Attorney-Approved Horse Bill of Sale Form for California

Misconceptions

Many people have misunderstandings about the California Horse Bill of Sale form. Here are seven common misconceptions, along with explanations to clarify them.

-

It is not necessary to have a Bill of Sale for a horse transaction.

Some believe that a verbal agreement is enough. However, having a written Bill of Sale provides legal protection for both the buyer and seller, clearly documenting the transaction.

-

The Bill of Sale must be notarized.

While notarization can add an extra layer of authenticity, it is not a requirement for the California Horse Bill of Sale. A simple signature from both parties is sufficient.

-

Only the seller needs to sign the Bill of Sale.

Both the buyer and seller should sign the document. This ensures that both parties acknowledge and agree to the terms of the sale.

-

The Bill of Sale is only necessary for expensive horses.

Regardless of the horse's value, a Bill of Sale is important. It protects both parties in any future disputes, making it wise to document every transaction.

-

All horses must have a health certificate to complete the Bill of Sale.

A health certificate is not required for the Bill of Sale itself. However, it is a good practice to provide one to assure the buyer of the horse's health status.

-

The Bill of Sale is only for the sale of horses.

This form can also be used for other equines, such as ponies and donkeys. It is not limited to just horses.

-

Once the Bill of Sale is signed, the transaction is final and cannot be reversed.

While the Bill of Sale signifies a completed transaction, there may still be grounds for disputes, such as misrepresentation or undisclosed issues. Legal recourse may be available in such cases.

Understanding these misconceptions can help buyers and sellers navigate horse transactions more effectively.

What to Know About This Form

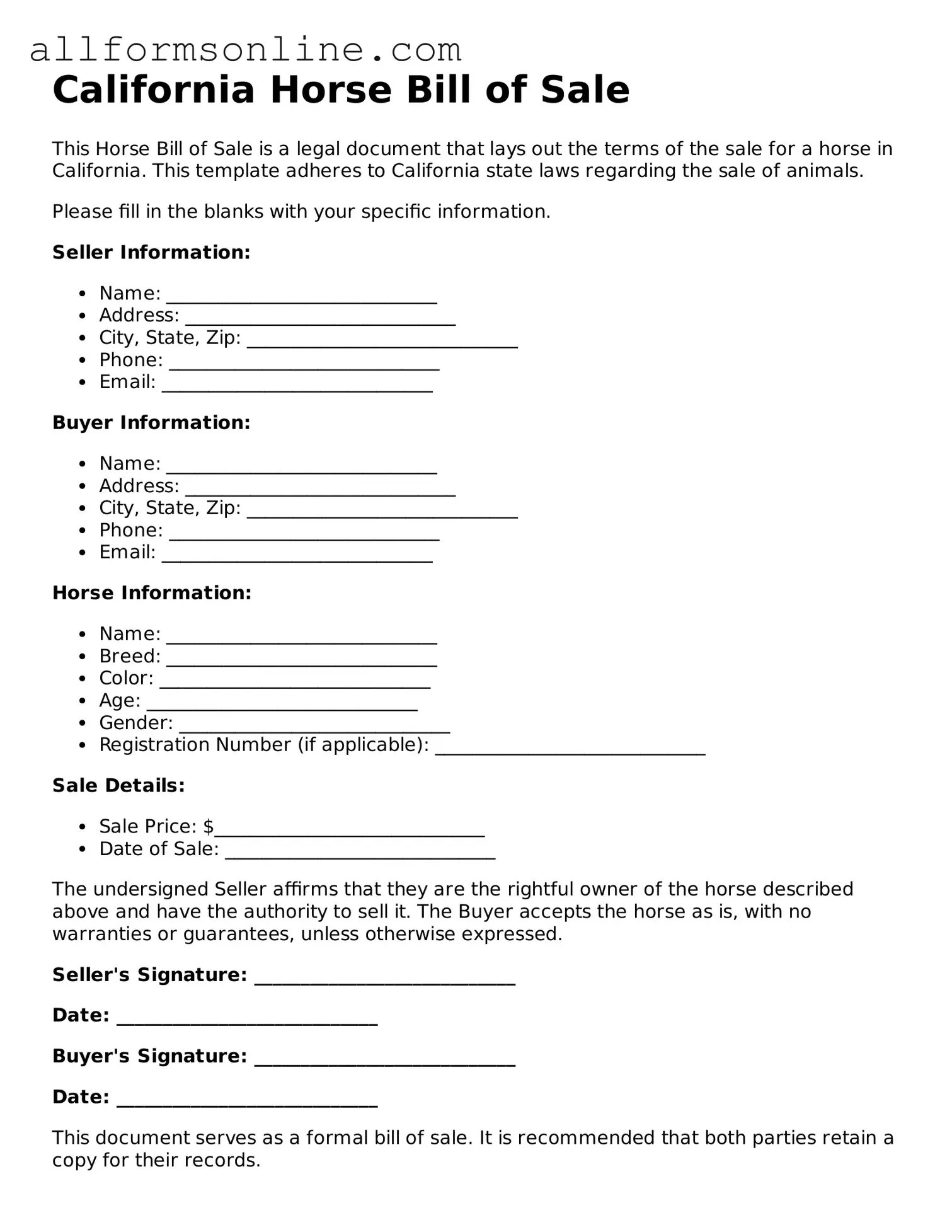

What is a California Horse Bill of Sale?

