Attorney-Approved Articles of Incorporation Form for California

Misconceptions

Many people have misunderstandings about the California Articles of Incorporation form. Here are seven common misconceptions, along with explanations to clarify them.

- Misconception 1: Anyone can file Articles of Incorporation without any knowledge.

- Misconception 2: The Articles of Incorporation are the only requirement to start a business.

- Misconception 3: You can use a generic template for the Articles of Incorporation.

- Misconception 4: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 5: The Articles of Incorporation protect personal assets automatically.

- Misconception 6: You must have a physical office in California to file.

- Misconception 7: The filing fee is the only cost involved in incorporating.

While it is possible to file the form without legal training, understanding the implications and requirements is crucial. Mistakes can lead to delays or even rejection of the application.

This is not true. Filing the Articles is just one step in the process. Other tasks, like obtaining permits and licenses, are also necessary to legally operate a business in California.

Using a generic template can lead to issues. Each business has unique needs, and the form must reflect those specifics to ensure compliance with state laws.

This is incorrect. Amendments can be made to the Articles if changes are needed in the future. However, this process requires additional filings and fees.

While incorporating does provide some protection, it is not absolute. Proper business practices must be followed to maintain that protection against personal liability.

This is a common belief, but it is not necessary. A registered agent can serve as your business's official address, allowing you to incorporate without a physical office.

In addition to the filing fee, there are other costs to consider, such as ongoing state fees, taxes, and potential legal fees. Being aware of these can help in budgeting for your business.

What to Know About This Form

What is the California Articles of Incorporation form?

