable and helpful for the underwriting process. After completing the form, it will need to be signed by a Florida-licensed inspector. This ensures that the inspection is valid and meets the necessary requirements.

- Start by entering the Insured/Applicant Name at the top of the form.

- Fill in the Application / Policy #.

- Provide the Address Inspected in the designated space.

- Record the Actual Year Built of the property.

- Enter the Date Inspected.

- Gather the required photos of the dwelling, roof, plumbing, and electrical systems as specified.

- Complete the Electrical System section, noting the type of panel, total amps, and any hazards present.

- Assess and document the HVAC System condition, including age and last service date.

- Evaluate the Plumbing System for leaks and the condition of fixtures, including age of piping.

- Inspect the Roof and provide details on the covering material, age, and any visible damage.

- Fill out the Additional Comments/Observations section if necessary.

- Ensure that the form is signed and dated by a verifiable Florida-licensed inspector.