Attorney-Approved Promissory Note Form for California

Misconceptions

Understanding the California Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are nine common misconceptions explained:

- All Promissory Notes are the Same: Many believe that all promissory notes are identical. In reality, each note can be tailored to fit the specific agreement between the lender and borrower.

- Promissory Notes are Only for Large Loans: Some think these notes are only necessary for significant amounts. In fact, they can be used for any loan amount, regardless of size.

- Verbal Agreements are Sufficient: There is a misconception that a verbal agreement suffices. Written notes provide clear terms and protect both parties in case of disputes.

- Interest Rates are Always Required: Many assume that a promissory note must include an interest rate. However, it is possible to create a note with no interest at all.

- Only Banks Use Promissory Notes: Some believe that only financial institutions utilize these documents. Individuals can also use them for personal loans between friends or family.

- Promissory Notes are Unenforceable: A common myth is that these notes hold no legal weight. In truth, properly executed promissory notes are legally binding agreements.

- They Must Be Notarized: Many think that notarization is mandatory for all promissory notes. While it can add an extra layer of validation, it is not always required.

- They are Only for Short-Term Loans: Some assume that promissory notes are only suitable for short-term loans. They can also be structured for long-term financing.

- Once Signed, They Cannot Be Changed: There is a belief that once a promissory note is signed, its terms are set in stone. Modifications can be made if both parties agree and document the changes properly.

By dispelling these misconceptions, borrowers and lenders can navigate the lending process more effectively and ensure that their agreements are clear and enforceable.

What to Know About This Form

What is a California Promissory Note?

