Attorney-Approved Articles of Incorporation Form for Florida

Misconceptions

Understanding the Florida Articles of Incorporation form is essential for anyone looking to establish a corporation in the state. However, several misconceptions often arise. Here are nine common misunderstandings:

- All businesses must file Articles of Incorporation. Many small businesses operate as sole proprietorships or partnerships and do not require this filing.

- Filing Articles of Incorporation guarantees business success. While this step is important, success depends on various factors, including market demand and management.

- The Articles of Incorporation are the only requirement to start a business. Additional permits, licenses, and tax registrations may also be necessary.

- Once filed, Articles of Incorporation cannot be changed. Amendments can be made to update information as needed.

- Articles of Incorporation are the same as bylaws. Articles establish the corporation's existence, while bylaws govern its internal operations.

- Anyone can file Articles of Incorporation. Typically, the person filing must be a resident of Florida or have a registered agent in the state.

- Filing fees are the same for all corporations. Fees can vary based on the type of corporation being established.

- Once filed, the corporation is immediately operational. Additional steps, such as obtaining an Employer Identification Number (EIN), may be required.

- Articles of Incorporation are only necessary for for-profit entities. Nonprofit organizations also need to file this document to be legally recognized.

Being informed about these misconceptions can help individuals navigate the incorporation process more effectively and set a strong foundation for their business.

What to Know About This Form

What is the Florida Articles of Incorporation form?

