Free Cg 20 10 07 04 Liability Endorsement PDF Form

Misconceptions

Misconceptions About the CG 20 10 07 04 Liability Endorsement Form

- Misconception 1: The endorsement automatically provides full coverage for all liabilities.

- Misconception 2: Additional insureds have the same coverage as the primary insured.

- Misconception 3: Coverage continues indefinitely after the work is completed.

- Misconception 4: The endorsement increases the overall policy limits.

- Misconception 5: Any additional insured can claim coverage without restrictions.

This is not true. The endorsement only covers liabilities for bodily injury, property damage, or personal and advertising injury that arise from your actions or those acting on your behalf. The coverage is limited to specific conditions outlined in the endorsement.

This is incorrect. The coverage for additional insureds is only as broad as what is required by contract. If the contract specifies limited coverage, that is what will apply, and it may not be as comprehensive as the primary insured's coverage.

This is a misunderstanding. The endorsement specifies that coverage does not apply to bodily injury or property damage occurring after all work on the project has been completed. Once the project is done, the coverage ceases for those specific operations.

This is false. The CG 20 10 07 04 endorsement does not increase the limits of insurance. The maximum amount payable for an additional insured is either what is required by the contract or the available policy limits, whichever is less.

This is misleading. The endorsement includes additional exclusions that apply specifically to additional insureds. Claims must still meet the conditions set forth in the endorsement, and coverage is not guaranteed for every situation.

What to Know About This Form

What is the purpose of the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 Liability Endorsement form is designed to add specific individuals or organizations as additional insureds under a commercial general liability policy. This means that these additional insured parties are protected against certain liabilities that may arise from the actions or omissions of the primary insured party while performing work on their behalf. It’s particularly useful in construction and service contracts, where multiple parties may be involved.

Who qualifies as an additional insured under this endorsement?

The endorsement allows for the inclusion of any person or organization listed in the schedule section of the form. They are considered additional insureds only with respect to liability for bodily injury, property damage, or personal and advertising injury that results from the acts or omissions of the primary insured or their representatives during ongoing operations at designated locations. It’s important to note that this coverage is limited to the scope specified in the contract or agreement.

What limitations are placed on the coverage for additional insureds?

While the endorsement offers valuable protection, it comes with specific limitations. Coverage for additional insureds only applies if the liability arises during ongoing operations and does not extend to situations where the work has been completed. Moreover, if the additional insured’s coverage is stipulated by a contract, the insurance provided cannot exceed what is required by that contract. This ensures that the coverage remains aligned with the contractual obligations of the primary insured.

What happens if the work has been completed?

If the work related to the project is completed, the coverage for additional insureds will no longer apply to any bodily injury or property damage that occurs after that completion. This includes all materials, parts, or equipment associated with the work. Essentially, once the project is finished and the work is put to its intended use, the additional insureds are not covered for any resulting claims.

How does the endorsement affect the limits of insurance?

The endorsement does not increase the overall limits of insurance provided by the policy. Instead, if coverage for the additional insured is required by a contract, the maximum amount payable will be the lesser of what is stipulated in the contract or the limits available under the primary insured’s policy. This ensures that the insurer's exposure remains consistent and manageable.

Is it necessary to include specific locations or operations for the additional insureds?

Yes, it is crucial to specify the locations and operations in the endorsement. This ensures clarity regarding where the coverage applies and what activities are included. Without this information, the endorsement may not provide the intended protection, potentially leaving the additional insureds vulnerable in situations where coverage is needed. Always ensure that this information is accurately reflected in the schedule section of the endorsement.

Different PDF Forms

Form 4056 - Use the included income data to understand contribution needs for retirement accounts.

For individuals looking to navigate the vehicle ownership process in Georgia, understanding the significance of the Motor Vehicle Bill of Sale form is vital. This document serves as a crucial piece of evidence for both buyers and sellers, detailing the transaction. To gain insight into filling it out correctly, refer to the comprehensive guide on the Motor Vehicle Bill of Sale form in Georgia.

Fake Dr Note - A document detailing doctor's advice for rest after illness.

How to Use Cg 20 10 07 04 Liability Endorsement

Filling out the CG 20 10 07 04 Liability Endorsement form is a straightforward process. This form allows you to designate additional insured parties under your commercial general liability policy. Follow these steps to ensure accurate completion.

