Attorney-Approved Tractor Bill of Sale Form for California

Misconceptions

When it comes to the California Tractor Bill of Sale form, several misconceptions often arise. Understanding these can help ensure that buyers and sellers navigate the process smoothly. Here are four common misconceptions:

- The Bill of Sale is not necessary for tractor sales. Many people believe that a Bill of Sale is optional when buying or selling a tractor. However, having a Bill of Sale provides a legal record of the transaction and can protect both parties in case of disputes.

- Only the seller needs to sign the Bill of Sale. Some individuals think that only the seller's signature is required for the Bill of Sale to be valid. In reality, both the buyer and seller should sign the document to confirm their agreement and ensure its legality.

- All tractors require a title for sale. There is a common belief that all tractors must have a title to be sold legally. However, some older tractors may not have titles, and in such cases, a Bill of Sale can still serve as proof of ownership.

- The Bill of Sale does not need to be notarized. Many people assume that notarization is mandatory for a Bill of Sale to be valid. While notarization can add an extra layer of security and verification, it is not always required in California for the sale of a tractor.

By addressing these misconceptions, buyers and sellers can better understand the importance of the California Tractor Bill of Sale form and ensure a smoother transaction process.

What to Know About This Form

What is a California Tractor Bill of Sale form?

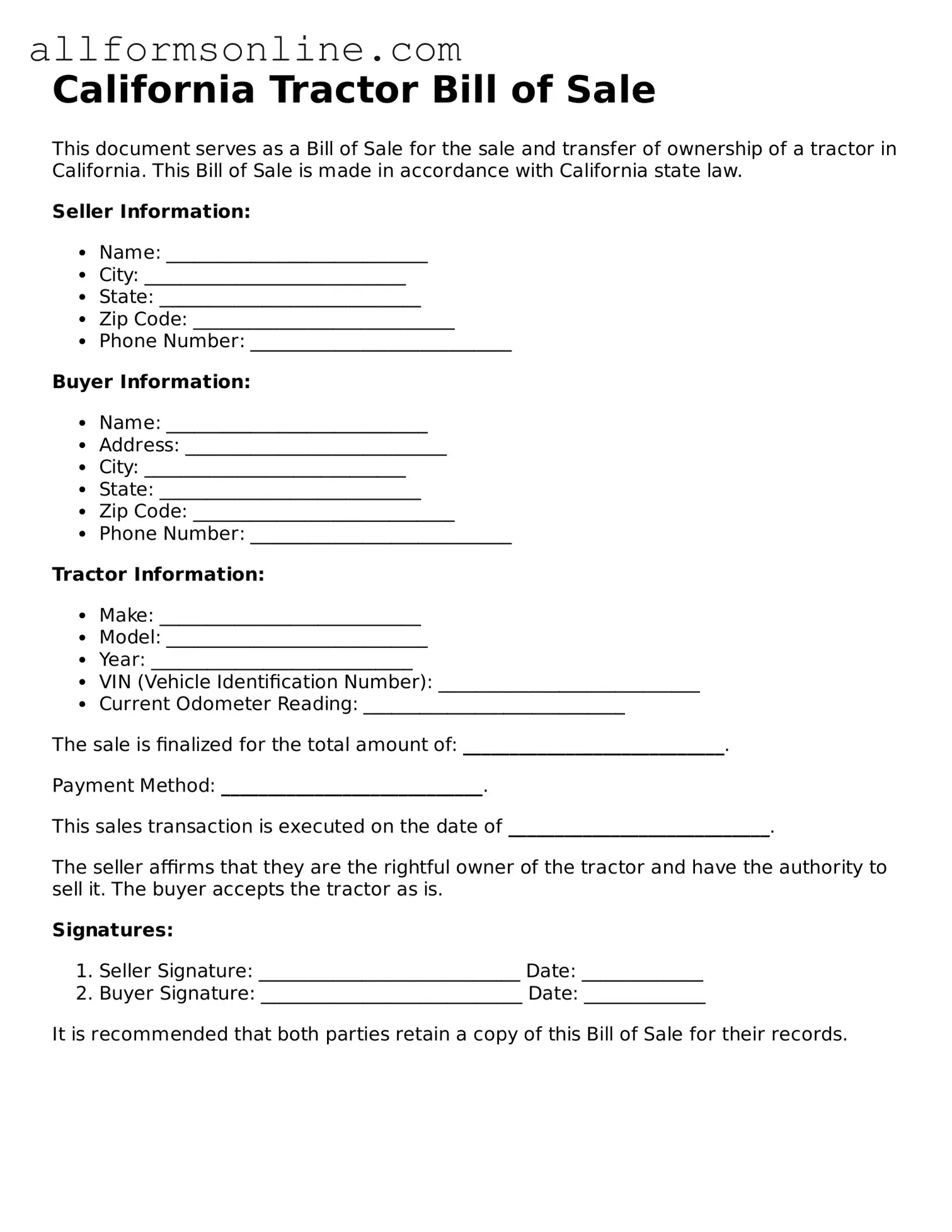

The California Tractor Bill of Sale form is a legal document used to transfer ownership of a tractor from one party to another. It serves as proof of the transaction and includes important details such as the buyer's and seller's information, the tractor's make, model, year, and Vehicle Identification Number (VIN).

Why do I need a Bill of Sale for my tractor?

A Bill of Sale is essential for several reasons. It provides a record of the sale, which can be useful for tax purposes. It also protects both the buyer and seller by documenting the terms of the transaction. Additionally, it may be required by the California Department of Motor Vehicles (DMV) for registration purposes.

What information is required on the form?

The form should include the names and addresses of both the buyer and seller, the date of the sale, a description of the tractor (including make, model, year, and VIN), the sale price, and any conditions of the sale. Both parties should sign the document to validate the transaction.

Is the Bill of Sale required to register my tractor in California?

Yes, the Bill of Sale is often required when registering a tractor in California. The DMV may ask for it as part of the registration process to verify ownership and the details of the sale. It is advisable to check with your local DMV office for specific requirements.

