Free Cash Receipt PDF Form

Misconceptions

Understanding the Cash Receipt form is essential for accurate financial record-keeping. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this important document.

-

All cash transactions require a Cash Receipt form.

Not every cash transaction necessitates a Cash Receipt form. For example, smaller transactions may be recorded differently, depending on the organization’s policies.

-

The Cash Receipt form is only for cash payments.

This form can also document payments made via checks or credit cards, not just cash. It serves as a record for various types of payments received.

-

Only the accounting department uses the Cash Receipt form.

While accounting relies heavily on this form, other departments such as sales and customer service may also use it to track payments and maintain customer records.

-

Cash Receipt forms do not need to be filed.

In fact, proper filing is crucial. These forms should be retained for auditing purposes and to ensure accurate financial reporting.

-

Once a Cash Receipt form is filled out, it cannot be changed.

Corrections can be made, but they must be documented properly. This ensures transparency and maintains the integrity of financial records.

-

Cash Receipt forms are only necessary for large transactions.

Regardless of the amount, any cash or payment received should be documented. This practice helps maintain accurate financial records.

-

The Cash Receipt form is the same as an invoice.

These two documents serve different purposes. An invoice requests payment, while a Cash Receipt form acknowledges that payment has been received.

-

Cash Receipt forms are outdated and no longer relevant.

Despite advancements in technology, Cash Receipt forms remain relevant for record-keeping and auditing purposes, especially in businesses that handle cash transactions.

-

All Cash Receipt forms look the same.

Different organizations may have unique formats or templates for their Cash Receipt forms. The content may vary, but the essential information remains consistent.

