Attorney-Approved Prenuptial Agreement Form for California

Misconceptions

When considering a prenuptial agreement in California, it is essential to address common misconceptions that may lead to confusion or hesitation. Understanding these misconceptions can help couples make informed decisions about their financial futures.

- Prenuptial agreements are only for the wealthy. Many people believe that only those with significant assets need a prenuptial agreement. In reality, anyone can benefit from outlining financial expectations and responsibilities, regardless of their financial status.

- Prenuptial agreements are unromantic. Some view prenuptial agreements as a lack of trust or a sign of impending divorce. However, these agreements can foster open communication about finances, ultimately strengthening the relationship.

- Prenuptial agreements are difficult to enforce. While some might think that prenuptial agreements are not legally binding, California courts generally uphold them as long as they are created and executed properly. This includes ensuring both parties fully understand the terms and have had the opportunity to seek independent legal advice.

- Prenuptial agreements can cover any aspect of marriage. Many assume that these agreements can dictate all aspects of a marriage, including personal matters. In California, prenuptial agreements can only address financial issues, such as asset division and spousal support.

- Prenuptial agreements are permanent and cannot be changed. Some believe that once a prenuptial agreement is signed, it cannot be modified. In truth, couples can revisit and amend their agreements as circumstances change, ensuring that the terms remain relevant throughout their marriage.

Understanding these misconceptions can empower couples to approach prenuptial agreements with clarity and confidence, ultimately supporting a healthier financial partnership.

What to Know About This Form

What is a prenuptial agreement in California?

A prenuptial agreement, often called a prenup, is a legal document that couples create before getting married. It outlines how assets and debts will be divided in the event of a divorce or separation. In California, these agreements can also address spousal support, property rights, and other financial matters. Having a prenup can provide clarity and peace of mind for both parties entering the marriage.

Who should consider a prenuptial agreement?

Couples in various situations might benefit from a prenuptial agreement. If one or both partners have significant assets, own a business, or have children from previous relationships, a prenup can protect those interests. Additionally, individuals entering a marriage later in life or those who anticipate a substantial increase in income may find it wise to consider a prenup to safeguard their financial future.

What are the legal requirements for a valid prenuptial agreement in California?

For a prenuptial agreement to be enforceable in California, it must meet specific legal requirements. Both parties must enter into the agreement voluntarily and without coercion. The agreement should be in writing and signed by both parties. Additionally, each partner should fully disclose their assets and liabilities. It is highly recommended that both individuals seek independent legal counsel to ensure their interests are represented and understood.

Can a prenuptial agreement be modified or revoked?

Yes, a prenuptial agreement can be modified or revoked after it has been executed. Both parties must agree to the changes, and these modifications should also be in writing and signed by both individuals. If circumstances change significantly, such as a major financial shift or the birth of a child, it may be wise to revisit the agreement to ensure it still reflects the couple’s intentions.

What happens if a prenuptial agreement is challenged in court?

If a prenuptial agreement is challenged in court, the judge will examine its validity based on California law. Factors such as whether both parties voluntarily signed the agreement, if there was full disclosure of assets, and whether the terms are fair and reasonable will be considered. If the court finds the agreement valid, it will be enforced. However, if it determines that the agreement was signed under duress or is unconscionable, it may be deemed unenforceable.

Is a prenuptial agreement only for wealthy individuals?

No, a prenuptial agreement is not exclusively for wealthy individuals. While it can be particularly beneficial for those with substantial assets, anyone can benefit from having a prenup. It helps clarify financial expectations and responsibilities within the marriage. Even couples with modest assets can use a prenup to protect personal property or outline how debts will be handled, making it a practical option for many.

Other Common State-specific Prenuptial Agreement Forms

New York Prenup - A prenuptial agreement can be revised if circumstances change.

Submitting the Chick-fil-A Job Application form can be a vital step for those aspiring to join this renowned fast-food chain, and utilizing resources like Fast PDF Templates can help streamline the application process, ensuring all necessary information is accurately provided to enhance your chances of employment.

Texas Prenup - Establishing a prenup can help reduce fears of financial insecurity in marriage.

Pennsylvania Prenup - This document can help set the stage for a respect-driven financial partnership in marriage.

