Free Erc Broker Market Analysis PDF Form

Misconceptions

- Misconception 1: The Erc Broker Market Analysis form is an appraisal.

- Misconception 2: The form includes a home inspection.

- Misconception 3: The Most Likely Sales Price is guaranteed.

- Misconception 4: State-specific disclosure requirements are not necessary.

Many people mistakenly believe that the Erc Broker Market Analysis form serves as an official appraisal of a property. In reality, this form is designed for comparative market analysis, which is different from an appraisal. An appraisal follows strict professional standards and is typically conducted by a licensed appraiser. The Erc form provides an estimate of the Most Likely Sales Price based on market conditions, but it should not be used as an appraisal for any purpose.

Some individuals may think that the Erc Broker Market Analysis form involves a comprehensive home inspection. However, this form is not intended to assess the physical condition of the property in detail. While it does allow brokers to note certain observable issues, it does not replace a thorough home inspection, which involves a detailed examination of the property's systems and structure.

Another common misunderstanding is that the Most Likely Sales Price (MLSP) provided in the analysis is a guaranteed sale price. The MLSP is merely an estimate based on current market conditions and the property's characteristics. It is subject to change based on various factors, including buyer interest and economic conditions.

Some may believe that the Erc Broker Market Analysis form does not require adherence to state-specific disclosure laws. In fact, brokers must be aware of and comply with any applicable state-specific disclosure requirements when using this form. Failing to include these disclosures could lead to legal issues or misunderstandings with clients.

What to Know About This Form

What is the purpose of the ERC Broker Market Analysis form?

