Blank Durable Power of Attorney Form

Durable Power of AttorneyDocuments for Particular States

Misconceptions

Understanding a Durable Power of Attorney (DPOA) is crucial for making informed decisions about your future. However, several misconceptions can lead to confusion. Here are five common misconceptions about the DPOA form:

-

It only applies to financial matters.

Many people believe that a DPOA is solely for managing financial affairs. In reality, a DPOA can also cover healthcare decisions. You can specify what actions your agent can take regarding your medical care if you become unable to communicate your wishes.

-

It becomes effective only when I am incapacitated.

Some think a DPOA only kicks in when they are incapacitated. However, you can choose for it to be effective immediately upon signing. This flexibility allows you to grant authority to your agent right away, if that is your preference.

-

It is the same as a regular Power of Attorney.

A regular Power of Attorney can become void if you become incapacitated. In contrast, a Durable Power of Attorney remains effective even if you lose the ability to make decisions. This durability is what sets it apart.

-

I can’t change or revoke it once it’s signed.

Many individuals believe that once a DPOA is executed, it cannot be altered. This is not true. You have the right to revoke or modify your DPOA at any time, as long as you are mentally competent to do so.

-

My agent can do whatever they want with my DPOA.

While your agent has significant authority, they are still bound by your wishes and the law. They must act in your best interest and cannot use the DPOA for personal gain. You can also set specific limitations in the document.

Being aware of these misconceptions can help you make better choices regarding your Durable Power of Attorney. It is essential to have clear communication with your agent and to understand your rights fully.

What to Know About This Form

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. This can include financial matters, healthcare decisions, or other personal affairs. The "durable" aspect means that the authority remains effective even if you become incapacitated.

Who should I appoint as my agent?

Your agent should be someone you trust completely. This could be a family member, close friend, or a professional such as an attorney. Consider their ability to handle your affairs responsibly and their willingness to act in your best interest. Communication with your chosen agent about your wishes is crucial.

When does a Durable Power of Attorney go into effect?

A DPOA can take effect immediately upon signing, or it can be set to activate only when you become incapacitated. This is known as a springing power of attorney. Discuss your preferences with your attorney to determine the best option for your situation.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a DPOA at any time as long as you are mentally competent. To do this, you must create a written revocation document and notify your agent and any relevant institutions. It's important to ensure that your revocation is clear and documented to avoid any confusion.

What happens if I don’t have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, a court may need to appoint a guardian or conservator to manage your affairs. This process can be lengthy and costly. Having a DPOA in place helps avoid this situation and allows you to choose someone you trust to make decisions for you.

Are there any limitations to what my agent can do?

Yes, there can be limitations. You can specify what powers your agent has in the DPOA document. For example, you may want to limit their authority to financial decisions only or exclude certain transactions. Clearly outlining these limitations can help ensure your wishes are followed.

Is a Durable Power of Attorney valid in all states?

While most states recognize Durable Power of Attorney documents, the specific requirements can vary. It's essential to follow the laws of your state when creating a DPOA. Consulting with a legal professional can ensure that your document meets all necessary requirements and is valid where you reside.

Popular Durable Power of Attorney Types:

Revocation of Power of Attorney Form - A simple way to withdraw the powers granted to your representative.

Completing an Employment Application PDF form accurately is crucial for job seekers, as it serves as a first impression to potential employers. This document often requests essential details about personal information, work history, and relevant skills, which are necessary for evaluating candidates. For those looking for resources to aid in this process, Fast PDF Templates offers various templates that can simplify the application procedure, ultimately improving the chances of securing an interview.

Power of Attorney Document - Important for those with complex property holdings or multi-state issues.

Power of Attorney Dmv - Grants authority to sign off on vehicle-related agreements.