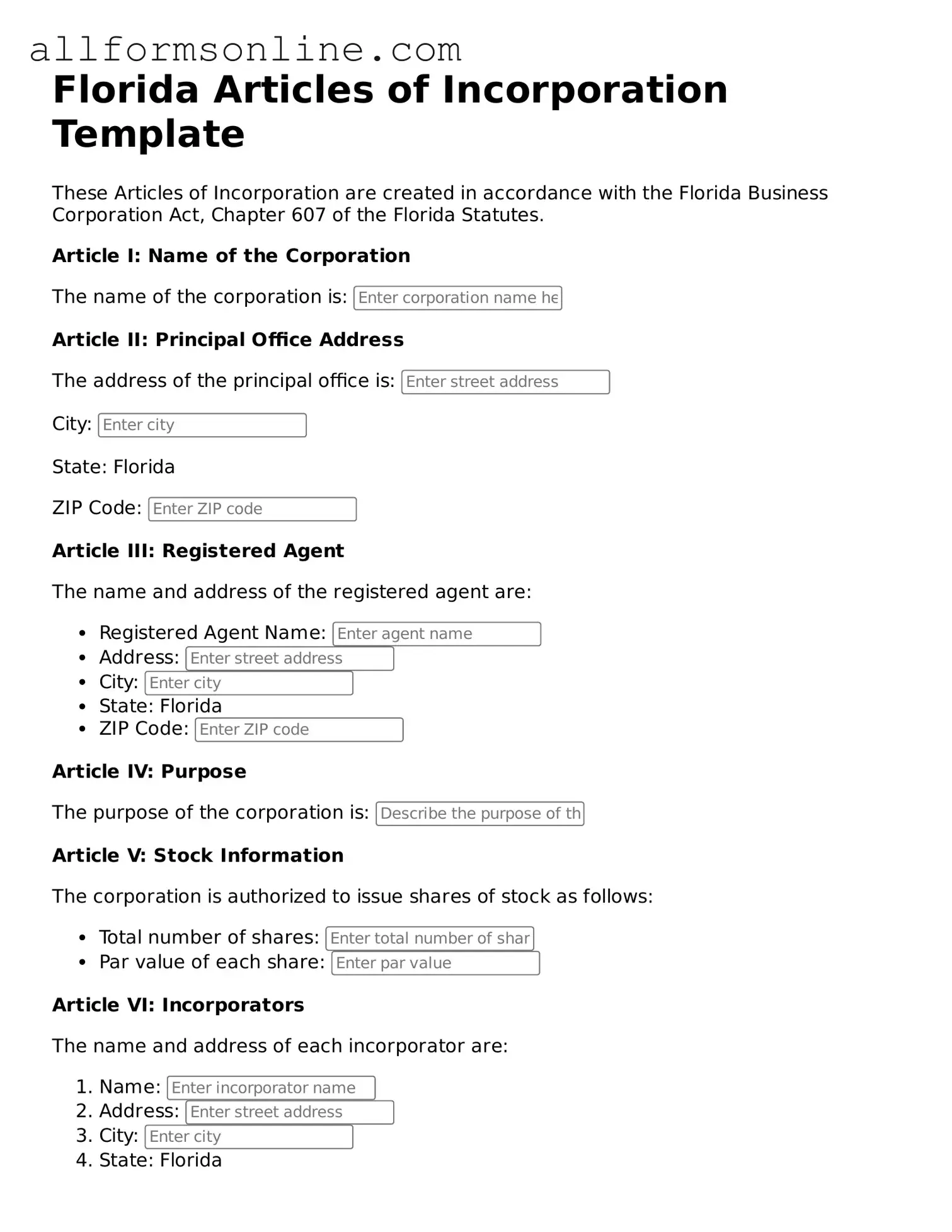

The Florida Articles of Incorporation form is a legal document required to establish a corporation in the state of Florida. This form outlines essential details about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this form with the Florida Division of Corporations is a crucial step in the incorporation process.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Florida must file the Articles of Incorporation. This includes businesses of various types, such as for-profit corporations, non-profit organizations, and professional corporations. It is important to ensure that the corporation complies with state regulations and has the necessary legal framework in place.

What information is required on the form?

The Articles of Incorporation form requires several key pieces of information. This includes the corporation's name, which must be unique and not similar to any existing entities in Florida. Additionally, the form requires the corporation's principal office address, the name and address of the registered agent, the purpose of the corporation, and details about the shares to be issued. Accurate and complete information is essential to avoid delays in processing.

How do I submit the Articles of Incorporation?

To submit the Articles of Incorporation, you can either file online through the Florida Division of Corporations' website or submit a paper form by mail. If filing online, you will need to create an account and follow the prompts to complete the process. If you choose to mail the form, ensure that it is signed and accompanied by the required filing fee. Always keep a copy of the submitted documents for your records.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Florida Articles of Incorporation varies depending on the type of corporation being formed. As of October 2023, the fee for a for-profit corporation is typically $70, while non-profit corporations may have a different fee structure. It is advisable to check the Florida Division of Corporations website for the most current fee schedule and any additional costs that may apply.

How long does it take to process the Articles of Incorporation?

Processing times for the Articles of Incorporation can vary. Generally, online submissions are processed more quickly, often within a few business days. Paper submissions may take longer, sometimes up to two weeks or more, depending on the volume of applications being handled. To expedite the process, ensure that all information is accurate and complete before submission.

Other Common State-specific Articles of Incorporation Forms

Texas Company Registration - Establishes basic information about the company.

Pennsylvania Corporation Bureau - The document must be filed with the state government.

Landlords seeking to understand the eviction process can greatly benefit from learning about the Notice to Quit form requirements, which specifies how to properly notify tenants to vacate a rental property.

Start Llc - Sets the stage for operational guidelines and policies.

How to Use Florida Articles of Incorporation

Once you have gathered all necessary information, you are ready to fill out the Florida Articles of Incorporation form. This form is essential for establishing your business entity in the state. After completing it, you will submit it to the Florida Department of State, Division of Corporations, along with the required filing fee.

- Begin by downloading the Florida Articles of Incorporation form from the Florida Division of Corporations website or obtain a physical copy.

- Provide the name of your corporation. Ensure that the name is unique and complies with Florida naming requirements.

- Specify the principal office address. This should be a physical address, not a P.O. Box.

- List the name and address of the registered agent. This person or business will receive legal documents on behalf of your corporation.

- Indicate the purpose of your corporation. Be clear and concise about what your business will do.

- Fill in the number of shares your corporation is authorized to issue. If applicable, specify the classes of shares.

- Provide the names and addresses of the incorporators. These are the individuals responsible for filing the Articles of Incorporation.

- Include any additional provisions that may be necessary for your corporation. This could include rules or regulations specific to your business.

- Sign and date the form. Ensure that all incorporators sign where required.

- Prepare the filing fee. Check the Florida Division of Corporations website for the current fee amount.

- Submit the completed form and payment to the Florida Department of State, Division of Corporations, either online or by mail.