Free Citibank Direct Deposit PDF Form

Misconceptions

When it comes to the Citibank Direct Deposit form, several misconceptions can lead to confusion. Understanding the facts can help ensure a smooth experience with your direct deposits. Here are seven common misconceptions:

-

Direct deposit is only for payroll.

Many believe that direct deposit is exclusively for salary payments. In reality, it can be used for various types of deposits, including government benefits, tax refunds, and other income sources.

-

You need a Citibank account to use the form.

While the form is designed for Citibank customers, it can also be used to set up direct deposits into other banks, provided the sender allows it.

-

Direct deposit takes a long time to set up.

In most cases, setting up direct deposit is a quick process. Once you submit the form to your employer or the paying entity, they typically process it within one or two pay cycles.

-

Direct deposits are always instant.

Although direct deposits are generally faster than traditional checks, they are not always instantaneous. It may take one business day for the funds to appear in your account after they are deposited.

-

You cannot change your direct deposit information.

Some people think that once they set up direct deposit, they cannot make changes. However, you can update your information anytime by submitting a new form to your employer or the paying entity.

-

Direct deposits are not secure.

Contrary to popular belief, direct deposits are often more secure than paper checks. They reduce the risk of theft or loss and are protected by banking regulations.

-

You cannot split your direct deposit.

Many assume that direct deposits must go into a single account. In fact, you can request that your deposits be split between multiple accounts, allowing for better budgeting and savings.

By clarifying these misconceptions, individuals can make informed decisions about utilizing the Citibank Direct Deposit form effectively. Take the time to understand the process and enjoy the benefits of direct deposit.

What to Know About This Form

What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document that allows you to authorize your employer or any other organization to deposit your paycheck or other payments directly into your Citibank account. This method is convenient, secure, and often faster than receiving a paper check.

