Free Cash Drawer Count Sheet PDF Form

Misconceptions

Understanding the Cash Drawer Count Sheet form is essential for accurate cash management. However, several misconceptions may lead to confusion. Below is a list of common misconceptions, along with clarifications.

- It is only necessary for large businesses. Many believe that only large businesses need a Cash Drawer Count Sheet. In reality, any business that handles cash transactions should use this form to maintain accurate financial records.

- The form is complicated and hard to use. Some people think that the Cash Drawer Count Sheet is overly complex. In fact, it is designed to be straightforward, allowing users to easily track cash inflow and outflow.

- It is only for end-of-day cash counts. Many assume that the form is only relevant for daily closing procedures. However, it can also be used throughout the day to monitor cash levels and identify discrepancies early.

- Only managers need to fill it out. There is a misconception that only management should complete the form. In truth, cashiers and other staff members can and should use it to ensure accountability and accuracy.

- It is unnecessary if using a cash register. Some believe that if a cash register is used, a Cash Drawer Count Sheet is not needed. However, the form provides an additional layer of verification and helps prevent errors.

- It does not need to be retained for record-keeping. There is a notion that once the cash count is complete, the form can be discarded. In reality, retaining these records is important for audits and financial reviews.

- It can be filled out at any time without consistency. Some think that the timing of filling out the form is flexible. Consistency in when and how the form is completed is crucial for reliable cash management.

Addressing these misconceptions can help businesses better utilize the Cash Drawer Count Sheet, leading to improved cash handling practices.

What to Know About This Form

What is a Cash Drawer Count Sheet?

