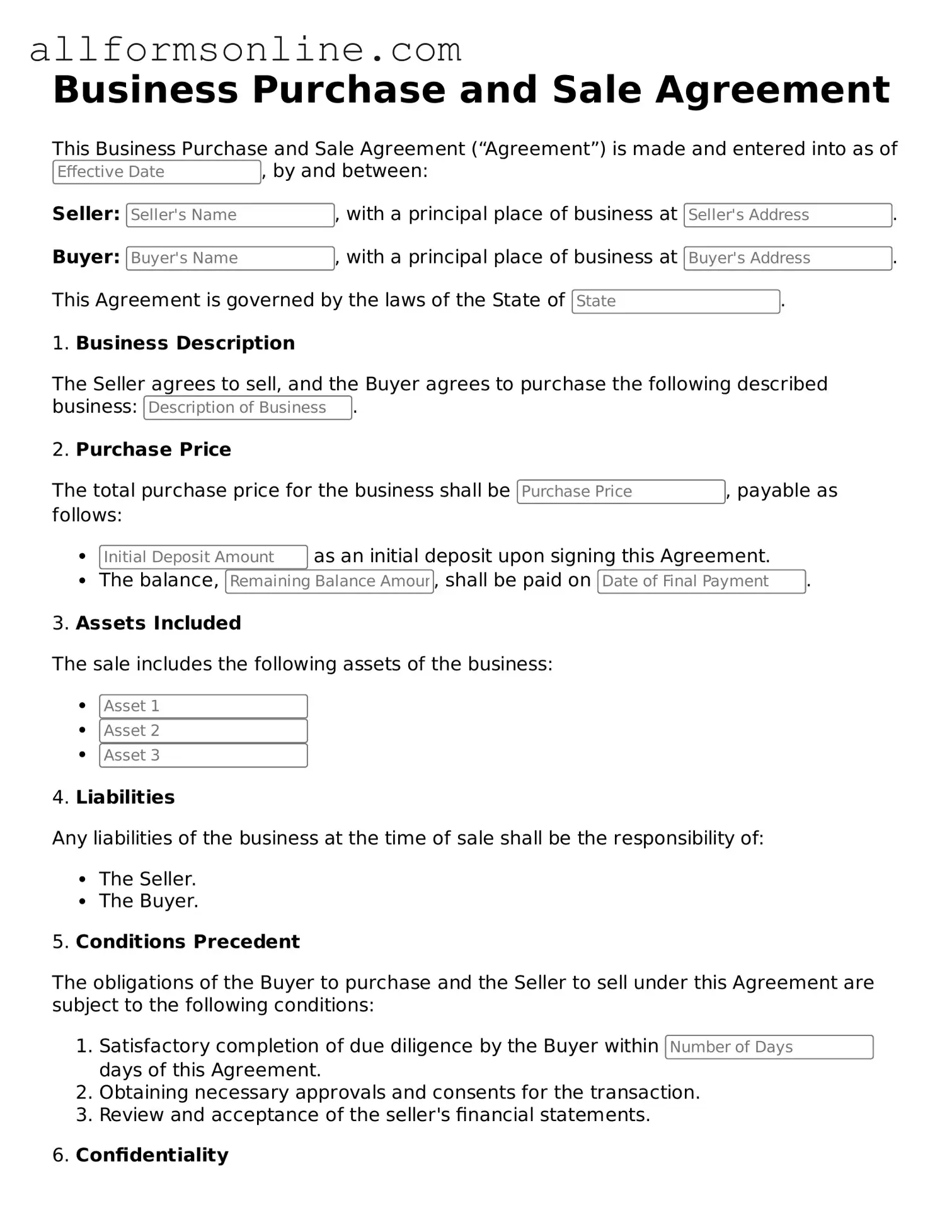

Blank Business Purchase and Sale Agreement Form

Misconceptions

The Business Purchase and Sale Agreement is a critical document in the process of buying or selling a business. However, several misconceptions surround this important agreement. Here are seven common misunderstandings:

-

It’s only necessary for large transactions.

Many believe that only significant business deals require a formal agreement. In reality, even small transactions benefit from a written agreement to clarify terms and protect both parties.

-

Verbal agreements are sufficient.

Some people think that a handshake or verbal agreement is enough. However, without a written document, misunderstandings can arise, leading to disputes that could have been avoided.

-

All agreements are the same.

Not all Business Purchase and Sale Agreements are created equal. Each agreement should be tailored to the specific details of the transaction, including the nature of the business and the terms negotiated.

-

Once signed, it cannot be changed.

Another misconception is that a signed agreement is set in stone. In fact, parties can negotiate amendments to the agreement, provided both sides agree to the changes.

