Attorney-Approved Real Estate Purchase Agreement Form for California

Misconceptions

The California Real Estate Purchase Agreement (RPA) is a crucial document in the home buying process, yet many people harbor misconceptions about it. Understanding these myths can help buyers and sellers navigate real estate transactions more effectively.

- Misconception 1: The RPA is a standard form that can be filled out without legal guidance.

- Misconception 2: The RPA guarantees a successful sale.

- Misconception 3: The RPA is only important for buyers.

- Misconception 4: Once signed, the terms of the RPA cannot be changed.

- Misconception 5: The RPA does not require any disclosures.

- Misconception 6: Only real estate agents can fill out the RPA.

- Misconception 7: The RPA is a one-size-fits-all document.

- Misconception 8: The RPA is only needed for residential properties.

While the RPA is a commonly used form, its nuances can vary significantly based on individual circumstances. Legal guidance can help ensure that all terms are accurately represented and understood.

Signing the RPA does not guarantee that a sale will go through. Factors such as financing, inspections, and contingencies can all impact the transaction's success.

Both buyers and sellers must understand the RPA. It outlines the rights and responsibilities of each party, making it essential for all involved in the transaction.

Terms in the RPA can be modified if both parties agree to the changes. This flexibility can be crucial in accommodating new information or concerns that arise during the process.

The RPA mandates certain disclosures to protect buyers and sellers. These disclosures ensure that all parties are aware of any issues that could affect the property's value or desirability.

While real estate agents are experienced in completing the RPA, buyers and sellers can fill it out themselves. However, it is advisable to seek assistance to avoid potential pitfalls.

The RPA can be tailored to fit the specific needs of the transaction. Customizing the agreement allows parties to address unique concerns or conditions relevant to the sale.

Although commonly associated with residential sales, the RPA can also apply to commercial transactions. Understanding its versatility is important for anyone involved in real estate.

