Free Acord 130 PDF Form

Misconceptions

- Misconception 1: The Acord 130 form is only for large businesses.

- Misconception 2: Completing the Acord 130 form is optional.

- Misconception 3: The Acord 130 form only collects basic information.

- Misconception 4: All information on the form is confidential and cannot be shared.

- Misconception 5: The Acord 130 form guarantees insurance coverage.

This form is applicable to businesses of all sizes. Small businesses often need workers' compensation insurance just as much as larger enterprises do.

In many cases, submitting this form is a requirement for obtaining workers' compensation insurance. It provides essential information that insurers need to assess risk and determine premiums.

While it does gather basic details, the form also requests comprehensive information about the business operations, employee classifications, and previous insurance history. This data is crucial for accurate underwriting.

While personal and sensitive information is protected, some details may be shared with relevant parties involved in the underwriting process or as required by law.

Filling out the form does not guarantee that coverage will be issued. Insurers will review the information and make a decision based on their underwriting guidelines.

What to Know About This Form

What is the purpose of the ACORD 130 form?

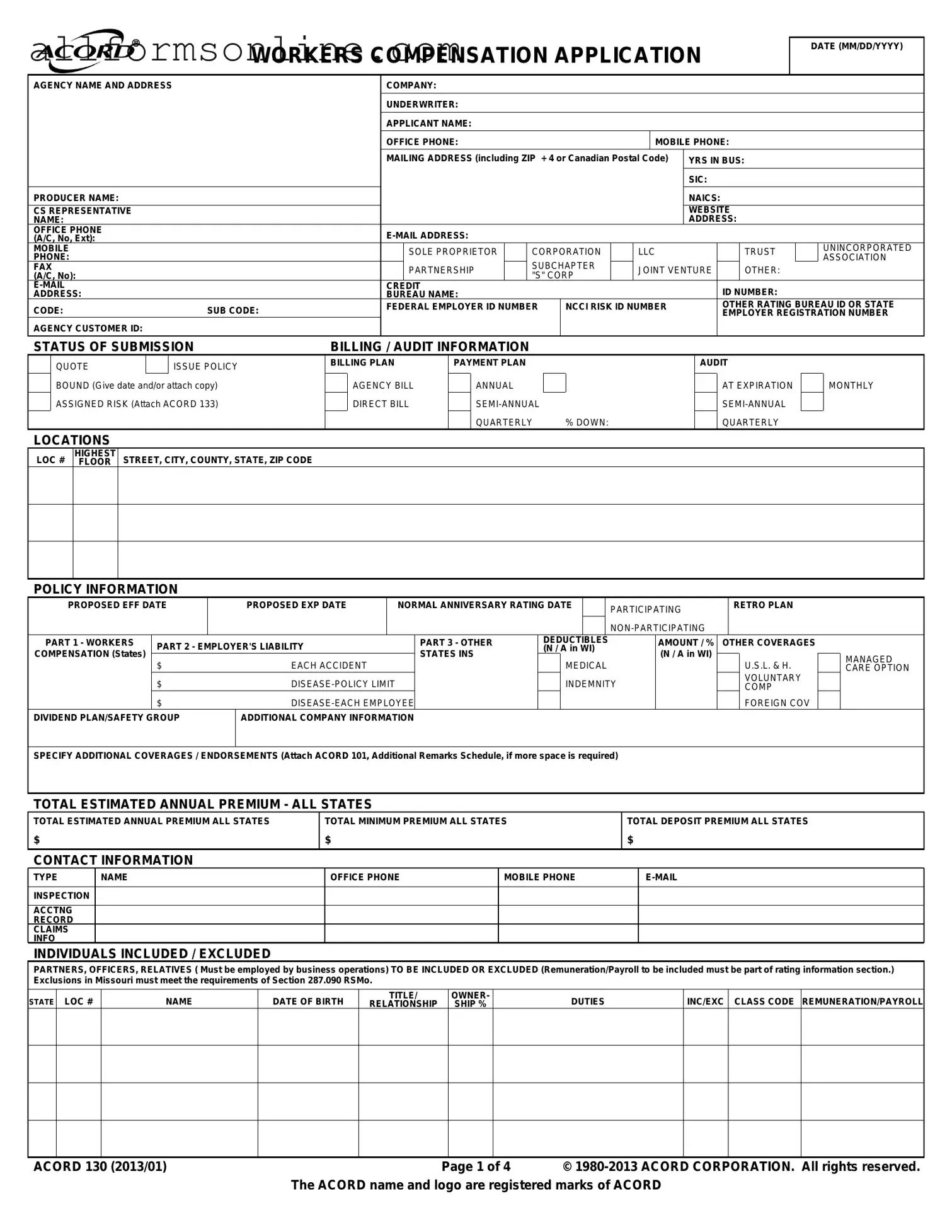

The ACORD 130 form is primarily used for applying for workers' compensation insurance. It collects essential information about the applicant's business, including details about operations, employee classifications, and prior insurance history. This information helps insurers assess risk and determine appropriate coverage and premium rates. By providing a comprehensive overview of the business, the form facilitates a smoother underwriting process, ensuring that both the insurer and the applicant have a clear understanding of the coverage needed.

What information do I need to provide on the ACORD 130 form?

When completing the ACORD 130 form, applicants must provide various details. Key information includes the agency name and address, applicant name, contact numbers, and business structure (such as corporation or LLC). Additionally, you will need to specify the nature of your business, estimated annual payroll, and any past claims history. It’s also crucial to disclose any additional coverages or endorsements required. All these details help insurers evaluate the risk associated with insuring your business.

How does the ACORD 130 form affect my workers' compensation premium?

The information provided on the ACORD 130 form directly influences your workers' compensation premium. Insurers use the data to assess various risk factors, including the nature of your business operations, employee classifications, and prior claims history. For instance, businesses with a higher risk of injury may face higher premiums. Conversely, companies with a strong safety record and lower risk may benefit from lower rates. Accurate and complete information on the form can help ensure that you receive a fair premium based on your specific circumstances.

