Free Business Credit Application PDF Form

Misconceptions

When it comes to the Business Credit Application form, several misconceptions can lead to confusion. Understanding these misconceptions can help streamline the application process and ensure a smoother experience. Here are seven common misconceptions:

-

It’s only for large businesses.

Many believe that only large corporations can apply for business credit. In reality, small businesses and startups can also benefit from this application, provided they meet the necessary criteria.

-

Personal credit is not considered.

Some applicants think that their personal credit history does not matter. However, lenders often review personal credit scores, especially for small businesses, to assess risk.

-

All applications are approved.

Many assume that submitting an application guarantees approval. Approval depends on various factors, including creditworthiness, financial history, and business stability.

-

It’s a quick process.

Some expect immediate results after submitting their application. The review process can take time, as lenders need to evaluate the information provided thoroughly.

-

Only financial information is required.

Applicants often think that only financial data is necessary. In fact, personal information, business structure, and operational details are also crucial for a comprehensive evaluation.

-

Once submitted, it cannot be modified.

There’s a belief that submitted applications are set in stone. However, applicants can often amend their forms if they realize they need to correct or add information.

-

All lenders use the same criteria.

Some think that all lenders evaluate applications in the same way. In truth, each lender has its own criteria, which can lead to different outcomes for similar applications.

By clarifying these misconceptions, applicants can approach the Business Credit Application process with a better understanding and increased confidence.

What to Know About This Form

What is a Business Credit Application form?

