Free Employee Advance PDF Form

Misconceptions

Understanding the Employee Advance form is crucial for both employees and employers. However, several misconceptions often cloud its purpose and functionality. Here are four common misunderstandings:

-

Employee Advances are Free Money:

Many believe that advances are simply free funds provided by the employer. In reality, an advance is a loan that must be repaid, typically through deductions from future paychecks. It’s essential to view it as a temporary financial solution rather than a gift.

-

Only Certain Employees Can Request Advances:

Some think that only employees in specific roles or with long tenures can access advances. In fact, most companies allow all eligible employees to request advances, provided they meet certain criteria outlined in company policy.

-

Advances Are Automatically Approved:

Another common belief is that all requests for advances will be approved without question. Approval often depends on various factors, including the employee's history with the company and the reason for the advance. A thoughtful review process is usually in place.

-

Using an Advance Will Hurt Your Credit:

Some employees worry that taking an advance will negatively impact their credit score. However, since these advances are internal transactions between the employee and employer, they do not affect personal credit ratings.

By dispelling these misconceptions, employees can make informed decisions about requesting advances and understanding their responsibilities in the process.

What to Know About This Form

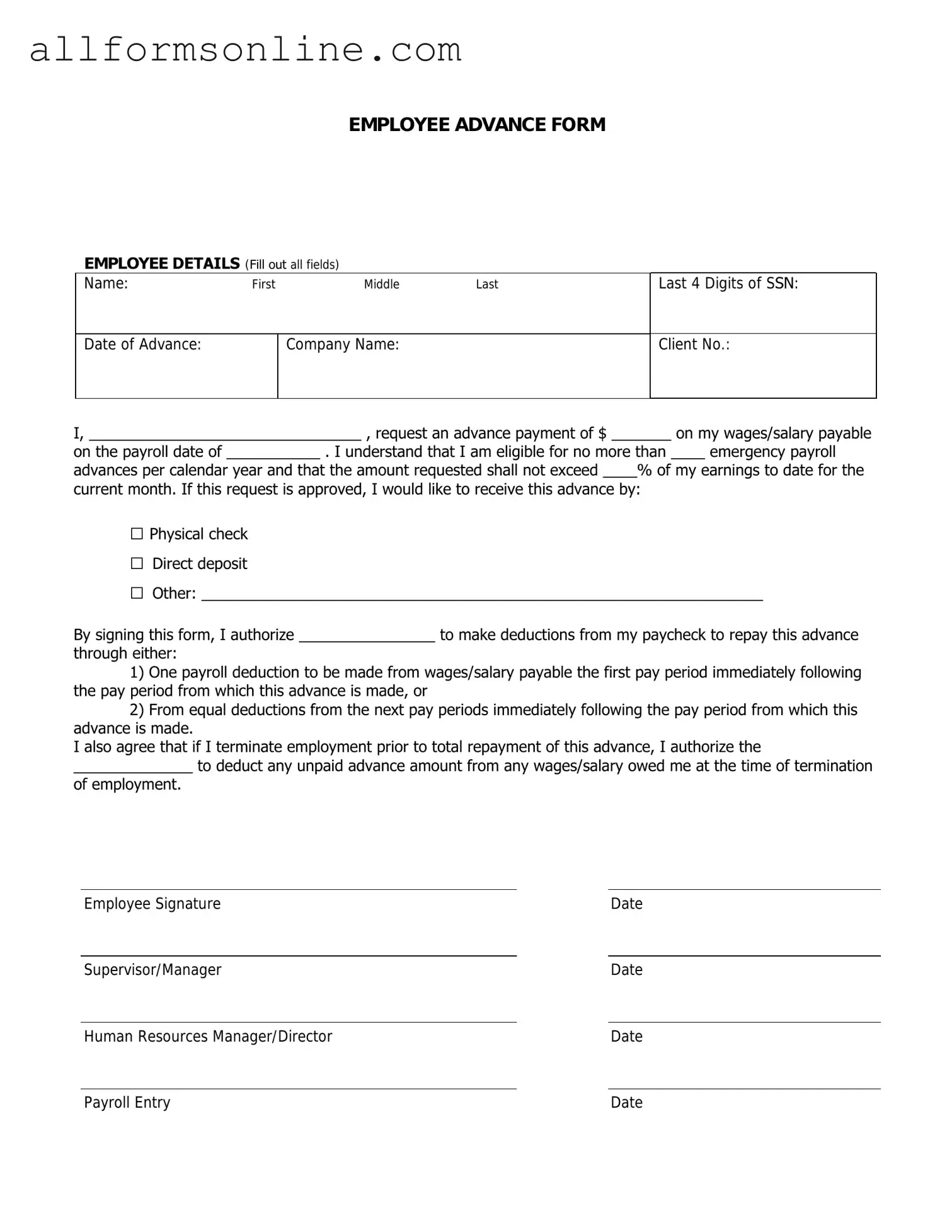

What is an Employee Advance form?

An Employee Advance form is a document used by employers to provide employees with a cash advance against their future earnings. This form outlines the details of the advance, including the amount, purpose, and repayment terms. It helps ensure transparency and accountability in the transaction between the employer and the employee.

Who can request an Employee Advance?

What information is required on the form?

How is the repayment of the advance structured?

What happens if an employee leaves the company before repaying the advance?

Are there any tax implications for receiving an Employee Advance?

Can an Employee Advance be denied?

Where can I obtain an Employee Advance form?

Different PDF Forms

Texas Hub - Guide users in maintaining accurate membership records.

The California Release of Liability form is a legal document that helps protect individuals and organizations from being held responsible for injuries or damages that may occur during certain activities. Typically used in recreational settings or events, this form outlines the risks involved and requires participants to acknowledge and accept those risks. For those looking for a reliable resource to understand and obtain this form, the Fast PDF Templates can offer valuable templates and information. Understanding this form is crucial for anyone seeking to participate in activities where liability concerns may arise.

How Do You Set Up Direct Deposit - Join the modern way to get paid with Citibank's direct deposit.

How to Use Employee Advance

Once you have the Employee Advance form in front of you, it's time to get started on filling it out. This form is essential for requesting an advance on your salary or expenses, and it helps ensure that everything is documented properly for your records and the company's. Follow these steps carefully to complete the form accurately.

- Begin by entering your full name in the designated field at the top of the form.

- Next, provide your employee ID number. This is typically found on your company ID or pay stub.

- In the following section, write the date you are submitting the request.

- Clearly state the amount you are requesting as an advance. Make sure this is a specific number.

- Indicate the reason for the advance in the provided space. Be concise but informative.

- If applicable, include any supporting documentation that may be required, such as receipts or invoices.

- Finally, sign and date the form at the bottom to confirm your request.

After completing the form, submit it to your supervisor or the designated department for processing. Keep a copy for your records, as it will help you track your request and any future discussions regarding it.