Attorney-Approved Gift Deed Form for California

Misconceptions

Understanding the California Gift Deed form is essential for anyone looking to transfer property without compensation. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- Gift Deeds are only for family members. Many believe that gift deeds can only be used to transfer property to relatives. In reality, anyone can gift property to another person, regardless of their relationship.

- A Gift Deed does not require a notary. Some people think that a gift deed can be valid without notarization. However, in California, a gift deed must be notarized to be legally effective.

- You cannot revoke a Gift Deed. There is a belief that once a gift deed is executed, it cannot be undone. While it is true that a gift deed is generally irrevocable, the donor may have the option to revoke it under specific circumstances.

- Gift Deeds avoid all taxes. Many assume that transferring property through a gift deed avoids all tax implications. While gift taxes may not apply, property taxes and potential capital gains taxes could still be relevant.

- Only real estate can be gifted. Some people think that gift deeds are limited to real estate. In fact, personal property can also be transferred using a gift deed, though the process may differ.

- A Gift Deed transfers ownership immediately. There is a misconception that ownership is transferred at the moment the gift deed is signed. In reality, the transfer is effective upon recording the deed with the county.

- You need to pay for a Gift Deed. Many believe that creating a gift deed requires expensive legal fees. However, there are many affordable templates and resources available for those who wish to complete the process themselves.

By clearing up these misconceptions, individuals can better understand the implications and requirements of using a California Gift Deed.

What to Know About This Form

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This deed is typically used when a property owner wishes to give their property as a gift to a family member or friend. It simplifies the transfer process and can help avoid potential disputes in the future.

How do I fill out a Gift Deed in California?

Filling out a Gift Deed involves providing specific information about the property and the parties involved. You'll need to include the names and addresses of both the giver (donor) and the recipient (grantee), a legal description of the property, and any relevant details about the gift. It's crucial to ensure that all information is accurate and complete to avoid any issues later on.

Do I need to have the Gift Deed notarized?

Yes, in California, a Gift Deed must be notarized to be legally binding. This means that the person making the gift (the donor) must sign the deed in front of a notary public. The notary will verify the identity of the signer and witness the signing. This step helps to prevent fraud and ensures that the transfer is valid.

Are there any tax implications when using a Gift Deed?

Yes, there can be tax implications when transferring property via a Gift Deed. The donor may need to file a gift tax return if the value of the property exceeds the annual exclusion limit set by the IRS. Additionally, the recipient may face property tax reassessment based on the current market value of the property. It’s advisable to consult with a tax professional to understand the full implications.

What happens if the Gift Deed is not recorded?

If a Gift Deed is not recorded with the county recorder's office, it may lead to complications. The transfer of ownership may not be recognized, and the recipient could face challenges in proving their ownership rights. Recording the deed protects the recipient's interests and provides public notice of the property transfer, making it an essential step in the process.

Other Common State-specific Gift Deed Forms

Gift Deed Form Texas - The gift must be given willingly and without coercion for the deed to be valid.

To further assist in the process of transferring ownership, you can utilize resources such as the Fast PDF Templates, which provide readily available templates for creating a comprehensive California Motorcycle Bill of Sale form.