What should I do if I need to make changes after submitting the ACORD 130 form?

If changes are necessary after submitting the ACORD 130 form, it is essential to contact your insurance agent or broker promptly. They can guide you through the process of updating the information. Depending on the changes, it may affect your coverage or premium, so timely communication is crucial. Always keep a record of any modifications made and ensure that your insurer has the most current information to avoid potential issues with coverage or claims in the future.

Different PDF Forms

What Do Immunization Records Look Like - Documentation of vaccines helps ensure children are protected against preventable diseases.

In California, the importance of having a properly completed Motor Vehicle Bill of Sale cannot be overstated, as it not only confirms the transfer of ownership but also protects both the seller and the buyer from potential disputes. For those looking for assistance in drafting this document, resources like Fast PDF Templates can provide valuable templates and guidance to ensure compliance with state regulations.

Dd Form 2870 Army Pubs - By filling out the DD 2870, service members can control who accesses their medical data.

How to Use Acord 130

Filling out the ACORD 130 form is an essential step in applying for workers' compensation insurance. This form collects vital information about your business, including its structure, operations, and insurance needs. To ensure accurate processing, follow these steps carefully.

- Begin by entering the date in the format MM/DD/YYYY.

- Fill in the agency name and address.

- Provide the company name and underwriter details.

- Enter the applicant's name and contact numbers, including office and mobile phone.

- Complete the mailing address, including the ZIP code.

- Indicate the years in business and the appropriate SIC and NAICS codes.

- Provide the producer name and contact details, including email address.

- Specify the business structure by selecting one from the options such as sole proprietor, corporation, LLC, etc.

- Fill in the federal employer ID number and any other relevant identification numbers.

- Indicate the status of submission and select the appropriate billing options.

- List the locations where business operations occur, including the highest street address.

- Provide the policy information, including proposed effective and expiration dates.

- Complete the sections on workers compensation and employer's liability coverage.

- Detail any additional company information and specify any extra coverages or endorsements.

- Estimate the annual premium amounts and fill in the necessary contact information.

- List any individuals included or excluded from coverage.

- Provide prior carrier information and loss history for the past five years.

- Describe your nature of business and operations thoroughly.

- Answer the general information questions honestly, especially those that require "yes" or "no" responses.

- Sign the form, ensuring that the signature is from an authorized representative of the applicant.