Attorney-Approved Bill of Sale Form for California

Misconceptions

The California Bill of Sale form is a useful document for various transactions, particularly when transferring ownership of personal property. However, several misconceptions exist regarding its use and requirements. Below are five common misconceptions, along with clarifications.

- Misconception 1: A Bill of Sale is only necessary for vehicle transactions.

- Misconception 2: A Bill of Sale does not need to be notarized.

- Misconception 3: A Bill of Sale is the same as a title transfer.

- Misconception 4: The Bill of Sale must be completed before payment is made.

- Misconception 5: A verbal agreement is sufficient without a Bill of Sale.

While many people associate Bills of Sale primarily with vehicles, they are also essential for other personal property transactions, such as boats, trailers, and even valuable items like art or jewelry.

Although notarization is not always required, certain transactions may benefit from it. Notarizing a Bill of Sale can provide additional proof of authenticity and may be necessary for specific types of property transfers.

A Bill of Sale serves as a receipt and proof of the transaction, while a title transfer is a separate legal process required for certain types of property, particularly vehicles. Both documents may be necessary to complete a transaction fully.

Though it is common to complete the Bill of Sale at the time of payment, it is not a strict requirement. The parties involved can agree on the timing, but having the document finalized before the exchange can help avoid disputes.

While verbal agreements can be legally binding, they are challenging to enforce. A written Bill of Sale provides clear evidence of the terms of the sale and can protect both parties in case of future disputes.

What to Know About This Form

What is a California Bill of Sale form?

A California Bill of Sale form is a legal document that records the transfer of ownership of personal property from one party to another. This form is particularly important for transactions involving vehicles, boats, and other significant assets. It serves as proof of the sale and includes details such as the names and addresses of the buyer and seller, a description of the item being sold, the sale price, and the date of the transaction. Having a Bill of Sale can protect both parties in case of disputes or legal issues in the future.

Is a Bill of Sale required in California?

While a Bill of Sale is not legally required for every transaction in California, it is highly recommended, especially for the sale of vehicles or high-value items. For vehicle sales, the California Department of Motor Vehicles (DMV) requires a Bill of Sale when transferring ownership. This document helps to ensure that the transaction is properly documented and can assist with registration and title transfer processes. Without it, you may face complications down the line.

What information should be included in a California Bill of Sale?