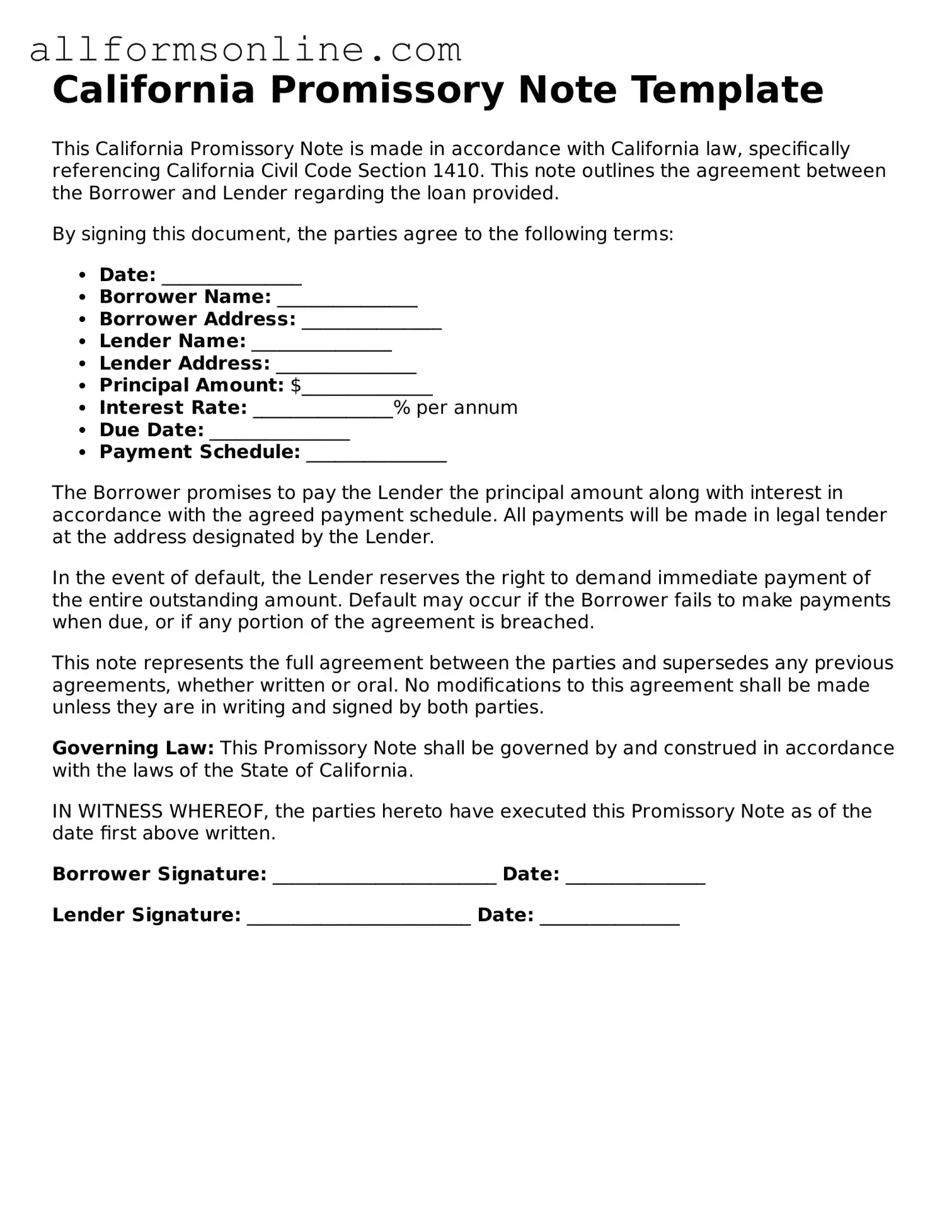

A California Promissory Note is a legal document in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) under agreed-upon terms. This document outlines the loan amount, interest rate, repayment schedule, and any other relevant conditions. It serves as a formal record of the debt and the obligations of both parties involved.

Who can use a Promissory Note in California?

Any individual or business can use a Promissory Note in California. This includes personal loans between friends or family, as well as business loans between companies. It is essential that both parties fully understand the terms and conditions outlined in the note before signing.

What are the key components of a California Promissory Note?

A California Promissory Note typically includes the following key components: the names and addresses of the borrower and lender, the principal amount of the loan, the interest rate, the repayment schedule, and any late fees or penalties. Additionally, it may contain clauses regarding default and remedies available to the lender if the borrower fails to repay the loan.

Is a Promissory Note legally binding?

Yes, a Promissory Note is legally binding once both parties sign it. This means that the borrower is obligated to repay the loan according to the terms specified in the note, and the lender has the right to take legal action if the borrower defaults. It is important for both parties to keep a copy of the signed document for their records.

Do I need to have a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, it is advisable, especially for larger loans or complex agreements. A legal professional can ensure that the document meets all legal requirements and adequately protects the interests of both parties. For simple loans, templates are available online that can be customized.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the borrower and lender to ensure clarity and legal enforceability. Verbal agreements regarding changes may not be sufficient.

Other Common State-specific Promissory Note Forms

Promissory Note Template Florida Pdf - Both parties should retain a copy of the signed promissory note for their records.

Free Loan Agreement Template Texas - A promissory note is less formal than a mortgage but serves a similar function in borrowing money.

The EDD DE 2501 form is a crucial document used in California to apply for Disability Insurance benefits. This form acts as a formal request for financial support during a period of temporary disability. Completing the DE 2501 accurately can significantly impact eligibility and the timely receipt of benefits, and resources such as Fast PDF Templates can assist applicants in ensuring that their submissions meet all necessary requirements.

New York Promissory Note - Promissory Notes can facilitate informal lending among friends and family.

How to Write a Promissory Note Example - Interest payments may be structured differently depending on the agreement reached.

How to Use California Promissory Note

Completing the California Promissory Note form is an important step in documenting a loan agreement. After filling out the form, both parties will have a clear understanding of the terms of the loan, including repayment details and interest rates. This clarity helps prevent misunderstandings and protects the interests of both the lender and the borrower.

- Begin by locating the California Promissory Note form. You can find it online or at legal stationery stores.

- At the top of the form, fill in the date on which the note is being executed.

- Enter the name and address of the borrower. Make sure to include the full legal name to avoid any confusion.

- Next, provide the name and address of the lender. Again, use the full legal name for accuracy.

- Specify the principal amount being borrowed. This is the total amount that the borrower will repay.

- Indicate the interest rate. Make sure to specify whether it is a fixed or variable rate.

- Fill in the repayment terms. This includes the schedule for payments, such as monthly or quarterly, and the final due date.

- If applicable, include any late fees or penalties for missed payments. Clearly outline the conditions under which these fees will apply.

- Provide any additional terms or conditions that may be relevant to the loan agreement. This could include collateral or prepayment options.

- Both the borrower and the lender should sign and date the form. This signifies that both parties agree to the terms outlined in the note.

Once the form is completed and signed, it is advisable to keep a copy for your records. This ensures that both parties have access to the agreed-upon terms in the future. If needed, consider consulting a legal professional for further guidance.