Blank Deed in Lieu of Foreclosure Form

Deed in Lieu of ForeclosureDocuments for Particular States

Misconceptions

When facing financial difficulties, many homeowners consider a deed in lieu of foreclosure as an option. However, several misconceptions can cloud understanding of this process. Below is a list of common misconceptions along with explanations to clarify them.

- It eliminates all debt immediately. Many believe that signing a deed in lieu of foreclosure wipes out all mortgage debt. In reality, it may not absolve you of other financial obligations related to the property, such as taxes or liens.

- It guarantees a quick resolution. Some think that a deed in lieu of foreclosure will speed up the process of resolving their mortgage issues. While it can be quicker than foreclosure, the timeline can still vary based on lender processes and requirements.

- It is the same as selling your home. People often confuse a deed in lieu with selling their home. A deed in lieu involves transferring ownership back to the lender, while selling typically involves a transaction with a buyer.

- It has no impact on credit scores. Many assume that a deed in lieu will not affect their credit. Unfortunately, it can still negatively impact your credit score, although it may be less severe than a foreclosure.

- It is only for homeowners in dire financial situations. Some believe that only those facing extreme financial distress can pursue a deed in lieu. However, homeowners facing various financial challenges may consider this option.

- All lenders accept deeds in lieu. It is a common misconception that every lender will accept a deed in lieu of foreclosure. Each lender has its own policies, and some may not offer this option at all.

- It absolves you of all legal obligations. Many think that once the deed is signed, they are free from any legal responsibilities. However, you may still be liable for any deficiencies or other obligations tied to the property.

- It is a simple process. Some homeowners believe that completing a deed in lieu is straightforward. While it can be simpler than foreclosure, it still involves paperwork and negotiations with the lender.

- It is a permanent solution. Many view a deed in lieu as a final solution to their housing problems. However, it may only be a temporary fix, as other financial challenges could arise later.

- It is only available for primary residences. Some individuals think that a deed in lieu can only be used for their primary home. In fact, it can also apply to investment properties, although the process may differ.

Understanding these misconceptions can help homeowners make informed decisions about their options. A deed in lieu of foreclosure can be a viable solution, but it is essential to consider all aspects before proceeding.

What to Know About This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This process allows the homeowner to relinquish their mortgage obligations while the lender takes possession of the property. It can be a less stressful and quicker alternative to going through a full foreclosure process.

Who qualifies for a Deed in Lieu of Foreclosure?

Typically, homeowners who are struggling to make mortgage payments and facing foreclosure may qualify. Lenders usually look for homeowners who have exhausted all other options, such as loan modifications or short sales. The homeowner must also be able to demonstrate financial hardship and a willingness to cooperate with the lender.

What are the benefits of a Deed in Lieu of Foreclosure?

One major benefit is that it can help homeowners avoid the lengthy and damaging foreclosure process. It may also allow them to walk away from their mortgage debt without the negative impact of a foreclosure on their credit score. Additionally, some lenders may offer cash incentives or relocation assistance as part of the agreement.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are potential drawbacks. The homeowner may still face tax implications, as forgiven mortgage debt can be considered taxable income. Furthermore, the lender may not accept the Deed in Lieu if there are junior liens or other encumbrances on the property. This could complicate the process and require additional negotiations.

How does the process work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then evaluate the homeowner's financial situation and the property itself. If approved, both parties will sign the necessary documents to transfer ownership, and the lender will take possession of the property.

Will a Deed in Lieu of Foreclosure affect my credit score?

Yes, it will impact your credit score, but generally less severely than a foreclosure. A Deed in Lieu may be reported as a "settled" account, which is better than a foreclosure. However, it will still remain on your credit report for several years, affecting your ability to secure future loans.

Can I negotiate the terms of a Deed in Lieu of Foreclosure?

Yes, homeowners can negotiate the terms. This might include discussing any potential cash incentives or how the lender will handle the remaining mortgage balance. Open communication with the lender can lead to a more favorable outcome for the homeowner.

What should I do if my lender denies my Deed in Lieu of Foreclosure request?

If your request is denied, consider seeking alternatives such as a short sale or loan modification. It may also be beneficial to consult with a housing counselor or an attorney who specializes in foreclosure issues to explore your options and determine the best course of action.

Is legal assistance necessary for a Deed in Lieu of Foreclosure?

While not strictly necessary, legal assistance can be very helpful. An attorney can guide you through the process, ensure that your rights are protected, and help you understand the implications of the agreement. This can make a significant difference in achieving a favorable outcome.

Popular Deed in Lieu of Foreclosure Types:

Quitclaim Deed Form New Jersey - Grantors can execute the deed without receiving anything in return.

