Blank Employee Loan Agreement Form

Misconceptions

Understanding the Employee Loan Agreement form can be tricky, and several misconceptions often arise. Here are five common misunderstandings that people have about this important document:

- All employee loans are interest-free. Many believe that loans provided by employers come without any interest. In reality, employers can charge interest on loans, and the terms should be clearly stated in the agreement.

- Only full-time employees can qualify for a loan. Some think that only full-time employees are eligible for loans. However, part-time employees may also qualify, depending on the employer's policies and the specifics outlined in the agreement.

- Loan agreements are informal and can be verbal. It’s a common misconception that loan agreements do not need to be formalized in writing. In fact, having a written agreement is crucial for both parties to understand the terms and obligations involved.

- Repayment terms are always flexible. Many assume that repayment terms can be easily adjusted. While some employers may offer flexibility, others may have strict repayment schedules that must be adhered to, as specified in the agreement.

- Loan agreements are only for emergencies. Some individuals believe that employee loans are only available for emergency situations. In truth, loans can be used for various purposes, and the agreement should outline acceptable uses.

By clarifying these misconceptions, employees can better understand their rights and responsibilities when it comes to borrowing from their employers. Always read the agreement carefully and seek clarification if needed.

What to Know About This Form

What is an Employee Loan Agreement?

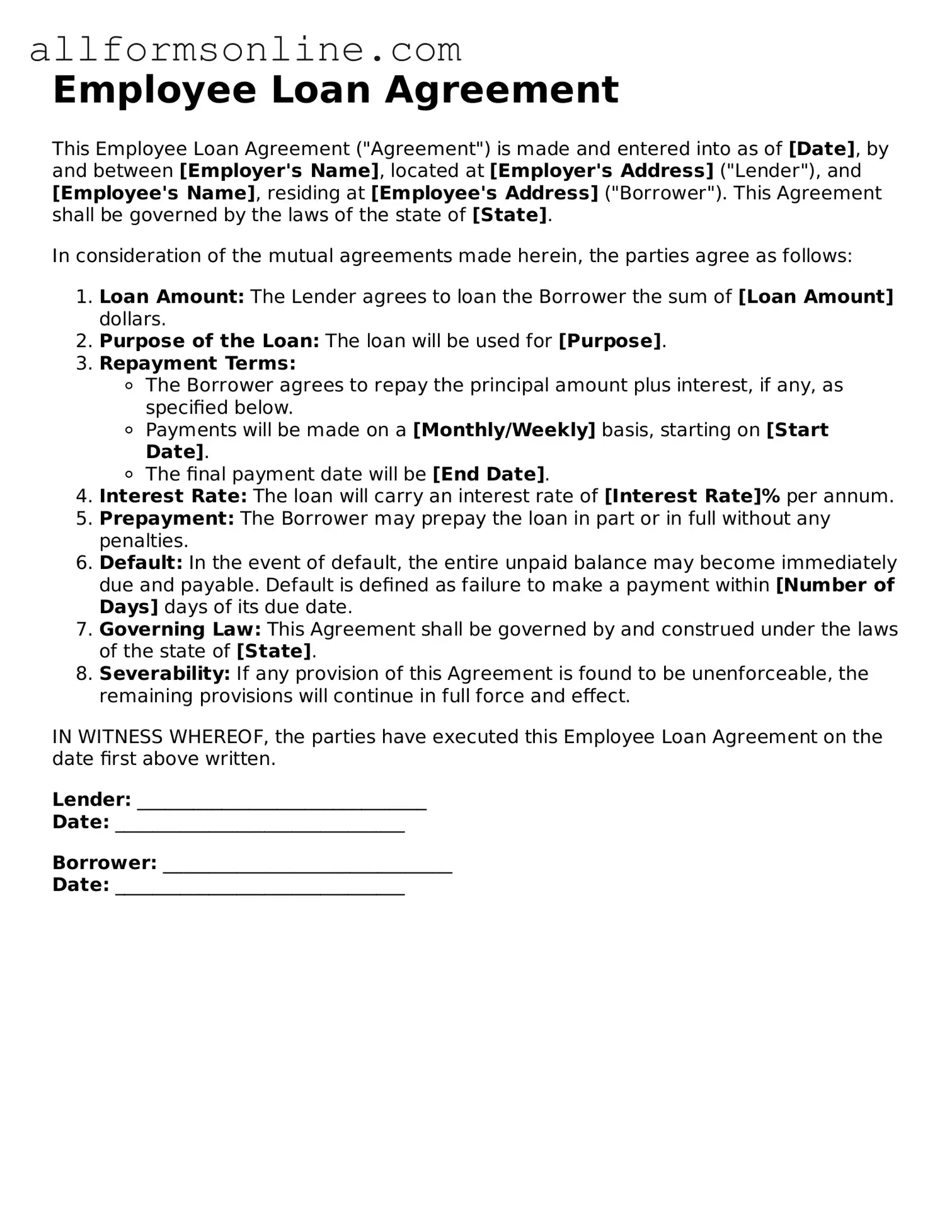

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement serves to protect both parties by clearly defining the loan amount, repayment schedule, interest rates, and any other relevant conditions. It is crucial for ensuring transparency and accountability in the lending process.

Who can request an Employee Loan?

What information is included in the Employee Loan Agreement?

The Employee Loan Agreement generally includes the loan amount, interest rate, repayment terms, and the schedule for payments. It may also specify the consequences of late payments or defaulting on the loan. Additionally, it often includes clauses about confidentiality and the rights of both the employer and employee regarding the loan.

How is the loan amount determined?

The loan amount can be determined based on various factors, including the employee's salary, length of employment, and the financial policies of the organization. Employers may also consider the employee's creditworthiness and repayment ability before approving the loan amount.

What happens if an employee cannot repay the loan?

If an employee is unable to repay the loan, the consequences may vary based on the terms outlined in the agreement. Possible outcomes could include deductions from the employee's salary, renegotiation of the repayment terms, or, in severe cases, legal action. It is essential for employees to communicate with their employer if they foresee any difficulties in repayment.

Are there any tax implications for the employee?

Can an Employee Loan Agreement be modified?

Is an Employee Loan Agreement legally binding?

What should an employee do if they have questions about the agreement?

How can an employee apply for a loan?

How to Use Employee Loan Agreement

Once you have the Employee Loan Agreement form, you will need to complete it accurately to ensure clarity and compliance. Follow these steps carefully to fill out the form correctly.

- Begin with the employee's full name. This should be the name of the individual requesting the loan.

- Enter the employee's job title. This provides context regarding their position within the company.

- Fill in the employee's department. This helps identify the area of the organization the employee works in.

- Provide the employee's contact information, including phone number and email address.

- State the amount of the loan being requested. Be specific about the dollar amount.

- Indicate the purpose of the loan. Briefly describe what the loan will be used for.

- Specify the repayment terms. This includes the duration and frequency of payments.

- Include any interest rate applicable to the loan. Clearly state if the loan is interest-free.

- Provide the date the agreement is being signed. This establishes the effective date of the loan.

- Both the employee and an authorized company representative must sign the form. Ensure that both parties have signed and dated the agreement.

After completing the form, review it for accuracy. Once everything is confirmed, submit the form to the appropriate department for processing.