Blank Business Bill of Sale Form

Misconceptions

The Business Bill of Sale form is an important document for transferring ownership of a business or its assets. However, several misconceptions surround its use and purpose. Here are six common misunderstandings:

-

It is only needed for large businesses.

Many believe that only large businesses require a Bill of Sale. In reality, any business transaction involving the sale of assets or ownership can benefit from this document, regardless of size.

-

It is the same as a purchase agreement.

While both documents are related to sales, a Business Bill of Sale specifically confirms the transfer of ownership, whereas a purchase agreement outlines the terms of the sale.

-

It is not legally binding.

Some people think that a Bill of Sale is merely a formality. In fact, when properly executed, it is a legally binding document that can protect both the buyer and seller in case of disputes.

-

It does not need to be notarized.

While notarization is not always required, having a Bill of Sale notarized can add an extra layer of authenticity and may be necessary for certain transactions or states.

-

It only covers physical assets.

Many assume that a Business Bill of Sale only applies to tangible assets. However, it can also cover intangible assets, such as intellectual property or goodwill.

-

It is a one-size-fits-all document.

Some believe that a generic Bill of Sale template will suffice for any transaction. Each sale is unique, and it is essential to tailor the document to reflect the specific details of the transaction.

What to Know About This Form

What is a Business Bill of Sale?