How to Use Durable Power of Attorney

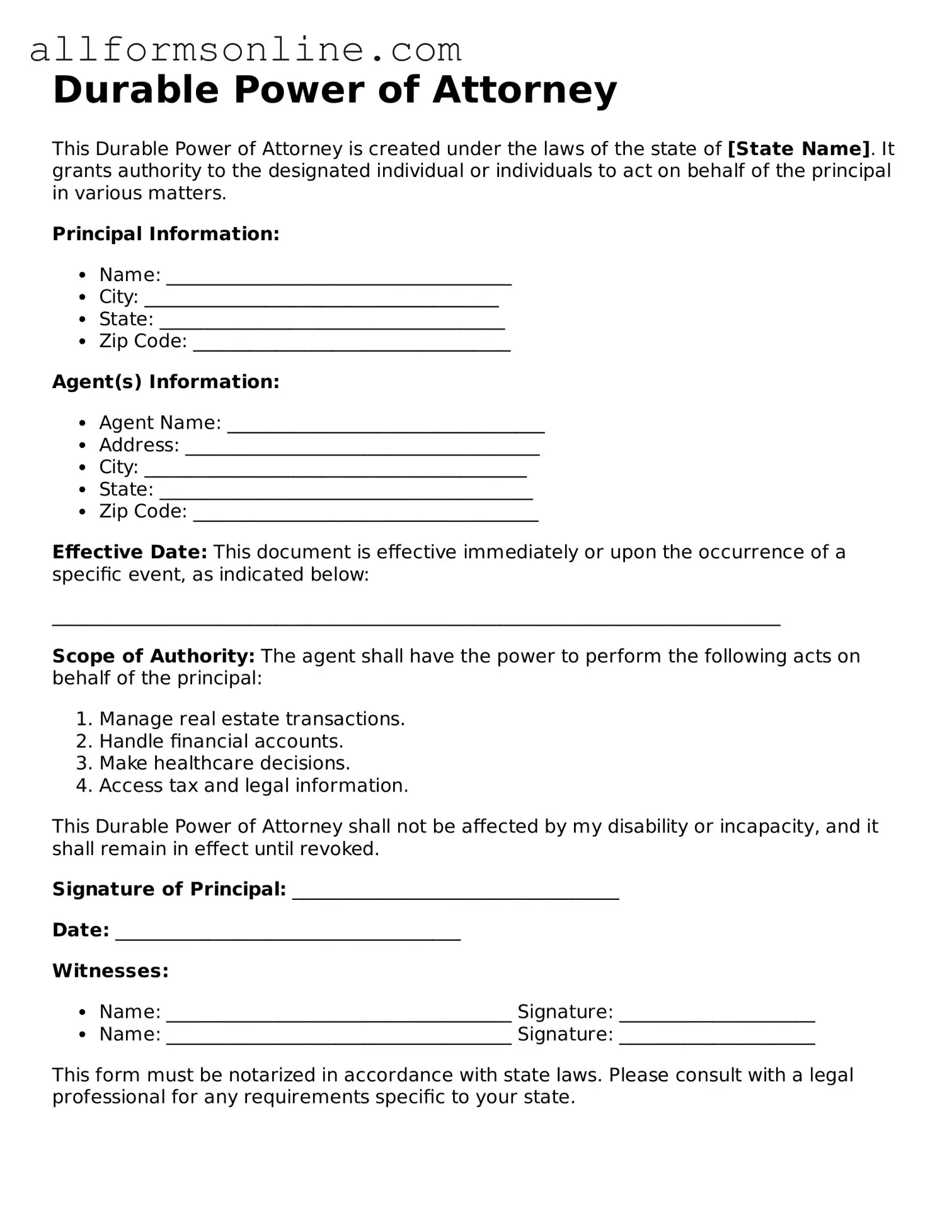

After obtaining the Durable Power of Attorney form, you will need to complete it carefully to ensure it reflects your wishes. This document allows you to designate someone to make decisions on your behalf in specific situations. Follow these steps to fill out the form correctly.

- Begin by entering your full name and address at the top of the form.

- Identify the person you are appointing as your agent. Provide their full name and address in the designated section.

- Clearly state the powers you are granting to your agent. This may include financial decisions, healthcare choices, or other specific powers.

- If applicable, specify any limitations on the powers you are granting. Be clear and concise in your wording.

- Include the date on which the Durable Power of Attorney will become effective. This could be immediately or at a future date.

- Sign the form in the presence of a notary public. This step is crucial for validating the document.

- Have the notary public sign and seal the document to complete the process.

- Make copies of the signed document for your records and provide copies to your agent and any relevant institutions.