Attorney-Approved Loan Agreement Form for California

Misconceptions

When dealing with the California Loan Agreement form, several misconceptions often arise. Understanding these misconceptions can help borrowers and lenders navigate the loan process more effectively.

- Misconception 1: The California Loan Agreement is a one-size-fits-all document.

- Misconception 2: A verbal agreement is sufficient without a written loan agreement.

- Misconception 3: Only large loans require a formal loan agreement.

- Misconception 4: Once signed, a loan agreement cannot be changed.

This is not true. While there are standard elements included in most loan agreements, each agreement can be tailored to fit the specific needs of the parties involved. Custom clauses can address unique terms and conditions.

Many believe that a verbal agreement can hold up in court, but this is often not the case. A written loan agreement provides clear documentation of the terms and is essential for legal protection.

Some people think that only significant amounts of money necessitate a formal agreement. However, even smaller loans benefit from a written document, as it outlines the expectations and responsibilities of both parties.

This is a common misunderstanding. While changes to a loan agreement can be complicated, they are possible. Both parties must agree to any modifications, and these changes should be documented in writing.

What to Know About This Form

What is a California Loan Agreement form?

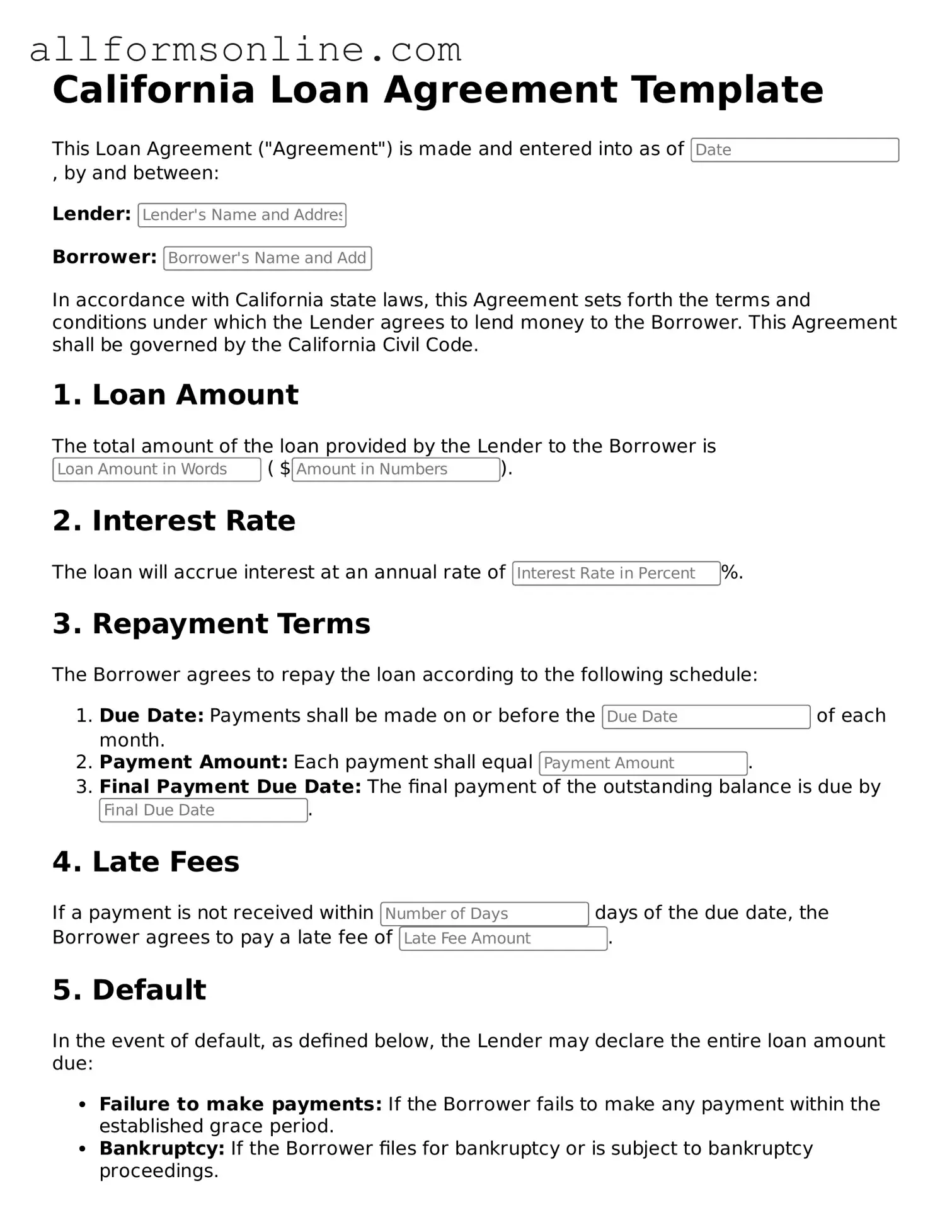

A California Loan Agreement form is a legal document that outlines the terms and conditions under which one party (the lender) provides a loan to another party (the borrower). This form typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved in the transaction. It serves to protect both parties by clearly defining their rights and responsibilities.