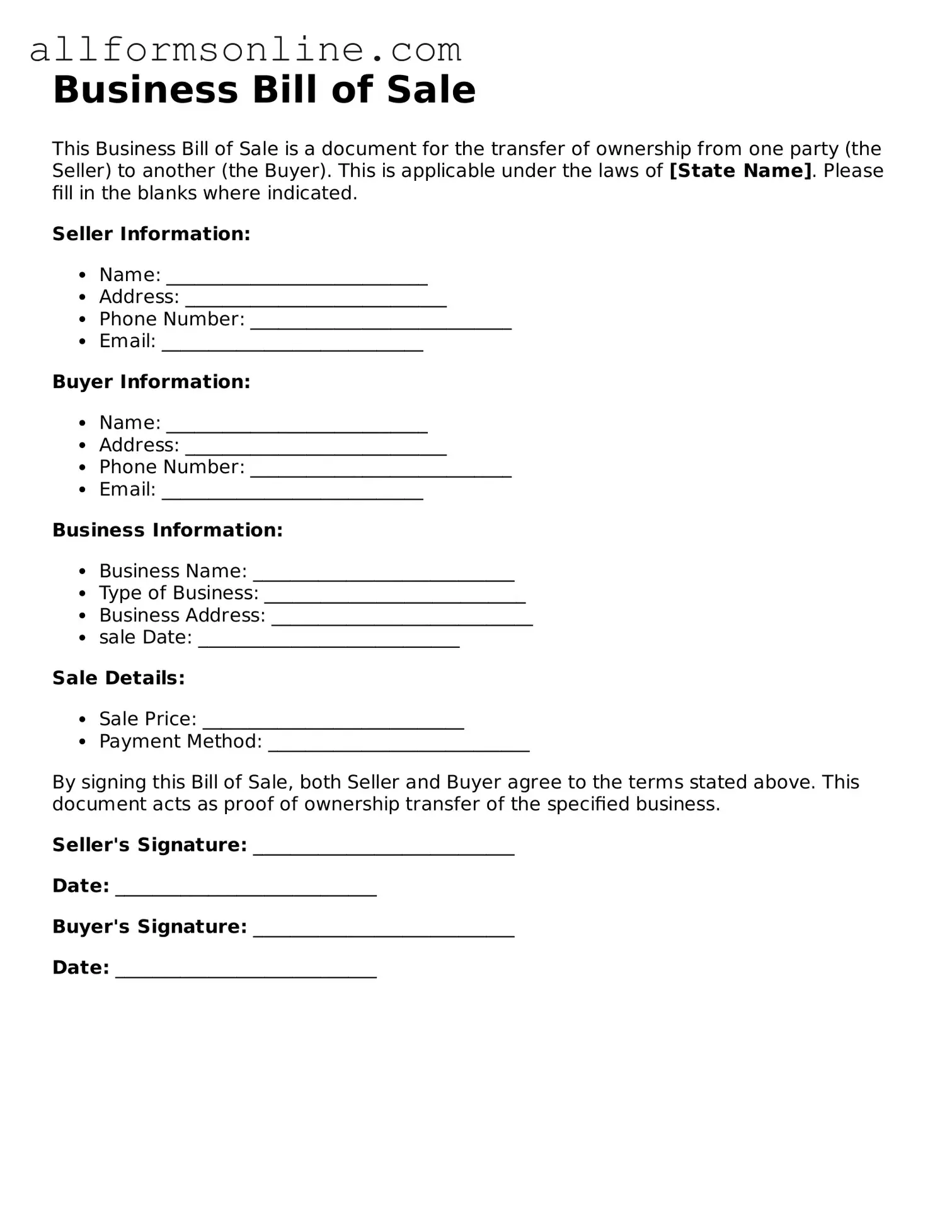

A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. This form outlines the details of the transaction, including the purchase price, the items being sold, and the parties involved. It serves as proof of the sale and protects both the buyer and seller during the transfer process.

When do I need a Business Bill of Sale?

You need a Business Bill of Sale when you are selling or purchasing a business or its assets. This document is essential for transactions involving equipment, inventory, or other tangible assets. It is also useful for tax purposes and may be required by local or state regulations.

What information is included in a Business Bill of Sale?

The form typically includes the names and addresses of both the buyer and seller, a description of the business or assets being sold, the purchase price, and the date of the transaction. Additionally, it may contain any warranties or representations made by the seller about the business or assets.

Is a Business Bill of Sale legally binding?

Yes, a Business Bill of Sale is a legally binding document once both parties sign it. This means that both the buyer and seller are obligated to adhere to the terms outlined in the agreement. However, it’s important to ensure that the document is properly completed and signed to enforce its terms.

Do I need a notary for a Business Bill of Sale?

Can I use a Business Bill of Sale for any type of business?

Yes, a Business Bill of Sale can be used for various types of businesses, whether it's a sole proprietorship, partnership, or corporation. However, specific requirements may vary depending on the type of business and local laws, so it’s advisable to check with local regulations.

What should I do after completing the Business Bill of Sale?

After completing the Business Bill of Sale, both parties should keep a copy for their records. It’s also a good idea to file the document with any relevant local or state authorities, especially if the sale involves significant assets or changes in business ownership. This helps ensure compliance with any applicable laws.

Popular Business Bill of Sale Types:

How to Write a Bill of Sale for a Dirt Bike - Use this form to officially record the sale of your dirt bike.

To further enhance your understanding of the Arizona Bill of Sale, it is advisable to refer to resources that provide templates and examples, such as arizonapdfs.com/bill-of-sale-template/, which can aid in properly drafting this important document.

How to Use Business Bill of Sale

Completing the Business Bill of Sale form is a crucial step in the process of transferring ownership of a business. Accurate and thorough information is essential to ensure that both parties are protected and that the transaction is legally binding. Follow the steps below to properly fill out the form.

- Begin by entering the date of the transaction at the top of the form.

- Provide the full legal name of the seller, including any business entity designation (e.g., LLC, Inc.).

- Next, fill in the seller's address, including street, city, state, and zip code.

- Enter the buyer's full legal name, ensuring it matches any identification or business registration.

- Include the buyer's address, formatted the same way as the seller's address.

- Clearly describe the business being sold, including its name, location, and any relevant details that define the business's operations.

- List any assets included in the sale, such as equipment, inventory, or intellectual property, and provide a brief description of each.

- Specify the total purchase price for the business and any payment terms, including deposits or financing arrangements.

- Include the signatures of both the seller and buyer, along with the date of signing.

- If applicable, have a witness sign the form and include their printed name and address.

After completing the Business Bill of Sale form, both parties should retain a copy for their records. This document serves as proof of the transaction and may be required for future reference or legal purposes. Ensure that all information is accurate and that both parties understand the terms before finalizing the sale.