Free Broker Price Opinion PDF Form

Misconceptions

Understanding the Broker Price Opinion (BPO) form is essential for anyone involved in real estate transactions. However, several misconceptions can cloud its purpose and function. Here are five common misunderstandings about the BPO form:

- A BPO is the same as a formal appraisal. Many people believe that a Broker Price Opinion is equivalent to a professional appraisal. While both documents aim to estimate property value, a BPO is typically less comprehensive and is often based on the broker's expertise and market knowledge rather than a detailed analysis of the property.

- Only banks and lenders use BPOs. Some individuals think that only financial institutions request BPOs. In reality, BPOs can be useful for a variety of stakeholders, including real estate agents, investors, and homeowners looking to understand their property’s market position.

- BPOs are only for distressed properties. There is a misconception that BPOs are exclusively for properties in foreclosure or needing significant repairs. However, BPOs can be used for any residential property, regardless of its condition, to assess current market value.

- The BPO process is quick and straightforward. While BPOs can be completed faster than formal appraisals, the process still requires careful consideration of various factors such as market conditions, comparable sales, and property specifics. Rushing through a BPO can lead to inaccurate valuations.

- A BPO guarantees a sale price. Some people mistakenly believe that a Broker Price Opinion guarantees the sale price of a property. Instead, a BPO provides an estimated value based on current market trends and comparable sales, but it does not ensure that the property will sell at that price.

By addressing these misconceptions, stakeholders can better understand the role of the BPO in real estate transactions and make more informed decisions.

What to Know About This Form

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion (BPO) is a professional assessment of a property's market value, typically prepared by a licensed real estate broker. It helps lenders, buyers, and sellers understand the current market conditions and what a property might sell for. BPOs are often used in situations like foreclosures, short sales, or when determining the value of a property for financing purposes.