Who needs to use a California Loan Agreement?

This form is essential for anyone lending or borrowing money in California, whether it’s for personal loans, business loans, or real estate transactions. It is especially important when the loan amount is significant or if the parties do not have an established relationship, as it helps to prevent misunderstandings and disputes.

What are the key components of a California Loan Agreement?

A typical California Loan Agreement includes several important components: the names of the lender and borrower, the loan amount, the interest rate, the repayment terms, any fees or penalties for late payments, and details about collateral if applicable. Additionally, it may include clauses regarding default, governing law, and dispute resolution procedures.

Is it necessary to have a lawyer review the Loan Agreement?

While it is not legally required to have a lawyer review a Loan Agreement, it is highly recommended, especially for larger loans or complex agreements. A legal professional can ensure that the terms are fair and compliant with California law, which can help avoid potential legal issues in the future.

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it is signed, but any changes must be documented in writing and signed by both parties. This process is known as an amendment. It is important to ensure that any modifications do not conflict with the original terms and that both parties agree to the new terms.

What happens if the borrower defaults on the loan?

If the borrower defaults, meaning they fail to make payments as agreed, the lender may have the right to take specific actions as outlined in the Loan Agreement. This could include charging late fees, accelerating the loan (demanding full repayment), or taking possession of collateral if it was pledged. The specific remedies available will depend on the terms of the agreement and applicable laws.

Is the Loan Agreement enforceable in court?

Yes, a properly executed Loan Agreement is generally enforceable in court, provided it meets the legal requirements for contracts in California. This includes having the necessary elements such as offer, acceptance, consideration, and the capacity of both parties to enter into the agreement. If a dispute arises, the agreement can serve as evidence in legal proceedings.

Are there any state-specific regulations for Loan Agreements in California?

Yes, California has specific laws governing loans, including interest rate limits and disclosure requirements. For instance, certain consumer loans may be subject to the California Finance Lenders Law, which regulates lending practices. It is important to be aware of these regulations to ensure compliance and avoid potential legal issues.

Where can I obtain a California Loan Agreement form?

California Loan Agreement forms can be obtained from various sources, including online legal document services, law offices, and state government websites. It is advisable to use a reputable source to ensure that the form is up-to-date and compliant with California laws. Customizing a template to fit specific needs can also be beneficial.

Other Common State-specific Loan Agreement Forms

Promissory Note Texas - This form can be customized to suit specific lending scenarios.

To facilitate the exchange of ownership for a trailer in Missouri, it is crucial to use the appropriate documentation. The Missouri Trailer Bill of Sale form serves this purpose, detailing essential information such as the trailer's make, model, and identification number. By completing this form, both parties can ensure a transparent and lawful transfer. For your convenience, you can access the necessary paperwork by visiting the Trailer Bill of Sale form.

Loan Agreement Template Florida - Both lender and borrower must agree on the terms to ensure clarity and avoid disputes.

Promissory Note Template New York - Gives the borrower notice of their repayment obligations in plain language.

How to Use California Loan Agreement

Completing the California Loan Agreement form requires careful attention to detail. Each section must be filled out accurately to ensure that the agreement reflects the intentions of both parties involved. Following these steps will help you navigate the process smoothly.

- Obtain the form: Download the California Loan Agreement form from a reliable source or request a copy from a legal professional.

- Read the instructions: Review any accompanying instructions to understand the requirements for completing the form.

- Fill in borrower information: Enter the full name, address, and contact information of the borrower at the designated section.

- Fill in lender information: Provide the full name, address, and contact information of the lender in the appropriate section.

- Specify loan details: Clearly state the loan amount, interest rate, repayment terms, and any applicable fees.

- Include payment schedule: Outline the payment schedule, including due dates and payment methods.

- Sign and date: Both parties must sign and date the form to validate the agreement.

- Make copies: Create copies of the signed agreement for both the borrower and lender for their records.