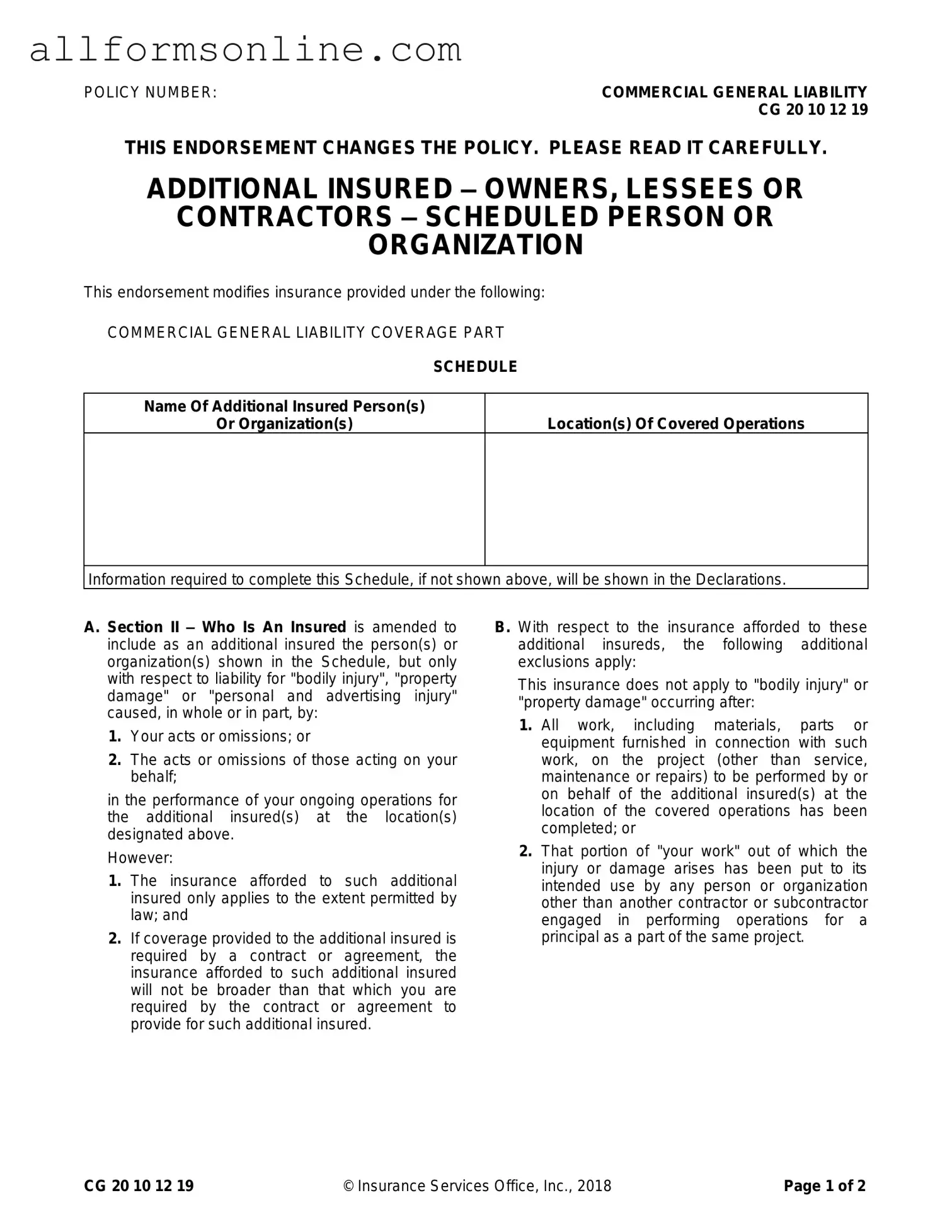

- Locate the Policy Number: At the top of the form, find the space labeled "POLICY NUMBER." Enter your commercial general liability policy number here.

- Identify Additional Insured: In the section labeled "Name Of Additional Insured Person(s) Or Organization(s)," write the names of the individuals or organizations you want to add as additional insureds.

- Specify Locations: Next, in the "Location(s) Of Covered Operations" section, indicate the locations where the covered operations will take place. Be as specific as possible.

- Review Information: Check the Declarations page of your policy. Ensure that all necessary information is accurately reflected and matches what you’ve entered on the form.

- Sign and Date: At the bottom of the form, sign and date it. This step confirms that you agree to the terms outlined in the endorsement.

- Submit the Form: Send the completed form to your insurance provider. Keep a copy for your records.

After completing the form, it will be processed by your insurance company. They will update your policy to reflect the changes and send you confirmation. Ensure that you retain a copy for your own records as well.