Free Childcare Receipt PDF Form

Misconceptions

Understanding the Childcare Receipt form is essential for parents and caregivers. However, several misconceptions can lead to confusion. Here are ten common misunderstandings about this important document:

- It’s only for tax purposes. Many believe the form is solely for tax deductions. While it can be used for that, it also serves as proof of payment for services rendered.

- Any receipt will do. Some think that any handwritten note from the provider is sufficient. However, a formal receipt with specific details is often required for clarity and record-keeping.

- Providers don't need to sign it. A signature from the childcare provider is crucial. It confirms that the payment was received and services were provided.

- All receipts are the same. Not all receipts contain the same information. Each receipt should include the date, amount, names, and service period for accuracy.

- It can be filled out later. Some parents believe they can complete the receipt after the fact. It’s best to fill it out immediately to ensure all details are accurate and fresh in memory.

- Childcare services are only for young children. Many think that the receipt is only relevant for infants or toddlers. However, it applies to all ages of children receiving care.

- Receipts are not necessary for occasional care. Even if care is infrequent, receipts are still important for tracking expenses and verifying payments.

- Digital receipts are not acceptable. Some assume that only paper receipts are valid. In fact, digital receipts can be just as legitimate if they contain all required information.

- Providers can charge whatever they want. There is a misconception that providers can set any price. However, rates should be discussed and agreed upon in advance to avoid misunderstandings.

- Once the form is filled out, it cannot be changed. Many think that any errors on the receipt are permanent. In reality, corrections can be made if both parties agree, ensuring accuracy.

By clarifying these misconceptions, parents and caregivers can navigate the childcare process more confidently. Understanding the Childcare Receipt form helps ensure that everyone is on the same page, promoting transparency and trust.

What to Know About This Form

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as an official record of payment for childcare services. Parents or guardians receive this receipt after making a payment to a childcare provider. It outlines essential details such as the date of the service, the amount paid, the names of the children receiving care, and the signature of the provider. This documentation is crucial for both financial tracking and potential tax deductions related to childcare expenses.

How should I fill out the Childcare Receipt form?

