Attorney-Approved Deed in Lieu of Foreclosure Form for California

Misconceptions

Understanding the California Deed in Lieu of Foreclosure can be challenging. Here are four common misconceptions that people often have about this process:

- It eliminates all debt obligations immediately. Many believe that signing a Deed in Lieu of Foreclosure automatically wipes out all debts related to the mortgage. In reality, while it may help discharge the mortgage debt, other obligations, such as second mortgages or personal loans, may still remain.

- It is a quick and easy solution. Some assume that a Deed in Lieu of Foreclosure is a fast way to resolve financial issues. However, the process can take time. Lenders often require documentation and may take weeks or months to review and approve the request.

- It has no impact on credit scores. Many think that a Deed in Lieu of Foreclosure will not affect their credit. This is not true. Such an action can significantly impact credit scores, similar to a foreclosure, and may hinder future borrowing opportunities.

- It is available to anyone facing foreclosure. Some believe that anyone can simply request a Deed in Lieu of Foreclosure. However, lenders typically require homeowners to demonstrate that they are unable to continue making payments and may have specific eligibility criteria that must be met.

Being informed about these misconceptions can help homeowners make better decisions regarding their financial situations.

What to Know About This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option allows the homeowner to relinquish ownership of the home and, in return, the lender agrees to cancel the mortgage debt. It can be a beneficial alternative for those facing financial difficulties, as it typically results in a less damaging impact on the homeowner's credit score compared to a foreclosure. Additionally, it may help the homeowner avoid the lengthy and stressful foreclosure process.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure generally depends on the lender’s policies, but certain criteria are common. Homeowners must typically be experiencing financial hardship and unable to keep up with mortgage payments. They should also be the legal owner of the property and have no other liens against the home that could complicate the transfer. Lenders usually require that the homeowner attempts to sell the property first, although this is not always a strict requirement. Each situation is unique, so it’s advisable to consult with the lender to understand specific eligibility requirements.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure can offer several advantages. First, it allows homeowners to avoid the lengthy foreclosure process, which can take months or even years. Second, it may have a less severe impact on the homeowner’s credit score compared to a foreclosure. Additionally, it can provide a sense of closure, allowing the homeowner to move on without the burden of an unpaid mortgage. Lastly, some lenders may offer relocation assistance or other benefits to help the homeowner transition to new living arrangements.

What are the potential downsides of a Deed in Lieu of Foreclosure?

While a Deed in Lieu of Foreclosure can be beneficial, there are potential downsides to consider. Homeowners may still face tax implications, as the IRS may consider the forgiven debt as taxable income. Additionally, the process may not be suitable for everyone, especially if there are multiple liens on the property. Furthermore, some lenders may not agree to a Deed in Lieu of Foreclosure, especially if they believe they can recover more through a foreclosure. It’s important to weigh these factors and consult with a financial advisor or attorney before proceeding.

How does the process of completing a Deed in Lieu of Foreclosure work?

The process begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will review the homeowner’s financial situation and may require documentation to assess eligibility. If approved, the homeowner will need to sign a deed transferring ownership of the property to the lender. This deed must be recorded with the county to finalize the transfer. Once completed, the lender typically cancels the mortgage debt, allowing the homeowner to avoid foreclosure. It’s advisable for homeowners to seek legal advice to ensure they understand their rights and responsibilities throughout this process.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Sample Deed in Lieu of Foreclosure - Homeowners should gather all relevant documents to streamline the process with the lender.

For those looking to ensure that their vehicle transactions are properly documented, the texasformspdf.com/fillable-statement-of-fact-texas-online provides a valuable resource to guide you through the completion of the Statement of Fact Texas form efficiently and accurately, helping you avoid any potential legal complications.

Deed in Lieu of Mortgage - A Deed in Lieu can also allow homeowners a quicker exit strategy in a distressed property situation.

Deed in Lieu - It can relieve that borrower from the burdens of property upkeep and mortgage payment obligations.

Deed in Lieu of Foreclosure Pa - A Deed in Lieu can prevent the lengthy court processes typically associated with traditional foreclosures.