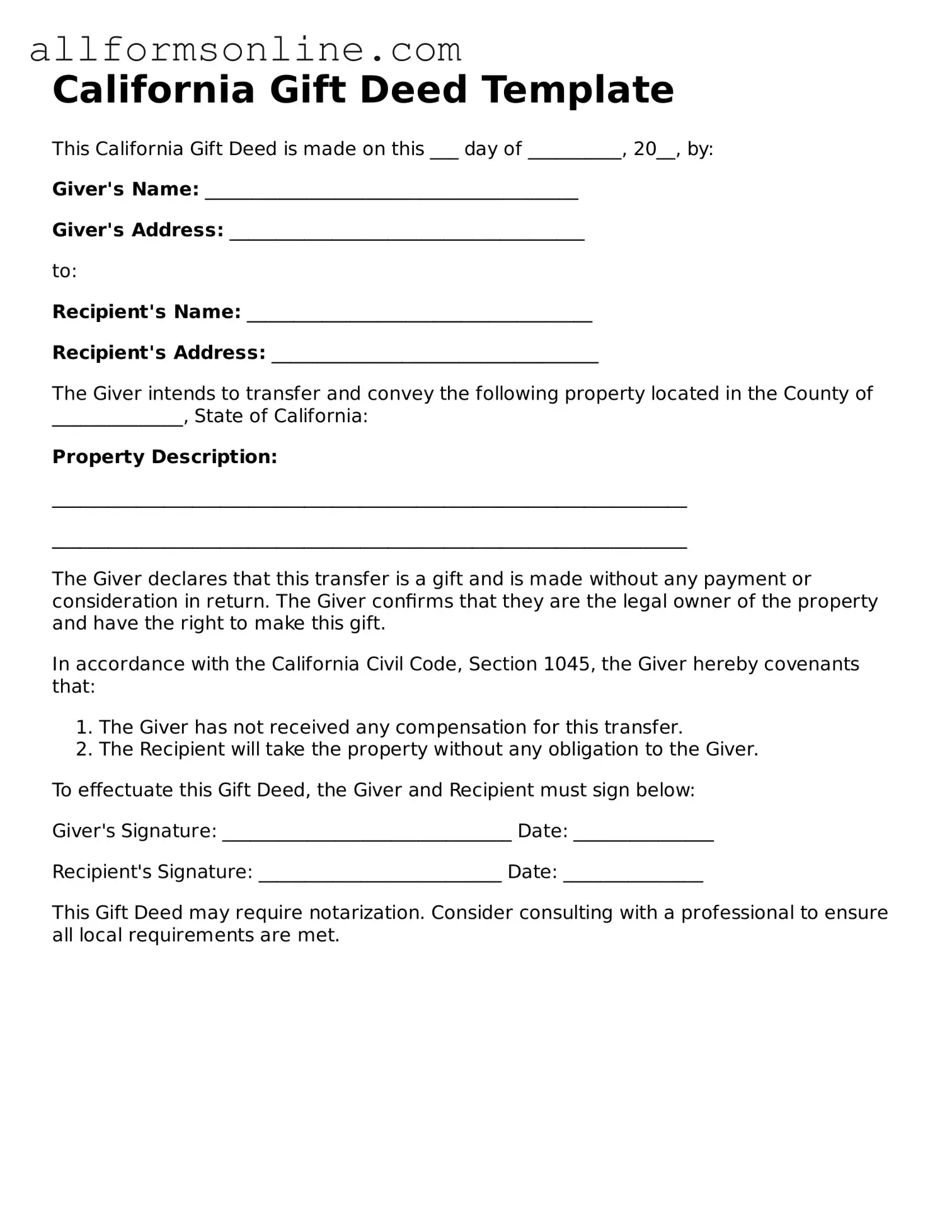

How to Use California Gift Deed

After obtaining the California Gift Deed form, you will need to fill it out accurately to ensure the transfer of property is legally recognized. Follow these steps carefully to complete the form correctly.

- Start by entering the date at the top of the form. This date is important for legal purposes.

- Provide the name and address of the person giving the gift (the donor). This information should be clear and accurate.

- Next, enter the name and address of the person receiving the gift (the recipient). Ensure that the recipient's details are also correct.

- In the section for property description, clearly describe the property being gifted. Include details such as the address and any relevant legal descriptions.

- Indicate whether the gift is made with or without any conditions. This is crucial for understanding the nature of the gift.

- Both the donor and the recipient must sign the form. Ensure that the signatures are dated to reflect when the gift was made.

- If applicable, have the form notarized. This step may be required to validate the deed in certain situations.

- Make copies of the completed form for your records before submitting it.

Once you have filled out the form, you will need to record it with the appropriate county office to finalize the transfer. This step is essential to ensure that the gift is recognized publicly and legally. Be sure to check for any additional requirements specific to your county.