What to Know About This Form

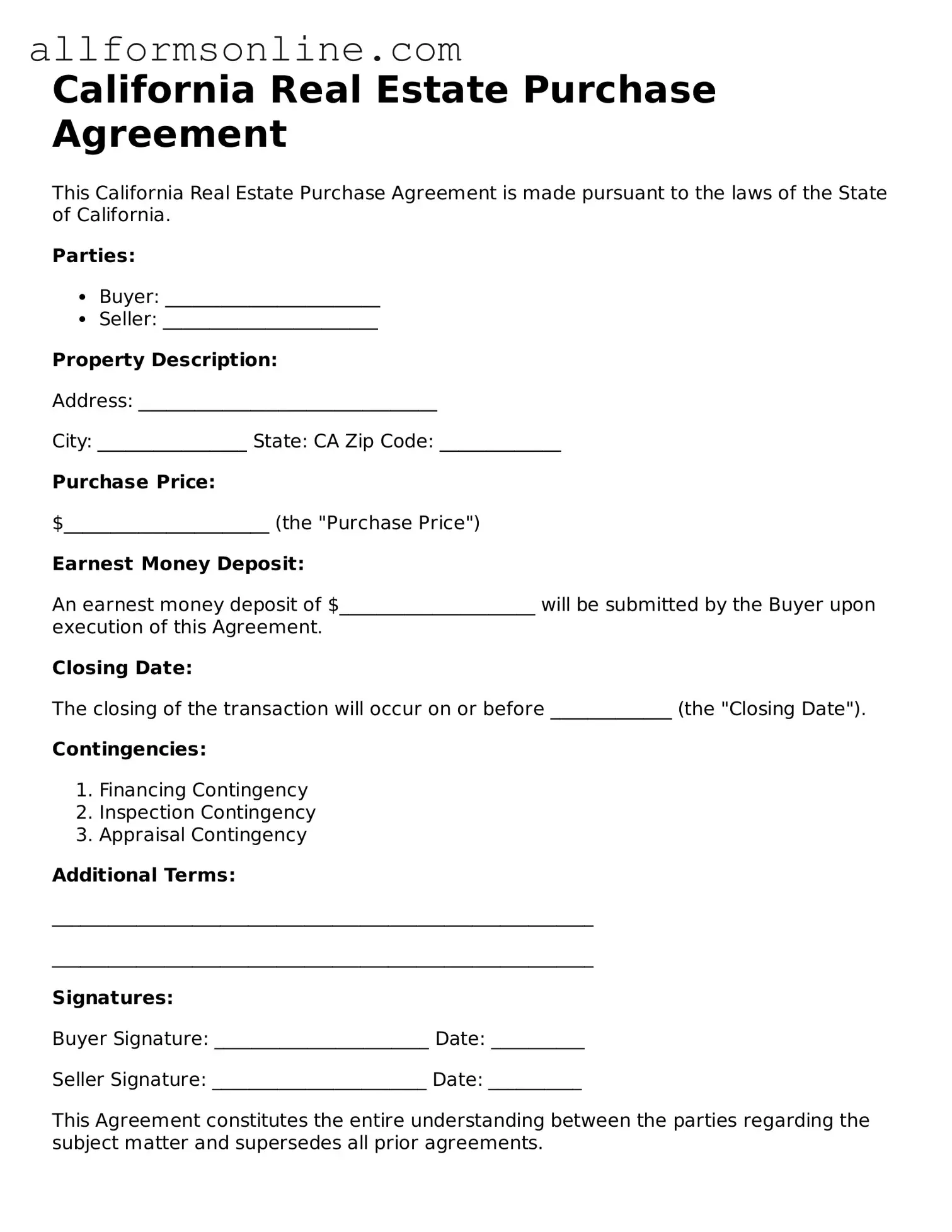

What is the California Real Estate Purchase Agreement form?

The California Real Estate Purchase Agreement form is a legal document used in real estate transactions within the state. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This form includes essential details such as the purchase price, financing terms, and contingencies. It serves as a binding contract once both parties sign it, ensuring that all parties understand their rights and obligations throughout the transaction process.

What key elements should be included in the agreement?

Several critical components must be present in the California Real Estate Purchase Agreement. First, the property description is vital; it should clearly identify the location and boundaries of the property. Second, the purchase price must be stated along with any deposit required. Additionally, the agreement should outline any contingencies, such as financing or inspection requirements, that must be satisfied before the sale can proceed. Finally, the closing date and any included fixtures or personal property should be detailed to avoid misunderstandings.

What are contingencies, and why are they important?

Contingencies are conditions that must be met for the sale to proceed. They protect both the buyer and the seller by allowing either party to back out of the agreement without penalties if specific conditions are not satisfied. Common contingencies include financing approval, home inspections, and appraisal results. Including contingencies in the purchase agreement is crucial because they help ensure that buyers are not committed to a purchase that may not be in their best interest due to unforeseen issues.

Can the agreement be modified after it has been signed?

Yes, the California Real Estate Purchase Agreement can be modified after it has been signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and legality. This process is essential for maintaining the integrity of the contract and preventing disputes. If changes are significant, it may be advisable to consult with a legal professional to ensure that all modifications comply with state laws and regulations.

Other Common State-specific Real Estate Purchase Agreement Forms

Real Estate Purchase Agreement Pdf - It details the rights and responsibilities of each party involved in the sale.

In addition to ensuring compliance with regulatory requirements, using a reliable resource can simplify the process of obtaining your Texas Certificate of Insurance. For a seamless experience, visit texasformspdf.com/fillable-texas-certificate-insurance-online to fill out your COI form and ensure you meet all necessary insurance obligations.

Texas Real Estate Contract - The form helps prevent misunderstandings and miscommunications.

How to Use California Real Estate Purchase Agreement

Completing the California Real Estate Purchase Agreement is an essential step in the home buying process. Once filled out correctly, this form sets the stage for negotiations and outlines the terms of the sale. Follow these steps to ensure you provide all necessary information accurately.

- Gather Necessary Information: Collect details about the property, including the address, legal description, and any relevant disclosures.

- Fill in Buyer Information: Enter the full names and contact information of all buyers involved in the transaction.

- Complete Seller Information: Provide the names and contact details of the sellers, ensuring accuracy.

- Specify Purchase Price: Clearly state the agreed-upon purchase price for the property.

- Outline Financing Terms: Indicate how the buyer plans to finance the purchase, whether through a mortgage, cash, or other means.

- Set Contingencies: List any conditions that must be met for the sale to proceed, such as inspections or financing approval.

- Determine Closing Date: Specify the date when the sale will be finalized and ownership transferred.

- Include Additional Terms: Note any other agreements or stipulations that are important to the transaction.

- Sign and Date: All parties must sign and date the agreement to make it legally binding.

After completing the form, review it carefully to ensure all information is accurate and complete. It may be wise to consult with a real estate professional or attorney before submitting the agreement to ensure compliance with local laws and regulations.