Attorney-Approved Transfer-on-Death Deed Form for California

Misconceptions

-

Misconception 1: The Transfer-on-Death Deed automatically transfers property upon death.

Many people believe that this deed allows for immediate transfer of property upon the owner's death. In reality, the transfer only occurs after the owner's passing and when the deed is properly recorded with the county. Until that time, the property remains under the owner's control.

-

Misconception 2: A Transfer-on-Death Deed avoids all taxes.

Some individuals think that using this deed eliminates tax liabilities. However, while it can help avoid probate, it does not exempt the property from property taxes or potential capital gains taxes upon transfer.

-

Misconception 3: The Transfer-on-Death Deed can only be used for residential properties.

This deed is often thought to apply solely to homes. In fact, it can be used for various types of real estate, including commercial properties, as long as they meet the legal requirements.

-

Misconception 4: Once a Transfer-on-Death Deed is created, it cannot be changed.

Some may assume that this deed is set in stone once executed. In truth, the owner can revoke or modify the deed at any time before their death, provided they follow the proper legal procedures.

-

Misconception 5: A Transfer-on-Death Deed eliminates the need for a will.

While this deed can simplify the transfer process for specific properties, it does not replace the need for a will. A comprehensive estate plan should include a will to address all assets and personal wishes.

What to Know About This Form

What is a Transfer-on-Death Deed in California?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner in California to transfer their real estate to a designated beneficiary upon their death. This type of deed helps avoid probate, which can be a lengthy and costly process. The property owner retains full control of the property during their lifetime and can change or revoke the deed at any time before their death.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in California can use a Transfer-on-Death Deed. This includes homeowners, co-owners, and individuals who hold property in trust. It is important that the person creating the deed is of sound mind and understands the implications of the transfer.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must complete the specific form provided by the state of California. The form requires details such as the property description, the name of the beneficiary, and the signature of the property owner. Once completed, the deed must be notarized and recorded with the county recorder’s office where the property is located. Recording the deed ensures that it is legally valid and enforceable.

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be changed or revoked at any time before the property owner’s death. To do this, you must create a new deed that either names a different beneficiary or explicitly revokes the previous deed. It is advisable to record any changes with the county recorder’s office to avoid confusion in the future.

What happens if the beneficiary dies before the property owner?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed will not be effective. In this case, the property owner should consider naming an alternate beneficiary in the deed. If no alternate is designated, the property will typically become part of the owner’s estate and may go through probate.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not create immediate tax consequences for the property owner. However, the beneficiary may face tax implications when they inherit the property. It is advisable to consult with a tax professional to understand any potential tax liabilities related to the transfer.

Can a Transfer-on-Death Deed be used for all types of property?

A Transfer-on-Death Deed can be used for most types of real property, including residential homes, commercial properties, and vacant land. However, it cannot be used for personal property, such as vehicles or bank accounts. For those types of assets, different estate planning tools may be more appropriate.

Is legal assistance recommended when creating a Transfer-on-Death Deed?

Other Common State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Florida Form - This deed can be revoked or changed by the property owner at any time before their death.

Transfer Deed Upon Death - Keep your estate matters simple with a Transfer-on-Death Deed, tailored to your needs.

The Chick-fil-A Job Application form is a key tool for individuals seeking employment at one of the most popular fast-food chains in America. Completing this form accurately can significantly enhance your chances of securing a position within the company, and for those looking for a reliable format, the Fast PDF Templates can be a valuable resource. Understanding its requirements and the application process is essential for potential applicants.

Where Can I Get a Tod Form - Each state has its own form and rules for the Transfer-on-Death Deed which must be followed.