A California Horse Bill of Sale is a legal document that records the sale of a horse from one party to another. This form serves as proof of the transaction and outlines the details of the sale, including the identities of the buyer and seller, the horse's description, and the sale price. It is important for both parties to have a written record to avoid disputes in the future.

Is a Horse Bill of Sale required in California?

While it is not legally required to have a Bill of Sale when selling a horse in California, it is highly recommended. This document protects both the buyer and seller by providing clear evidence of the transaction. In case of any disputes, having a Bill of Sale can be invaluable in proving ownership and terms of the sale.

What information should be included in the Bill of Sale?

A comprehensive Bill of Sale should include several key pieces of information. This includes the names and addresses of both the buyer and seller, a detailed description of the horse (including breed, age, color, and any identifying marks), the sale price, and the date of the transaction. Additionally, any warranties or guarantees regarding the horse's health or condition should also be documented.

Do I need to have the Bill of Sale notarized?

Notarization is not a requirement for a Horse Bill of Sale in California. However, having the document notarized can add an extra layer of authenticity and may be beneficial if disputes arise. It can also provide assurance to the buyer that the seller is the rightful owner of the horse.

Can I use a generic Bill of Sale form for my horse sale?

Yes, you can use a generic Bill of Sale form, but it is advisable to use one specifically designed for horse sales. A specialized form will ensure that all necessary details pertinent to the sale of a horse are included, reducing the risk of omitting critical information that could lead to misunderstandings later on.

What happens if the horse is sold with undisclosed issues?

If a horse is sold with undisclosed health issues or defects, the buyer may have legal recourse against the seller, especially if the seller knowingly withheld this information. The Bill of Sale can include clauses regarding the horse's health and condition, which can protect the seller from liability if the buyer accepts the horse "as is." However, transparency is crucial in maintaining trust between both parties.

How should I handle payment when completing a horse sale?

Payment methods can vary, but it is essential to choose a secure option that both parties agree upon. Cash, certified checks, or electronic transfers are common methods. It is advisable to document the payment in the Bill of Sale, noting the amount received and the method used. This provides clarity and protects both parties in the transaction.

What if the buyer changes their mind after the sale?

Once a horse sale is completed and the Bill of Sale is signed, the transaction is generally considered final. However, if the buyer changes their mind, they may not have legal grounds to reverse the sale unless there was fraud or misrepresentation involved. Including a clear return policy in the Bill of Sale can help address such situations, but it is not a legal requirement.

Can I sell a horse that I do not own?

No, selling a horse that you do not own is illegal and could lead to serious legal consequences. It is crucial to ensure that you have clear ownership of the horse before attempting to sell it. The Bill of Sale should only be signed by the legal owner of the horse to validate the transaction.

Where can I find a California Horse Bill of Sale template?

Templates for a California Horse Bill of Sale can be found online through various legal document websites, or you may consult with a local attorney for a customized form. Ensure that any template you use complies with California laws and includes all necessary details specific to your transaction.

Other Common State-specific Horse Bill of Sale Forms

Equine Bill of Sale Pdf - Important for keeping a record of the horse's previous ownership.

To ensure a smooth application process for Disability Insurance benefits, applicants are encouraged to use reliable resources for guidance, such as the Fast PDF Templates, which provide essential templates and information related to the EDD DE 2501 form.

How to Use California Horse Bill of Sale

Completing the California Horse Bill of Sale form is a straightforward process that requires attention to detail. After filling out the form, you will have a legal document that reflects the sale of the horse, providing protection for both the buyer and the seller. Ensure all information is accurate to avoid any potential disputes in the future.

- Obtain the form: You can download the California Horse Bill of Sale form from a reliable online source or request a hard copy from a local equestrian organization.

- Fill in the date: Write the date of the sale at the top of the form.

- Provide seller information: Enter the seller's full name, address, and contact information in the designated section.

- Provide buyer information: Enter the buyer's full name, address, and contact information in the appropriate section.

- Describe the horse: Include details such as the horse's name, breed, color, age, and any identifying marks or registration numbers.

- State the purchase price: Clearly write the amount agreed upon for the sale of the horse.

- Include payment terms: Specify how the payment will be made, whether in full or through installments.

- Signatures: Both the seller and buyer must sign and date the form to validate the agreement.

- Witness signature (if applicable): If required, have a witness sign the document to further authenticate the transaction.

After completing the form, both parties should keep a copy for their records. This document serves as proof of the transaction and should be stored in a safe place. If any questions arise later, having a well-documented bill of sale will be invaluable.