-

It only covers the sale price.

While the sale price is a key component, the agreement also addresses other important aspects, such as payment terms, liabilities, and contingencies. These details are crucial for a smooth transaction.

-

It’s not necessary if the buyer is financing the purchase.

Some believe that financing eliminates the need for an agreement. However, lenders often require a formal agreement to protect their interests and ensure all terms are clear.

-

Legal help is not needed.

Many think they can draft the agreement themselves without legal assistance. While it’s possible to create a basic agreement, having a legal professional review it can help avoid costly mistakes and ensure all necessary provisions are included.

Understanding these misconceptions can help both buyers and sellers navigate the complexities of business transactions more effectively.

What to Know About This Form

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is sold. It serves as a contract between the buyer and seller, detailing the assets being sold, the purchase price, and any other relevant terms. This agreement helps protect both parties by clearly defining their rights and obligations during the transaction.

Why is this agreement important?

This agreement is crucial because it provides clarity and legal protection for both the buyer and the seller. It minimizes misunderstandings and disputes by specifying what is included in the sale, such as inventory, equipment, and intellectual property. A well-drafted agreement can prevent future legal issues and ensure a smoother transition of ownership.

What should be included in the agreement?

The agreement should include several key elements: a description of the business being sold, the purchase price, payment terms, any contingencies, and representations and warranties from both parties. It may also outline the responsibilities of the seller after the sale, such as training the new owner or assisting in the transition.

How is the purchase price determined?

The purchase price is typically determined through negotiation between the buyer and the seller. Factors influencing the price may include the business's financial performance, market conditions, and the value of its assets. An appraisal or business valuation can also provide insights to help both parties agree on a fair price.

Can the agreement be modified after signing?

What happens if one party breaches the agreement?

If one party breaches the agreement, the other party may have legal recourse. This could include seeking damages or specific performance, which means asking the court to enforce the terms of the agreement. The specific remedies available will depend on the nature of the breach and the terms outlined in the agreement.

Is legal assistance necessary when drafting this agreement?

While it is possible to draft a Business Purchase and Sale Agreement without legal assistance, it is highly recommended to consult with an attorney. Legal professionals can ensure that the agreement complies with state laws and adequately protects your interests. Their expertise can help identify potential issues that may not be immediately apparent.

How long does the process take?

The duration of the process can vary widely. It depends on factors such as the complexity of the business, the negotiation process, and the due diligence required. On average, it may take several weeks to a few months to finalize the agreement and complete the sale.

What are the tax implications of selling a business?

Selling a business can have various tax implications, including capital gains taxes on the profit made from the sale. The specific tax consequences will depend on how the business is structured and the terms of the sale. It is advisable to consult with a tax professional to understand the potential impacts and plan accordingly.

What if I have more questions after reading this?

If you have additional questions, it is always best to seek professional advice. Consulting with an attorney or a business advisor can provide tailored guidance based on your specific situation. They can help clarify any uncertainties and ensure that you are making informed decisions throughout the process.

Popular Templates:

Ncoer Order of Signatures - It helps identify future leaders and provides a basis for strategic personnel decisions.

To ensure protection during vehicle transactions, using a comprehensive Vehicle Release of Liability form is crucial. This document clarifies the responsibilities of all parties involved and minimizes potential legal complications in case of disputes arising from vehicle-related incidents.

How to Write a Bill of Sale for a Dirt Bike - A must-have for anyone selling or buying a dirt bike.

CBP Declaration Form 6059B - The questions on the CBP 6059B form are designed to gather pertinent information efficiently.

How to Use Business Purchase and Sale Agreement

Once you have the Business Purchase and Sale Agreement form in front of you, it’s important to fill it out carefully. Each section requires specific information to ensure clarity and legal compliance. Follow these steps to complete the form accurately.

- Identify the Parties: Fill in the names and addresses of the buyer and seller. Ensure that all parties are correctly identified.

- Describe the Business: Provide a detailed description of the business being sold, including its name, location, and any relevant business identification numbers.

- Specify the Purchase Price: Clearly state the total purchase price for the business. Include any payment terms or conditions if applicable.

- Outline Assets Included: List all assets that are part of the sale. This may include equipment, inventory, and intellectual property.

- Detail Liabilities: Indicate any liabilities that the buyer will assume as part of the transaction.

- Set Closing Date: Specify the date on which the sale will be finalized. This is typically agreed upon by both parties.

- Include Contingencies: Note any conditions that must be met before the sale can be completed, such as financing or inspections.

- Signatures: Ensure that both parties sign and date the agreement. Witness signatures may also be required depending on state laws.