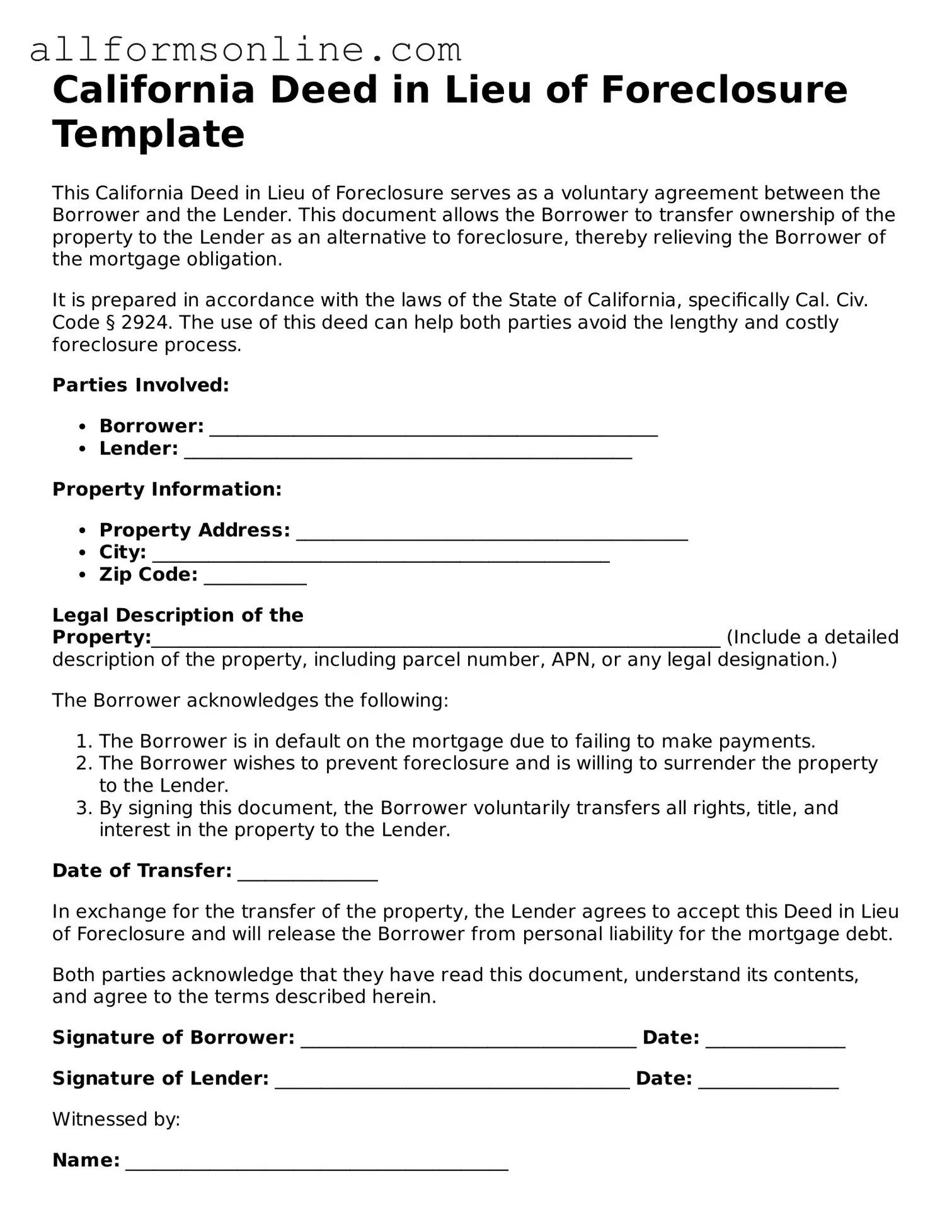

How to Use California Deed in Lieu of Foreclosure

After completing the California Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate parties. This typically involves sending it to your lender, who will then process the deed. Ensure that you keep copies for your records. Following this, you may receive confirmation from the lender regarding the acceptance of the deed.

- Obtain the California Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the date at the top of the form.

- Provide the name and address of the property owner (grantor).

- Enter the name and address of the lender (grantee).

- Clearly describe the property being transferred, including the address and legal description.

- Indicate any existing liens or encumbrances on the property.

- Sign the form in the designated area. Ensure that the signature matches the name of the property owner.

- Have the signature notarized by a licensed notary public.

- Make copies of the completed and notarized form for your records.

- Submit the original form to your lender along with any required documentation.