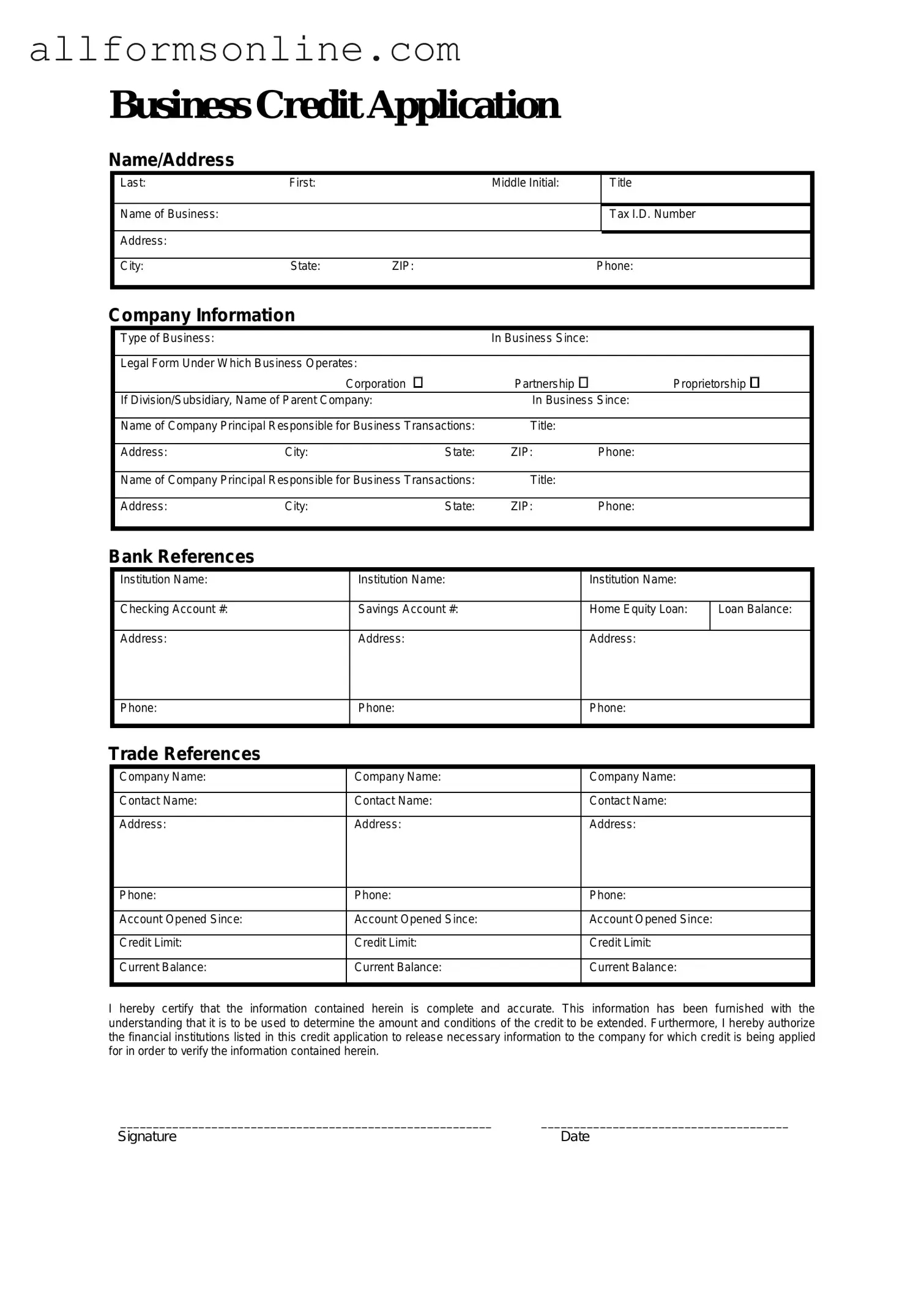

A Business Credit Application form is a document that businesses fill out to apply for credit from a lender or supplier. It collects essential information about the business, including its financial history, ownership details, and creditworthiness. This information helps the lender assess the risk of extending credit to the business.

Who needs to fill out a Business Credit Application?

Any business seeking to establish a line of credit or obtain financing from a lender or supplier should complete a Business Credit Application. This includes small businesses, startups, and larger corporations looking to secure loans, credit lines, or trade credit.

What information is typically required on the form?

The form usually requests basic information such as the business name, address, and contact details. It may also ask for financial statements, tax identification numbers, ownership structure, and banking information. Some applications may require personal guarantees from the business owners.

How is the information used?

Lenders use the information provided in the application to evaluate the business's creditworthiness. They assess factors like the business's financial health, payment history, and overall risk. This evaluation helps lenders decide whether to approve the credit application and under what terms.

What happens after I submit the application?

After submission, the lender will review the application and may conduct additional checks, such as credit history assessments. The review process can take anywhere from a few days to several weeks, depending on the lender's policies and the complexity of the application.

Can I apply for credit if my business is new?

Yes, new businesses can apply for credit, but they may face more scrutiny due to a lack of established credit history. Providing a solid business plan, personal credit history, and any relevant financial projections can help strengthen the application.

What if my application is denied?

If your application is denied, the lender is required to provide a reason for the denial. Understanding the reasons can help you address any weaknesses in your financial standing or credit history. You can then take steps to improve your situation before reapplying.

Is there a fee associated with submitting the application?

Most lenders do not charge a fee for submitting a Business Credit Application. However, some may have processing fees or charges for credit checks. It’s always a good idea to clarify any potential costs with the lender before submitting your application.

How often should I update my Business Credit Application?

It’s wise to update your Business Credit Application regularly, especially if there are significant changes in your business, such as new ownership, changes in financial status, or shifts in business operations. Keeping your information current helps maintain a good relationship with lenders and ensures accurate evaluations in the future.

Different PDF Forms

Partial Waiver of Lien Chicago Title - Waiving the lien eliminates the potential for financial claims post-payment.

In today's competitive job market, submitting a well-prepared application is crucial, and utilizing resources like Fast PDF Templates can make the process easier for candidates. An Employment Application PDF form is a standardized document that job seekers use to apply for positions within a company. This form typically includes personal information, work history, and relevant skills, allowing employers to evaluate potential candidates efficiently. Understanding how to fill out this form effectively can significantly enhance a candidate's chances of securing an interview.

Create a Gift Card - Surprise them with a world of options through our Gift Certificate.

How to Use Business Credit Application

Completing the Business Credit Application form is an essential step for businesses seeking credit. After submitting the form, the credit issuer will review your application and determine your eligibility for credit based on the information provided.

- Begin by entering your business name in the designated field. Ensure the spelling is accurate.

- Provide the business address, including street, city, state, and zip code.

- Fill in the contact information, including a phone number and email address for the primary contact person.

- Specify the type of business entity, such as corporation, partnership, or sole proprietorship.

- Indicate the date the business was established. This information helps assess the stability of your business.

- List the owners or key stakeholders in the business, including their names and ownership percentages.

- Provide the federal tax identification number (EIN) if applicable. This is crucial for verification purposes.

- Detail your business's annual revenue and the number of employees. This information provides insight into the scale of your operations.

- List any previous credit relationships, including names of creditors and the amounts owed.

- Sign and date the application to certify that the information provided is accurate and complete.