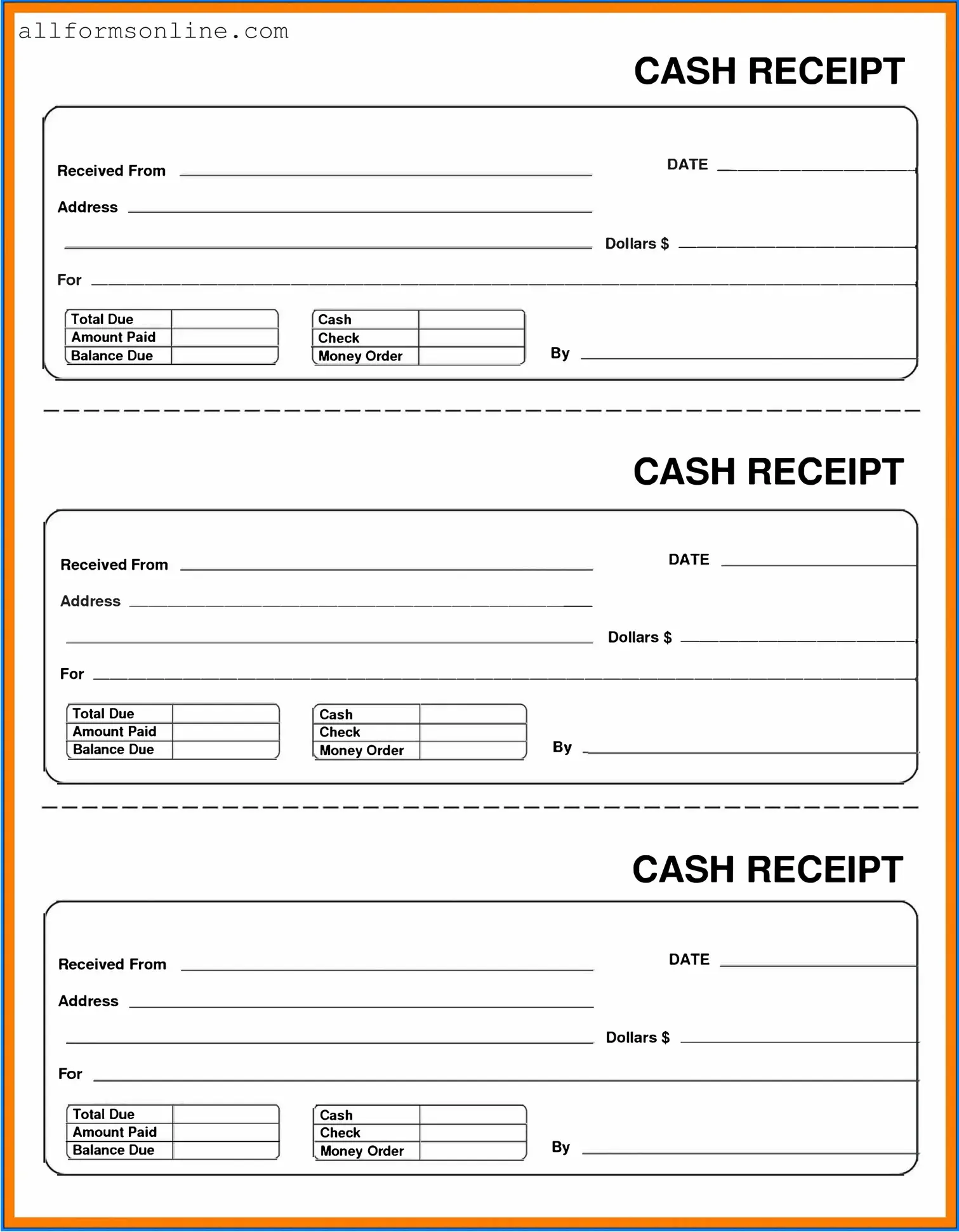

What to Know About This Form

What is a Cash Receipt form?

A Cash Receipt form is a document used to acknowledge the receipt of cash payments. It serves as proof for both the payer and the payee that a transaction has taken place. This form typically includes details such as the date of the transaction, the amount received, the name of the payer, and a description of the purpose of the payment.

Why is a Cash Receipt form important?

This form is crucial for record-keeping and accounting purposes. It helps businesses track cash inflows and provides a clear record of transactions. For individuals or businesses receiving payments, it offers protection by documenting that a payment has been made, which can be useful in case of disputes or audits.

Who should use a Cash Receipt form?

Any individual or business that receives cash payments can benefit from using a Cash Receipt form. This includes retail businesses, service providers, and freelancers. It is particularly useful for transactions that do not involve electronic payment methods, such as checks or credit cards.

What information should be included in a Cash Receipt form?

A well-structured Cash Receipt form should include the following details: the date of the transaction, the amount received, the name of the payer, the purpose of the payment, and any relevant invoice or reference number. Additionally, it may include the signature of the person receiving the cash to further validate the transaction.

How can I create a Cash Receipt form?

You can create a Cash Receipt form using various templates available online or by designing one from scratch. Many word processing programs offer templates that can be customized to fit your needs. Ensure that it includes all necessary fields and is easy to read to facilitate smooth transactions.

Is it necessary to provide a copy of the Cash Receipt form to the payer?

Yes, it is essential to provide a copy of the Cash Receipt form to the payer. This ensures they have proof of their payment for their records. It also fosters transparency and trust between the parties involved in the transaction.

Can a Cash Receipt form be used for non-cash transactions?

No, a Cash Receipt form is specifically designed for cash transactions. For non-cash payments, such as checks or electronic transfers, different forms or receipts should be used. Each type of transaction has its own documentation requirements to ensure accurate record-keeping.

Different PDF Forms

Test Drive Agreement - Take note of the test drive conditions to avoid misunderstandings.

In addition to understanding the importance of the EDD DE 2501 form for applying for Disability Insurance benefits, individuals can benefit from resources like Fast PDF Templates that provide templates and guidance for accurately completing this essential document.

Girlfriend Application Funny - Wants a companion who is open-minded and embraces diversity.

Free Direct Deposit Form Pdf - This form is necessary for receiving payroll or expense reimbursements via direct deposit.

How to Use Cash Receipt

Once you have the Cash Receipt form in front of you, it's time to fill it out accurately to ensure proper record-keeping. This process is straightforward, and following the steps below will help you complete the form correctly.

- Begin by entering the date of the transaction in the designated space at the top of the form.

- Next, fill in the name of the person or organization making the payment. Make sure to spell everything correctly.

- In the following section, write the amount received. Be sure to use the correct currency and format.

- Indicate the method of payment used, such as cash, check, or credit card, by marking the appropriate box.

- If applicable, provide any reference number associated with the payment, such as a check number or transaction ID.

- Finally, sign and date the form at the bottom to validate the receipt.

After completing the form, it should be filed in the appropriate location for future reference. Keeping accurate records is essential for financial tracking and accountability.