When engaging in the sale or purchase of a trailer, it's crucial to have the appropriate documentation, such as the California Trailer Bill of Sale form. This form serves to officially transfer ownership and contains important details about the buyer, seller, and the trailer itself. To facilitate this process, you can obtain a professional template from Fast PDF Templates, ensuring that all necessary information is accurately captured for a smooth transaction.

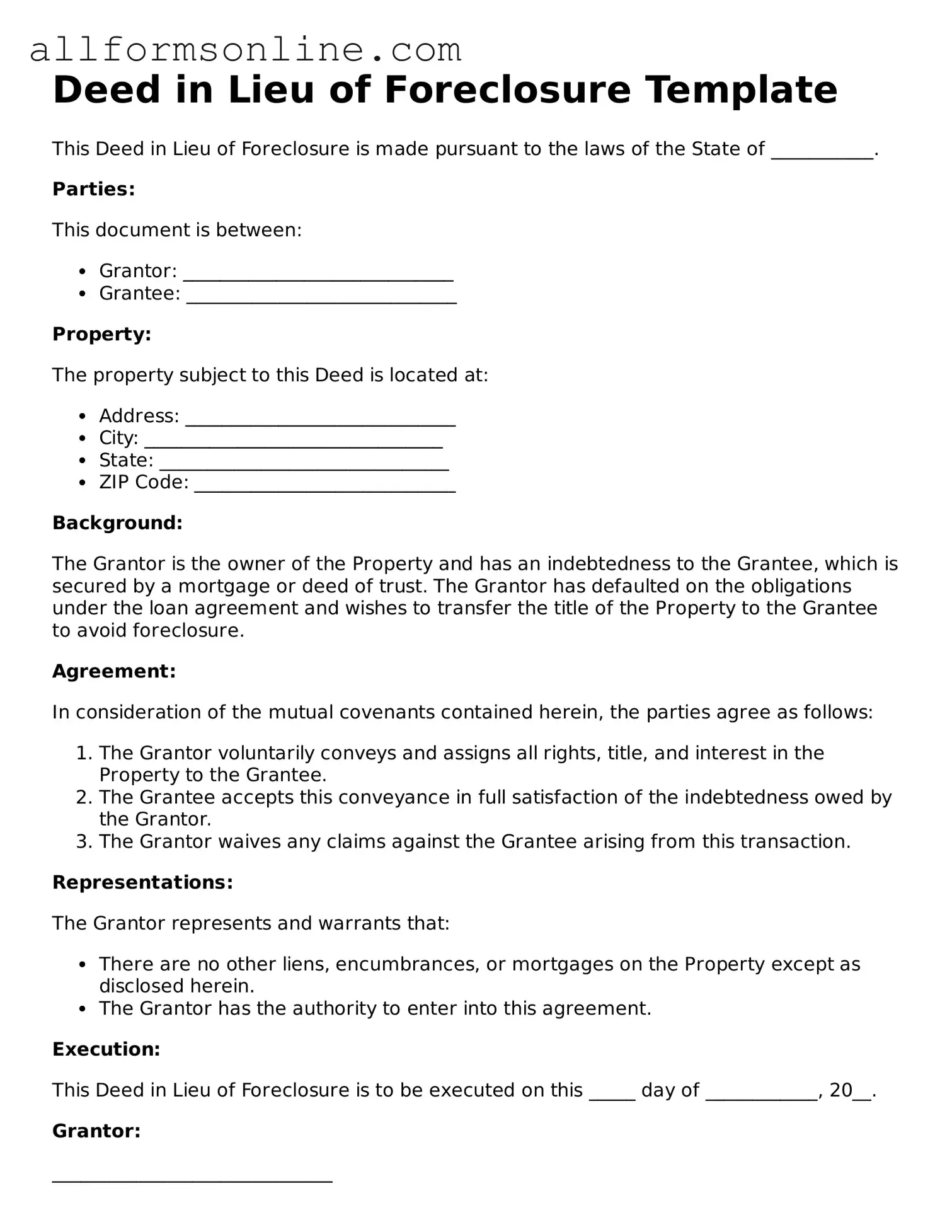

How to Use Deed in Lieu of Foreclosure

Once you have completed the Deed in Lieu of Foreclosure form, you will need to submit it to your lender. This process may involve additional documentation, so ensure you have all necessary information ready. After submission, your lender will review the form and reach out to you regarding the next steps.

- Begin by obtaining the Deed in Lieu of Foreclosure form from your lender or a trusted legal resource.

- Fill in your name and address in the designated fields at the top of the form.

- Provide the name and address of the lender in the appropriate section.

- Include the property address that is subject to the deed.

- State the reason for the deed in lieu of foreclosure in a clear and concise manner.

- Sign and date the form in the specified area, ensuring your signature matches the name on the document.

- If applicable, have a witness sign the document, as some jurisdictions require this step.

- Make copies of the completed form for your records before submitting it to your lender.