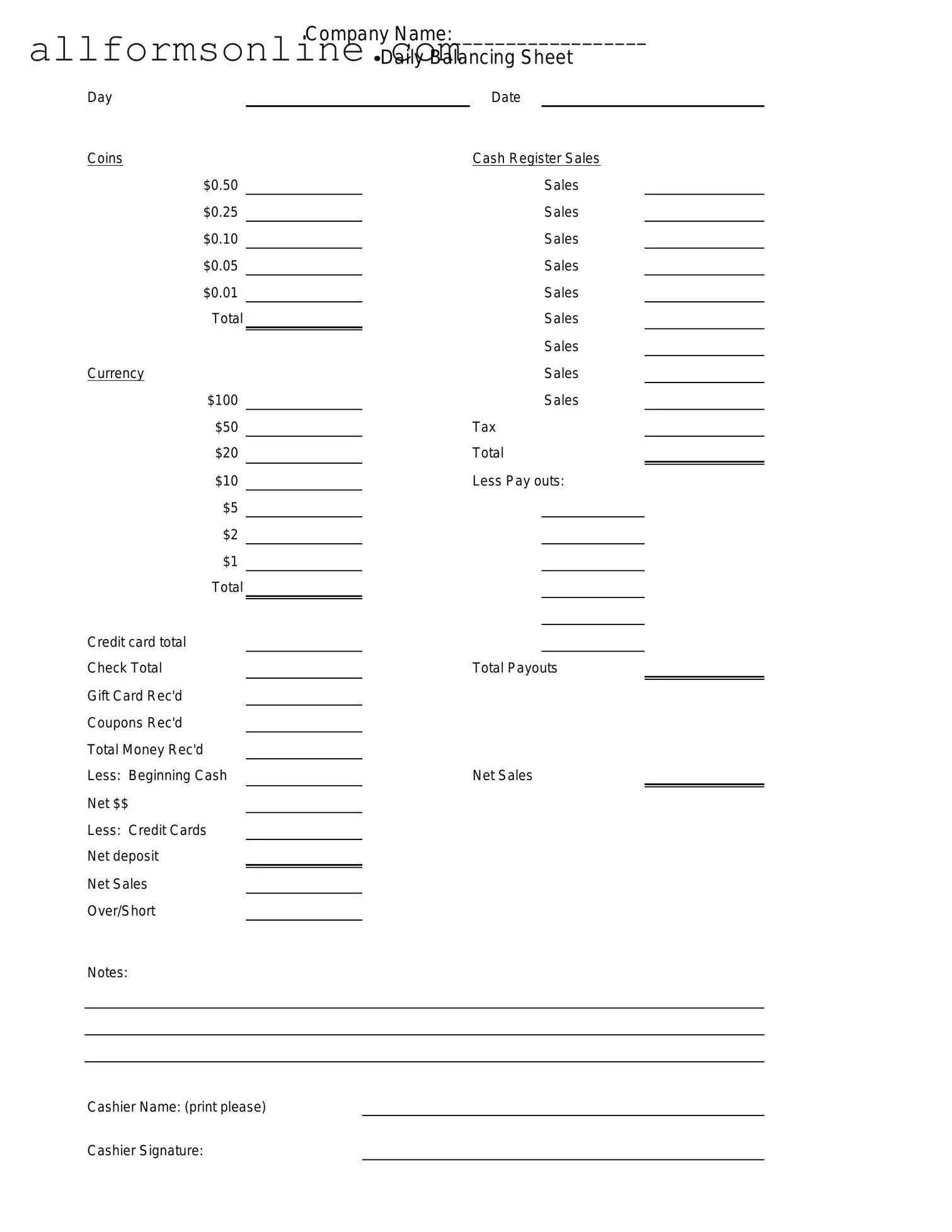

A Cash Drawer Count Sheet is a document used by businesses to track the amount of cash in a cash drawer at the end of a shift or business day. It helps ensure that the cash on hand matches the sales recorded during that period. This sheet is essential for maintaining accurate financial records and preventing discrepancies.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for several reasons. First, it promotes accountability by providing a clear record of cash transactions. Second, it helps identify any cash shortages or overages, which can prevent theft or errors. Lastly, it supports accurate financial reporting, which is vital for business operations and tax purposes.

How do I fill out a Cash Drawer Count Sheet?

To fill out a Cash Drawer Count Sheet, start by entering the date and the name of the person responsible for the cash drawer. Next, count the cash in the drawer, including bills and coins, and record the amounts in the designated sections. Finally, total the amounts and compare them to the expected cash based on sales records. Ensure that you sign and date the sheet for verification.

How often should I complete a Cash Drawer Count Sheet?

It is recommended to complete a Cash Drawer Count Sheet at the end of each shift or business day. Regular counting helps catch discrepancies early and keeps financial records accurate. Some businesses may also choose to do random counts throughout the day to ensure ongoing accountability.

What should I do if there is a discrepancy in the cash count?

If you find a discrepancy in the cash count, first double-check your calculations and the sales records. If the discrepancy persists, investigate potential causes, such as errors in transactions or possible theft. Document the findings on the Cash Drawer Count Sheet and discuss the issue with a manager or supervisor to determine the next steps.

Different PDF Forms

Employer's Quarterly Federal Tax Return - The IRS provides a guide to help employers navigate common filing issues.

For those navigating the complexities of motorcycle ownership, understanding the necessary documentation is key. Our guide on the essential Motorcycle Bill of Sale template outlines the critical elements to include, ensuring both buyers and sellers are well-informed throughout the transaction. For more specific details, visit our comprehensive Motorcycle Bill of Sale form.

Free Direct Deposit Form Pdf - Sign this document to enable your employer or payer to deposit funds directly.

Free Printable Puppy Health Guarantee Template - The deposit mentioned in the contract is non-refundable and is critical for securing the puppy.

How to Use Cash Drawer Count Sheet

Once you have the Cash Drawer Count Sheet in front of you, it’s time to get started on filling it out accurately. This process will help ensure that your cash drawer is balanced and that you have a clear record of your cash transactions. Follow the steps below to complete the form correctly.

- Begin by entering the date at the top of the form. This helps in tracking the count for specific days.

- Next, write down your name or the name of the person responsible for the cash drawer. This identifies who completed the count.

- In the designated section, note the starting cash amount in the drawer. This is the total amount of cash before any transactions.

- List each denomination of bills and coins separately. For example, include the number of $1, $5, $10, $20, and so on.

- As you list the denominations, calculate the total amount for each type. Multiply the number of bills or coins by their respective values.

- Sum up all the totals from each denomination to get the overall cash total. Write this amount in the specified area.

- Finally, double-check all entries for accuracy. Make sure that the total cash amount matches what is physically in the drawer.

With the Cash Drawer Count Sheet filled out, you can now use it for record-keeping and to ensure that your cash transactions are in order. This will help maintain transparency and accountability in your financial operations.