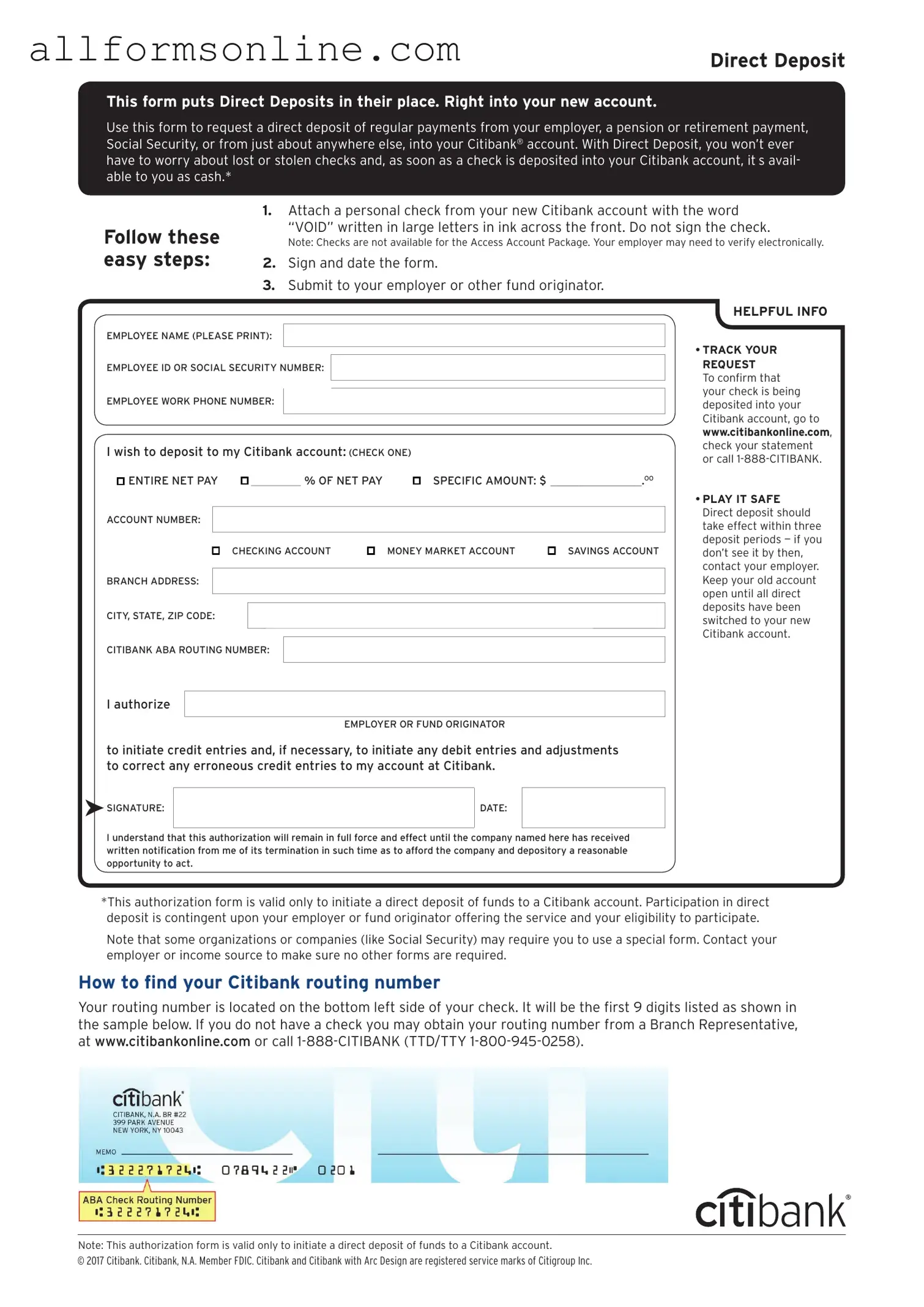

How do I fill out the Citibank Direct Deposit form?

To complete the form, you’ll need to provide your personal information, including your name, address, and Social Security number. You will also need to include your Citibank account number and the bank's routing number. Make sure to double-check all the information for accuracy to avoid any delays in processing.

Where can I obtain the Citibank Direct Deposit form?

You can typically find the Citibank Direct Deposit form on Citibank's official website or by visiting a local branch. If you are an employee, your employer may also provide the form directly or have it available through their HR department.

How long does it take for direct deposits to start?

The time it takes for direct deposits to begin can vary. Generally, it may take one to two pay cycles for your employer to process the form and set up the direct deposit. Be sure to check with your employer for their specific timeline.

What should I do if I change my bank account?

If you decide to change your bank account, you will need to fill out a new Citibank Direct Deposit form with your updated account information. Submit the new form to your employer or the organization making the payments. It’s wise to ensure that the old account is closed only after the new direct deposit has been confirmed.

Is there a fee for using direct deposit with Citibank?

Generally, there are no fees associated with receiving direct deposits into your Citibank account. However, it's always a good idea to review your account terms or contact customer service for specific details regarding any potential fees.

Can I set up multiple direct deposits to different accounts?

Yes, you can set up multiple direct deposits to different accounts, but this typically requires separate authorization forms for each account. Check with your employer or payment provider to understand their policies regarding multiple direct deposits.

What should I do if my direct deposit is incorrect?

If you notice an error in your direct deposit, such as an incorrect amount or a missed payment, contact your employer or the organization responsible for the deposit immediately. They can investigate the issue and help resolve it. Additionally, keep an eye on your bank account for any discrepancies.

Different PDF Forms

Tb Test Form California - This form can be utilized in various healthcare settings, including clinics and hospitals.

For those looking to fulfill their responsibilities regarding the Texas Employment Verification form, it is essential to understand the online options available. Employers can conveniently access the necessary resources and fill out the required documentation without hassle by visiting https://texasformspdf.com/fillable-texas-employment-verification-online/, ensuring compliance and expediting the process of verifying employment information for state benefits.

File Form 2553 Online - Consulting IRS instructions can help clarify the filing process for Form 2553.

Fake Electric Bill - Essential for maintaining accurate billing records.

How to Use Citibank Direct Deposit

Filling out the Citibank Direct Deposit form is a straightforward process. Once you complete the form, you can submit it to your employer or the relevant financial department. This will help ensure that your funds are deposited directly into your Citibank account.

- Begin by entering your personal information at the top of the form. This includes your full name, address, and phone number.

- Locate the section for your bank account details. Here, you will need to provide your Citibank account number and the routing number. You can find the routing number on your checks or by visiting the Citibank website.

- Indicate whether this is a checking or savings account. Make sure to check the appropriate box.

- Next, fill in your employer's information. This includes the company name and address where you work.

- Sign and date the form at the bottom. Your signature authorizes the direct deposit.

- Review the form for accuracy. Ensure all information is correct before submitting.