Can I create my own Bill of Sale form?

Yes, you can create your own Bill of Sale form as long as it includes all necessary information. However, using a standardized form can help ensure that you don't miss any important details. There are templates available online that can guide you in creating a comprehensive document.

What should I do after completing the Bill of Sale?

Once the Bill of Sale is completed and signed by both parties, keep a copy for your records. The buyer should present the form to the DMV when registering the tractor. It is also a good idea for the seller to retain a copy as proof of the sale.

Other Common State-specific Tractor Bill of Sale Forms

Simple Bill of Sale Florida - Helps foster trust by documenting the transaction process.

Completing the Texas Certificate of Insurance is essential for any Responsible Master Plumber looking to comply with state regulations and protect themselves against potential liabilities. By ensuring you have the correct coverage, you can operate your plumbing business with confidence. For a streamlined process, visit texasformspdf.com/fillable-texas-certificate-insurance-online/ to fill out your Texas Certificate Insurance form accurately and efficiently.

How to Use California Tractor Bill of Sale

Once you have the California Tractor Bill of Sale form in front of you, it’s time to fill it out accurately. This form is essential for documenting the sale of a tractor, ensuring both parties have a clear record of the transaction. Follow these steps carefully to complete the form correctly.

- Obtain the form: Make sure you have the official California Tractor Bill of Sale form. You can find it online or at your local DMV office.

- Seller information: Write the full name and address of the seller. This is the person or entity selling the tractor.

- Buyer information: Fill in the full name and address of the buyer. This is the person or entity purchasing the tractor.

- Tractor details: Provide specific information about the tractor, including the make, model, year, Vehicle Identification Number (VIN), and any other identifying details.

- Sale price: Clearly state the sale price of the tractor. This should be the amount agreed upon by both parties.

- Odometer reading: If applicable, record the odometer reading at the time of sale. This is important for tracking usage and value.

- Date of sale: Indicate the date when the transaction is taking place. This helps establish the timeline of ownership.

- Signatures: Both the seller and buyer must sign the form. This confirms that both parties agree to the terms outlined in the document.

- Notarization: Although not always required, consider having the form notarized to add an extra layer of authenticity.

After completing the form, make sure both parties keep a copy for their records. This documentation is crucial should any disputes arise in the future. Additionally, you may need to submit this form to the DMV to finalize the transfer of ownership.