How to Use California Prenuptial Agreement

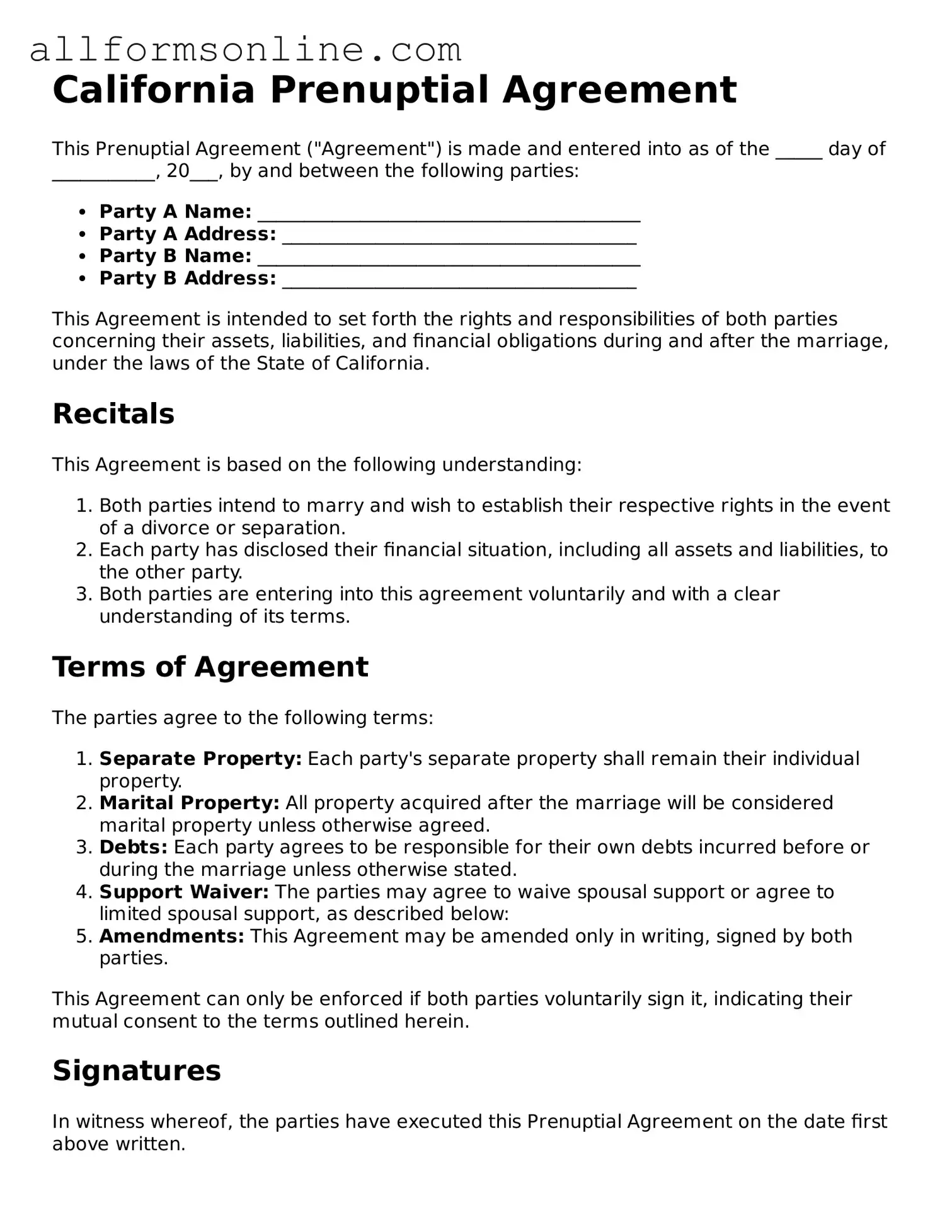

Completing the California Prenuptial Agreement form requires careful attention to detail. This document will help outline the financial arrangements and responsibilities for both parties before entering into marriage. It is important to ensure that all information is accurate and clearly stated.

- Begin by entering the full names of both parties at the top of the form.

- Provide the current addresses for each party. Make sure these are up to date.

- Include the date of the marriage. This is essential for the agreement's validity.

- List all assets owned by each party. Be thorough and include property, bank accounts, investments, and any other significant items.

- Detail any debts that each party has. This includes loans, credit card debts, and any other financial obligations.

- Outline how assets and debts will be managed during the marriage. Specify if they will remain separate or be combined.

- Discuss any spousal support arrangements in the event of a divorce. Clearly state any terms that both parties agree upon.

- Include any other provisions that both parties wish to address in the agreement. This could include inheritance rights, business interests, or other financial matters.

- Both parties must sign and date the form in the designated areas. Ensure that signatures are clear and legible.

- Consider having the agreement notarized. This adds an extra layer of validity and may be required for certain provisions.

Once the form is filled out completely, both parties should review the document carefully. It is advisable to consult with a legal professional to ensure that the agreement complies with California laws and adequately protects both parties' interests.