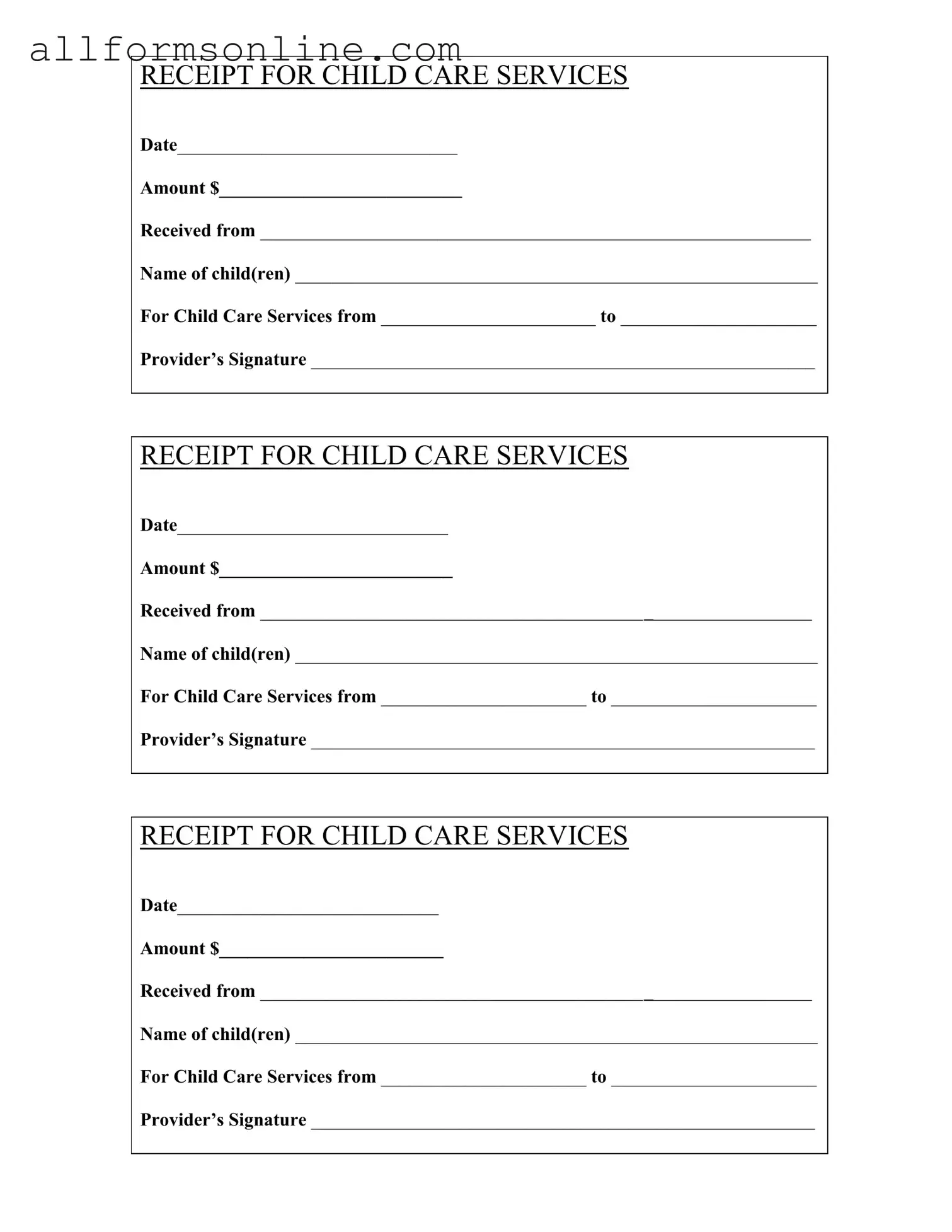

To complete the Childcare Receipt form, begin by entering the date of the transaction at the top of the form. Next, specify the amount received in the designated space. Fill in your name as the person making the payment, along with the names of the child or children for whom the care was provided. Indicate the period during which the childcare services were rendered. Finally, ensure that the provider signs the form to validate the receipt. Accurate and complete information is essential for the receipt to be effective.

Can I use the Childcare Receipt form for multiple children?

Yes, the Childcare Receipt form can accommodate multiple children. When filling out the form, simply list the names of all the children receiving care in the designated space. This ensures that the receipt accurately reflects the services provided for each child, which can be beneficial for record-keeping and tax purposes. However, if you prefer, you may also use separate forms for each child to maintain clearer records.

What should I do if I lose my Childcare Receipt form?

If you lose your Childcare Receipt form, it is advisable to contact your childcare provider as soon as possible. They can issue a duplicate receipt or provide you with the necessary information to recreate it. Keeping a digital or physical copy of important documents can help prevent future loss. It is essential to maintain these records for your financial documentation, especially when preparing for tax season.

Different PDF Forms

Form 4056 - Use the form to verify your tax return details if needed.

Dr 835 - The Tax POA DR 835 provides legal protection for both taxpayer and representative.

Filling out the Texas Certificate of Insurance form accurately is essential for all Master Plumbers to maintain their legal standing; you can easily complete this process by visiting https://texasformspdf.com/fillable-texas-certificate-insurance-online to ensure you have the proper coverage and documentation in place before starting any plumbing work.

USCIS Form I-864 - Immigrant applicants should consult with professionals for assistance with the I-864.

How to Use Childcare Receipt

Filling out the Childcare Receipt form is a straightforward process. This form serves as a record of payment for childcare services provided. Completing it accurately ensures both the provider and the parent have a clear understanding of the transaction.

- Begin by entering the Date of the transaction in the designated space.

- Next, fill in the Amount paid for the childcare services.

- In the Received from section, write the name of the person making the payment.

- List the Name of child(ren) receiving care.

- Indicate the period for which services were provided by filling in the For Child Care Services from and to dates.

- Finally, the provider should sign the form in the Provider’s Signature area.