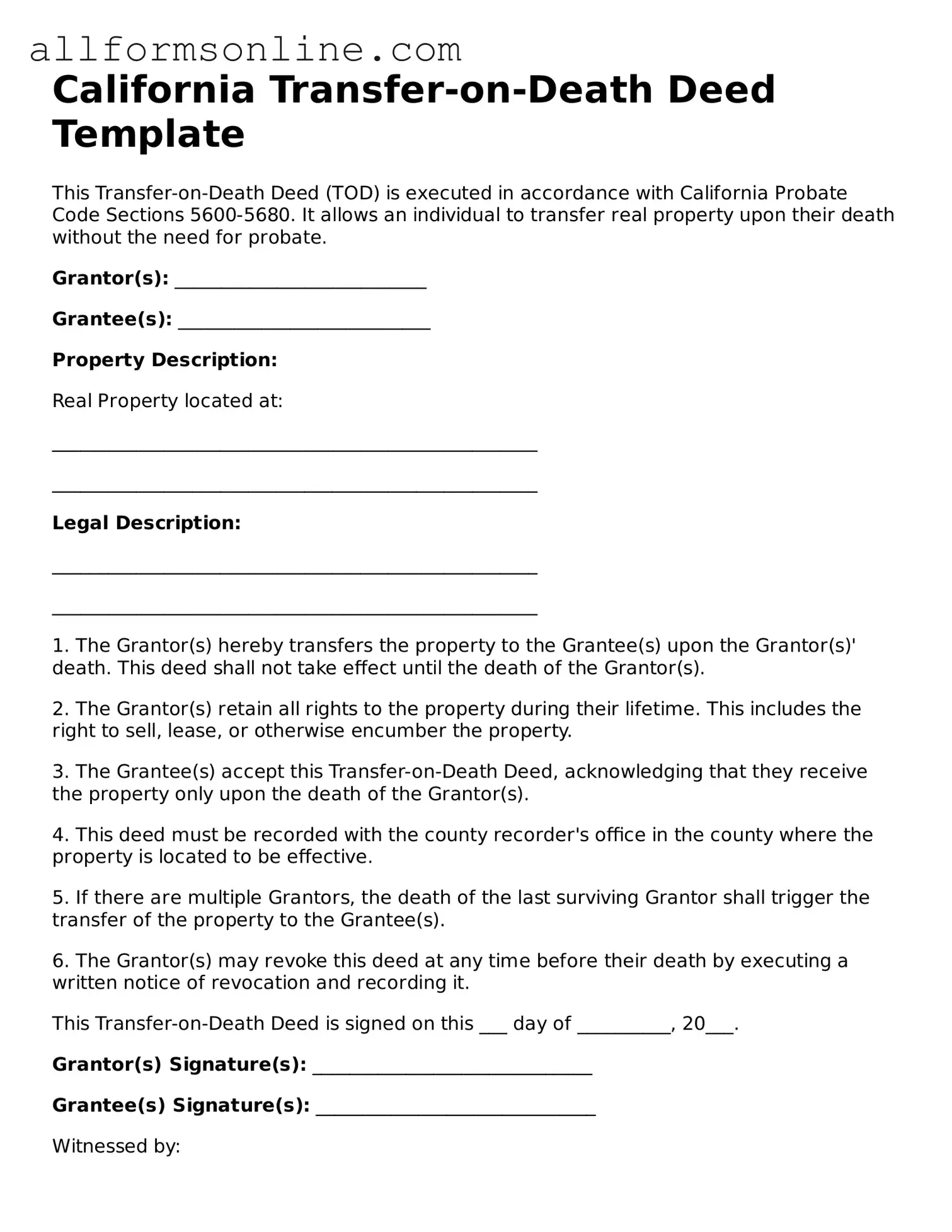

How to Use California Transfer-on-Death Deed

After you have gathered the necessary information, you are ready to fill out the California Transfer-on-Death Deed form. This process involves several straightforward steps. Follow them carefully to ensure that your deed is completed correctly.

- Begin by entering the name of the property owner(s) at the top of the form.

- Provide the address of the property that will be transferred.

- Include the legal description of the property. You can find this information on your property tax bill or deed.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon your passing.

- Specify the relationship between you and each beneficiary.

- Sign and date the form in the designated area. If there are multiple owners, all must sign.

- Have the form notarized to ensure its validity.

- File the completed deed with the county recorder's office where the property is located.

Once you have completed these steps, your Transfer-on-Death Deed will be in effect, allowing for a smooth transfer of property upon your death. Make sure to keep a copy for your records and inform your beneficiaries about the deed.