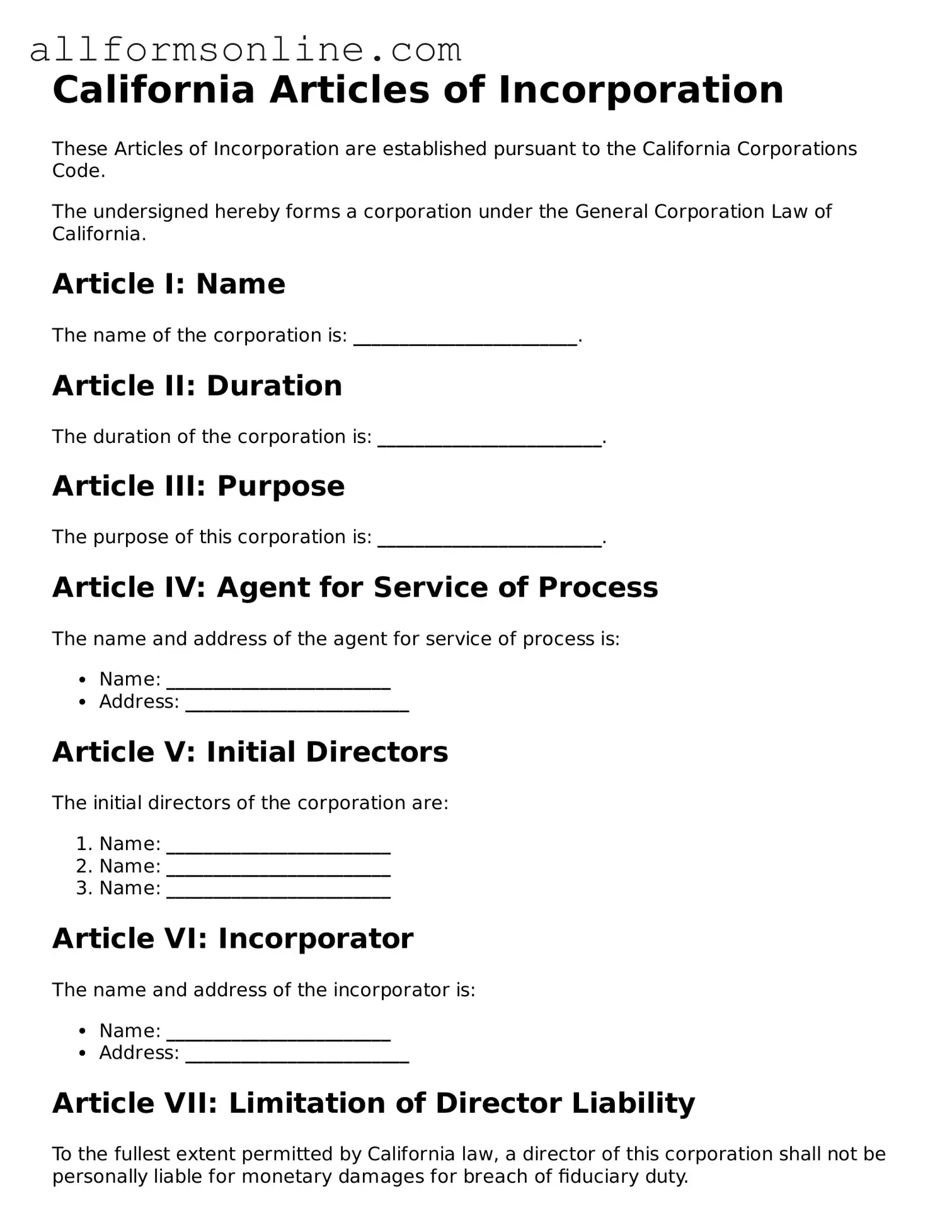

The California Articles of Incorporation form is a legal document that establishes a corporation in California. It provides essential information about the corporation, including its name, purpose, and the address of its initial registered office. Filing this form is the first step in creating a corporation in the state.

Who needs to file the Articles of Incorporation?

Anyone wishing to start a corporation in California must file the Articles of Incorporation. This includes individuals or groups who want to create a for-profit corporation, a nonprofit organization, or a professional corporation. It is a necessary step for legal recognition and protection of the business.

What information is required on the form?

The form requires several key pieces of information. You will need to provide the corporation's name, its purpose, the name and address of the registered agent, and the number of shares the corporation is authorized to issue. Additionally, you may need to include the names and addresses of the initial directors.

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online, by mail, or in person at the California Secretary of State's office. If filing online, visit the Secretary of State's website. If you choose to mail it, send the completed form to the appropriate address along with the required filing fee. Make sure to keep a copy for your records.

Is there a fee to file the Articles of Incorporation?

Yes, there is a fee associated with filing the Articles of Incorporation. The amount varies depending on the type of corporation you are forming. For example, the fee for a standard corporation is different from that of a nonprofit corporation. Check the California Secretary of State’s website for the most current fee schedule.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, if you file online, you may receive confirmation within a few business days. Mail filings can take longer, sometimes up to several weeks. If you need expedited processing, you may have the option to pay an additional fee for faster service.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are approved, your corporation is officially formed. You will receive a stamped copy of the Articles from the Secretary of State. After that, you should obtain any necessary business licenses and permits, and you may want to create corporate bylaws and hold an initial board meeting.

Can I amend the Articles of Incorporation later?

Yes, you can amend the Articles of Incorporation if necessary. This may be needed if you want to change the corporation's name, purpose, or other important details. To do this, you will need to file an amendment form with the Secretary of State and pay any applicable fees.

Do I need a lawyer to file the Articles of Incorporation?

While it is not required to have a lawyer to file the Articles of Incorporation, consulting one can be beneficial. A lawyer can help ensure that all information is accurate and that you comply with all legal requirements. This can save you time and potential issues down the road.

What are the consequences of not filing the Articles of Incorporation?

If you do not file the Articles of Incorporation, your business will not be recognized as a corporation. This means you will not have the legal protections that come with corporate status, such as limited liability. Additionally, you may face penalties and fines for operating a business without proper registration.

Other Common State-specific Articles of Incorporation Forms

Florida Business Forms - It can establish voting rights for shareholders and directors.

The Employment Verification Form is designed to confirm a person's employment status, title, and duration of employment at a particular company, and can be easily created with resources like Fast PDF Templates. Employers often request this form during background checks or when applying for loans or rental agreements. By providing accurate information, the form ensures that the employment history presented by an applicant is legitimate and reliable.

Pennsylvania Corporation Bureau - The articles detail the corporation's name and address.

Texas Company Registration - Key document for mergers and acquisitions.

New York Division of Corporations - The form typically includes the corporation's name, purpose, and duration.

How to Use California Articles of Incorporation

Once you have the California Articles of Incorporation form in hand, you can begin the process of completing it. This form is essential for establishing your corporation in California. After filling it out, you'll submit it to the California Secretary of State along with the required filing fee. Here are the steps to guide you through the process of filling out the form.

- Begin by entering the name of your corporation. Ensure that it complies with California naming requirements.

- Provide the address of the corporation's initial office. This should be a physical address in California.

- List the name and address of the corporation's agent for service of process. This person or entity will receive legal documents on behalf of the corporation.

- Specify the purpose of the corporation. You can provide a general statement or be more specific about the business activities.

- Indicate the number of shares the corporation is authorized to issue. This should reflect your business structure and needs.

- Include the names and addresses of the initial directors. At least one director is required, and they must be individuals.

- Sign and date the form. Ensure that the person signing has the authority to do so on behalf of the corporation.

- Review the completed form for accuracy and completeness. Double-check all entries before submission.

After completing these steps, you will be ready to submit the form along with the filing fee to the appropriate office. This will initiate the official process of forming your corporation in California.