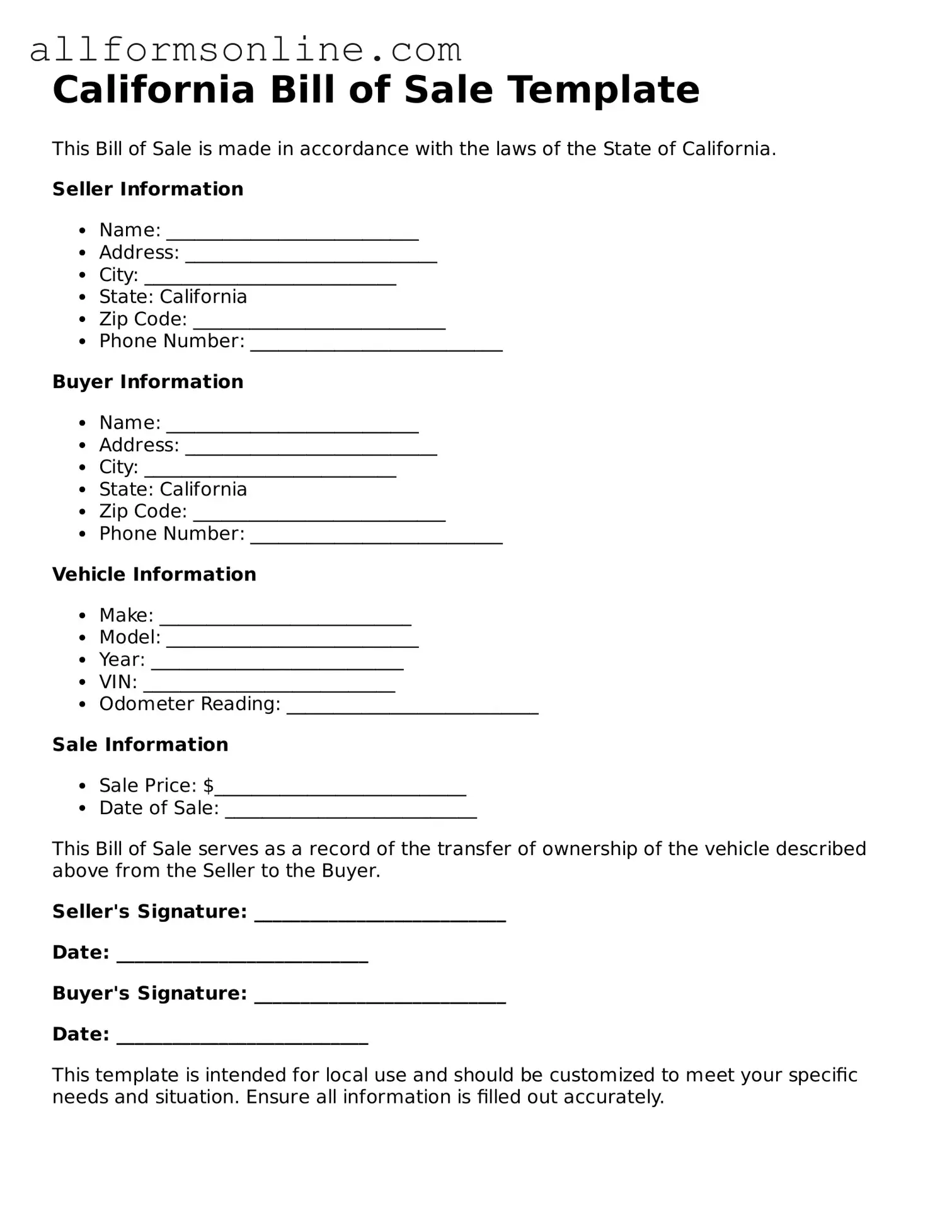

A comprehensive California Bill of Sale should include several key pieces of information. First, include the full names and addresses of both the buyer and the seller. Next, provide a detailed description of the item being sold, including its make, model, year, and any identification numbers, such as a Vehicle Identification Number (VIN) for cars. The sale price must also be clearly stated, along with the date of the transaction. Finally, both parties should sign and date the document to validate the agreement.

Can a Bill of Sale be used as a receipt?

Yes, a Bill of Sale can serve as a receipt for the transaction. Once both parties have signed the document, it acts as proof that the buyer has purchased the item and that the seller has received payment. This is particularly useful for tax purposes and can help both parties keep accurate records of their transactions. Retaining a copy of the Bill of Sale is advisable for future reference and to protect your interests.

Other Common State-specific Bill of Sale Forms

Format for Bill of Sale - The document can be used for various types of property, including vehicles and equipment.

For those looking to understand the transaction process, a reliable resource is the detailed guide on the General Bill of Sale requirements, available at General Bill of Sale.

Texas Auto Bill of Sale - The form can be used to document gifts of property between parties.

How to Use California Bill of Sale

Once you have the California Bill of Sale form in front of you, you’ll want to fill it out carefully. This form is essential for documenting the sale of personal property. Follow these steps to ensure everything is completed correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Make sure to include city, state, and zip code.

- Next, fill in the buyer’s full name and address in the designated section.

- Describe the item being sold. Include details like the make, model, year, and any identification numbers, such as a VIN for vehicles.

- Indicate the sale price of the item clearly. If there are any additional terms, note them as well.

- Both the seller and buyer should sign the form at the bottom. Each signature confirms the agreement.

- Finally, make a copy of the completed form for your records. This will serve as proof of the transaction.