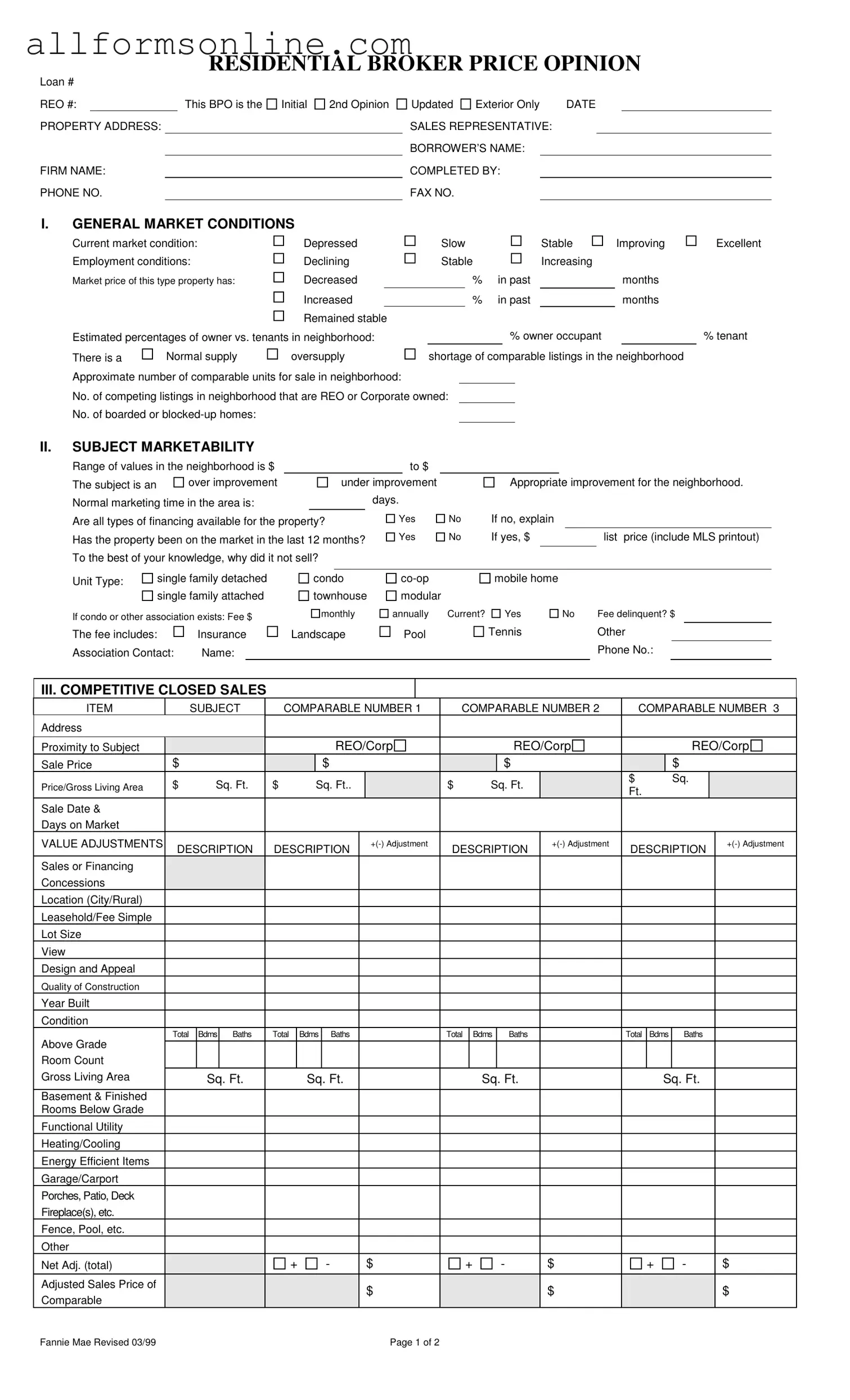

What information is included in a BPO form?

A BPO form includes several key sections. It covers general market conditions, such as employment trends and housing supply. It also assesses the subject property's marketability, comparing it to similar properties (comps) in the area. Details about repairs, marketing strategies, and competitive listings are also included. This comprehensive approach helps provide a clear picture of the property's value.

How is the market value determined in a BPO?

The market value in a BPO is determined by comparing the subject property to similar properties that have recently sold in the area. Adjustments are made based on differences in size, condition, location, and features. The final value is suggested based on these comparisons and the current market conditions.

Who uses a Broker Price Opinion?

Various parties utilize BPOs. Lenders often request them to evaluate properties for loans or foreclosures. Buyers and sellers may also use them to understand a property's value before making decisions. Real estate agents may prepare BPOs for clients to help guide pricing strategies in the market.

What is the difference between a BPO and an appraisal?

While both BPOs and appraisals aim to determine property value, they differ in their processes and purposes. An appraisal is typically more formal and detailed, conducted by a licensed appraiser. It often follows strict guidelines and is used for legal and financial transactions. A BPO is less formal and can be completed more quickly, making it a cost-effective option for certain situations.

Can a BPO be used for financing purposes?

Yes, a BPO can be used for financing purposes, but it may not always replace a formal appraisal. Lenders may accept a BPO for certain types of loans, especially in cases where time or cost is a concern. However, for larger loans or specific requirements, a full appraisal may still be necessary to meet regulatory standards.

Different PDF Forms

Excel Bar Chart - Consider audience understanding when adding details.

Adp Paystub - Employers have a responsibility to provide accurate pay stubs, and ADP helps facilitate that process.

The California Release of Liability form is an essential legal document that protects both individuals and organizations from potential liability in various activities. This form outlines the inherent risks associated with these activities, ensuring that participants are fully aware and acknowledge such risks before engaging. For those seeking templates or further information, resources like Fast PDF Templates can provide valuable assistance in creating a comprehensive and effective release form.

Proof Paperwork Positive Planned Parenthood Pregnancy Test Results - Contact information is critical for follow-up regarding your test results.

How to Use Broker Price Opinion

Filling out the Broker Price Opinion (BPO) form requires careful attention to detail. Each section of the form is designed to gather specific information about the property and its market conditions. Completing this form accurately can provide valuable insights for potential buyers and lenders. Below are the steps to guide you through the process.

- Begin by entering the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS, FIRM NAME, PHONE NO., and the DATE.

- Indicate if this is an Initial, 2nd Opinion, or Updated BPO.

- Complete the SALES REPRESENTATIVE and BORROWER’S NAME fields.

- In section I, assess the CURRENT MARKET CONDITIONS and select the appropriate options regarding employment conditions and market prices.

- Estimate the percentage of owner occupants versus tenants in the neighborhood.

- Evaluate the supply of comparable listings and input the approximate number of units available.

- In section II, determine the SUBJECT MARKETABILITY by providing a range of values and assessing the property’s improvement status.

- State the normal marketing time and whether all types of financing are available for the property.

- Indicate if the property has been on the market in the last 12 months and provide the list price if applicable.

- Identify the Unit Type and any association fees, if applicable.

- Proceed to section III and list COMPARABLE CLOSED SALES. Enter details for each comparable property, including address, sale price, and adjustments.

- In section IV, outline the MARKETING STRATEGY and the necessary repairs.

- Document all repairs needed in section V, including costs and total expenses.

- In section VI, complete the COMPETITIVE LISTINGS section by entering similar details as in section III.

- Finally, calculate the MARKET VALUE and suggested list price, and provide any additional comments or concerns in the designated area.

- Sign and date the form at the bottom.