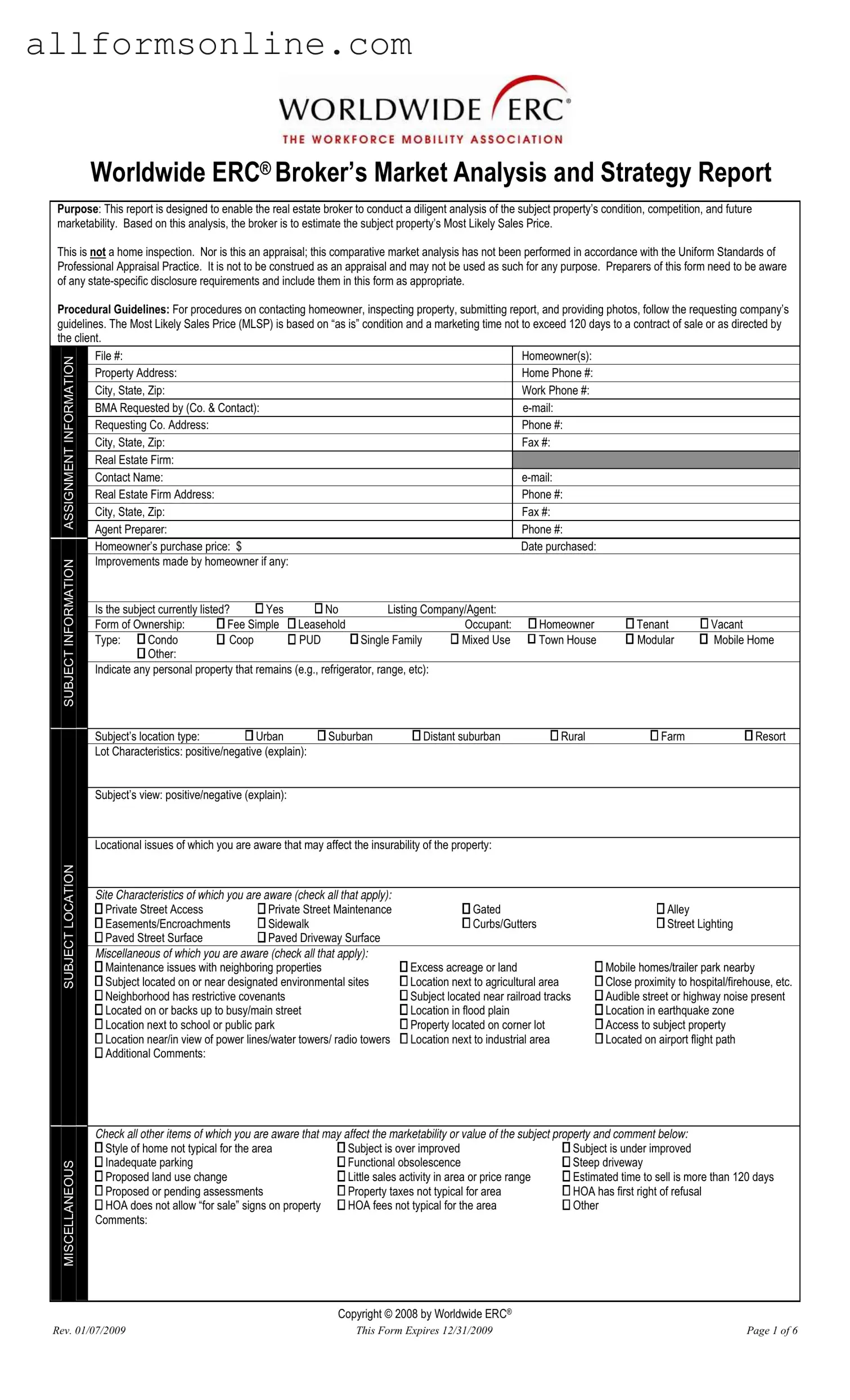

The ERC Broker Market Analysis form is designed to help real estate brokers conduct a thorough analysis of a property’s condition, competition, and potential marketability. This analysis ultimately aids in estimating the property’s Most Likely Sales Price (MLSP). It’s important to note that this form is not an appraisal or a home inspection; rather, it serves as a comparative market analysis. Brokers must also consider any state-specific disclosure requirements when using this form.

How should brokers prepare for using the ERC Broker Market Analysis form?

Brokers should follow specific procedural guidelines when preparing the analysis. This includes contacting the homeowner, inspecting the property, and submitting the report according to the requesting company’s guidelines. Additionally, brokers should gather all necessary information about the property, including its condition, improvements made, and any relevant locational issues that may affect its marketability.

What information is required on the ERC Broker Market Analysis form?

The form requires various pieces of information, including the homeowner's contact details, property address, and specifics about the property itself. Brokers must document the property’s condition, any improvements made, and its current listing status. They also need to assess the neighborhood and broader market area, including property values and market trends. This comprehensive data collection helps in forming a well-rounded analysis.

What factors influence the Most Likely Sales Price (MLSP) on the form?

The MLSP is influenced by several factors, including the property’s condition, location, and the current market environment. Brokers must evaluate the property “as is” and consider a marketing time frame of no more than 120 days. They should also analyze comparable properties in the area, taking into account their sale prices, days on the market, and any concessions offered to buyers or brokers.

What should brokers keep in mind regarding state-specific requirements?

Each state may have unique disclosure requirements that brokers must adhere to when filling out the ERC Broker Market Analysis form. It’s essential for brokers to be aware of these requirements to ensure compliance and accuracy. This may involve including specific disclosures about the property’s condition or any known issues that could affect its insurability or marketability.

Different PDF Forms

Form I864 - The I-864 form collects information about the sponsor's income, assets, and employment.

A comprehensive understanding of the California Lease Agreement is essential for both landlords and tenants, as it sets the foundation for a successful rental experience. For those looking to simplify the process, resources like Fast PDF Templates can provide valuable templates to help outline important terms and conditions effectively.

Dekalb County Water Application - This document supports you in obtaining necessary water services.

W9 Form 2022 - It’s important to update the W-9 whenever your personal or business information changes.

How to Use Erc Broker Market Analysis

Filling out the ERC Broker Market Analysis form is a straightforward process that requires attention to detail. Each section of the form gathers essential information about the property and its market environment. Once completed, this form will provide a comprehensive analysis that helps in estimating the property's Most Likely Sales Price (MLSP). Here’s how to fill it out step by step.

- Gather Information: Collect all necessary details about the property, including the homeowner's name, property address, and contact information.

- Fill in the Information Section: Enter the file number, homeowner(s) details, property address, and contact numbers for both the homeowner and the requesting company.

- Complete the Assignment Section: Provide details about the real estate firm, including the contact name, email, and address.

- Document Property Details: Note improvements made by the homeowner, current listing status, and type of ownership. Be sure to check appropriate boxes for occupant type and property type.

- Assess Lot Characteristics: Describe the lot's characteristics, view, and any locational issues that may affect insurability.

- Evaluate Site Characteristics: Check all relevant site characteristics that apply, such as private street access or easements.

- Identify Miscellaneous Factors: Note any additional factors that may impact the property’s marketability, including neighborhood conditions or maintenance issues.

- Inspect Property Condition: For each condition observed, check the appropriate box and provide comments where necessary.

- Estimate Repair Costs: List recommended repairs and improvements for both interior and exterior items, including estimated costs.

- Identify Required Inspections: List any required, customary, and recommended inspections for the property.

- Discuss Financing Options: Identify the most probable means of financing and any potential issues that may arise.

- Analyze the Neighborhood: Define the subject neighborhood and provide insights into property values and market conditions.

- Compile Competing Listings: List comparable properties, including their details, prices, and days on market.

- Summarize Comparable Sales: Document comparable sales data, including original list prices, final sales prices, and seller concessions.

Once you have filled out the form, review all entries for accuracy. This thorough analysis will serve as a valuable tool in understanding the property's market position and helping the homeowner make informed decisions.