Attorney-Approved Durable Power of Attorney Form for California

Misconceptions

Understanding the California Durable Power of Attorney (DPOA) form is essential for anyone looking to plan for the future. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings about this important document:

- Misconception 1: A DPOA is only for elderly individuals.

- Misconception 2: A DPOA takes away your rights.

- Misconception 3: A DPOA is only effective after you become incapacitated.

- Misconception 4: You can’t change or revoke a DPOA.

- Misconception 5: The person I appoint as my agent must be a lawyer.

- Misconception 6: A DPOA is the same as a will.

- Misconception 7: A DPOA can only be used for financial matters.

- Misconception 8: Once a DPOA is signed, it cannot be questioned.

- Misconception 9: A DPOA is a one-size-fits-all document.

This is not true. Anyone can create a DPOA at any age. It’s a proactive way to ensure that your wishes are respected, regardless of your age or health status.

Actually, a DPOA allows you to designate someone you trust to make decisions on your behalf if you become unable to do so. You retain control until you can’t make decisions for yourself.

While a DPOA can become effective upon incapacity, it can also be set to take effect immediately. This flexibility allows you to choose how and when it operates.

In fact, you can change or revoke a DPOA at any time, as long as you are mentally competent. It’s important to review your documents regularly.

This is false. You can appoint anyone you trust, such as a family member or friend, as your agent. They do not need to have legal training.

A DPOA and a will serve different purposes. A DPOA allows someone to manage your affairs while you’re alive, while a will dictates how your assets are distributed after your death.

While financial decisions are a common focus, a DPOA can also cover health care decisions if you include those provisions in the document.

It’s possible for the validity of a DPOA to be challenged in court, especially if there are concerns about the principal’s mental capacity or if the agent is acting against the principal's interests.

Every DPOA can be tailored to fit your specific needs. You can customize the powers you grant to your agent based on your personal circumstances.

Being informed about these misconceptions can empower you to make better decisions regarding your financial and health care planning. Always consult with a professional if you have questions or need assistance with your DPOA.

What to Know About This Form

What is a Durable Power of Attorney in California?

A Durable Power of Attorney is a legal document that allows you to appoint someone to manage your financial affairs if you become incapacitated. Unlike a regular Power of Attorney, a Durable Power of Attorney remains effective even if you lose the ability to make decisions for yourself.

Who can be appointed as an agent under a Durable Power of Attorney?

You can appoint any competent adult as your agent. This can be a family member, friend, or a professional such as an attorney. It’s important to choose someone you trust, as they will have significant control over your financial matters.

How do I create a Durable Power of Attorney in California?

To create a Durable Power of Attorney, you must complete a form that complies with California law. You can find templates online or consult with an attorney. After filling out the form, you must sign it in front of a notary public or two witnesses to ensure its validity.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any financial institutions that may have a copy of the original document.

What powers can I grant to my agent?

You can grant your agent a wide range of powers, including managing bank accounts, paying bills, buying or selling property, and making investment decisions. You can specify which powers your agent has or limit them as you see fit.

Is a Durable Power of Attorney effective immediately?

It can be effective immediately or only upon your incapacitation, depending on how you draft the document. If you want it to take effect right away, you must indicate that in the form. Otherwise, it will activate only when you are unable to make decisions.

Do I need a lawyer to create a Durable Power of Attorney?

No, you do not need a lawyer to create a Durable Power of Attorney. However, consulting with a legal professional can help ensure that the document meets all legal requirements and accurately reflects your wishes.

What happens if I don’t have a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney, your family may need to go through a court process to obtain guardianship or conservatorship. This can be time-consuming and costly, and it may not align with your preferences.

Can I include specific instructions in my Durable Power of Attorney?

Yes, you can include specific instructions regarding how you want your agent to act on your behalf. This can provide clarity and help ensure that your wishes are followed, especially in complex financial situations.

How often should I review my Durable Power of Attorney?

It’s advisable to review your Durable Power of Attorney regularly, especially after major life changes such as marriage, divorce, or the birth of a child. Changes in your financial situation or relationships may also warrant an update to the document.

Other Common State-specific Durable Power of Attorney Forms

Durable Power of Attorney Pdf - You can revoke or modify this power anytime while you are still competent.

Obtaining an Emotional Support Animal Letter can greatly enhance the quality of life for individuals who require the comfort of an animal companion, and resources like Fast PDF Templates can provide valuable assistance in navigating the process of securing this important document.

How to Get Power of Attorney Florida - Can empower the agent to make charitable contributions if desired.

Power of Attorney Form Pennsylvania - This form empowers you to choose someone who understands your needs and values.

How to Use California Durable Power of Attorney

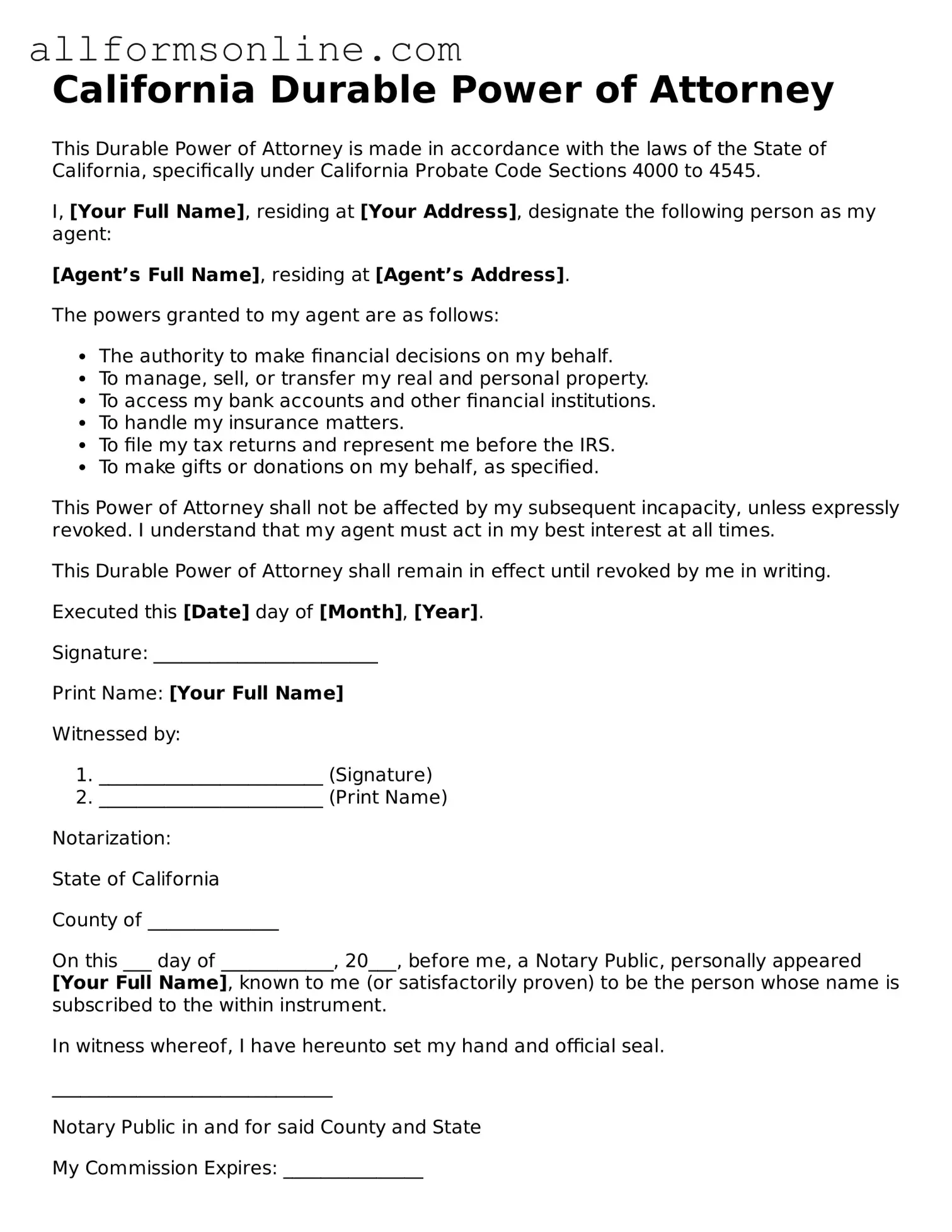

Filling out the California Durable Power of Attorney form is an important step in ensuring your financial and legal decisions are managed according to your wishes. Once you have completed the form, it will need to be signed and possibly notarized, depending on your specific situation. Below are the steps to guide you through the process of filling out the form.

- Obtain the California Durable Power of Attorney form. You can find it online or request a copy from a legal professional.

- Begin by entering your full name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Clearly outline the powers you are granting to your agent. You can choose specific powers or give them broad authority.

- Indicate any limitations on the powers you are granting. If there are specific actions your agent cannot take, list them here.

- Include the effective date of the Durable Power of Attorney. This can be immediate or set to activate upon a specific event, such as your incapacitation.

- Sign and date the form in the designated area. Your signature must be witnessed by at least one person, or you may choose to have it notarized.

- Provide a copy of the completed form to your agent and keep a copy for your records.

After completing these steps, your Durable Power of Attorney will be ready for use. Make sure to review it periodically and update it as necessary to reflect any changes in your circumstances or wishes.