Free Florida Commercial Contract PDF Form

Misconceptions

- Misconception 1: The Florida Commercial Contract form is only for large commercial transactions.

- Misconception 2: Once signed, the contract cannot be changed.

- Misconception 3: The buyer is responsible for all costs associated with closing.

- Misconception 4: The seller must disclose every possible issue with the property.

- Misconception 5: The contract guarantees financing for the buyer.

- Misconception 6: The buyer has unlimited time to complete due diligence.

- Misconception 7: All deposits are non-refundable.

This form is designed for a variety of commercial real estate transactions, regardless of size. It can be used for small businesses and properties as well.

While the contract is binding once signed, it can be modified if both parties agree to the changes in writing. Flexibility exists as long as both parties consent.

Closing costs can be shared or negotiated between the buyer and seller. The contract outlines who is responsible for specific fees, allowing for a clear understanding of financial obligations.

While sellers are required to disclose known defects, they are not obligated to reveal every minor issue. The buyer has the opportunity to conduct inspections to uncover potential problems.

The contract includes provisions for financing, but it does not guarantee that financing will be obtained. Buyers must still apply and qualify for loans as per the terms outlined.

The contract specifies a limited time frame for due diligence. Buyers must act within this period to ensure they can assess the property's suitability.

Deposits can be refundable under certain conditions, such as failure to obtain financing or if the buyer cancels the contract within the specified time frame. Understanding these conditions is crucial.

What to Know About This Form

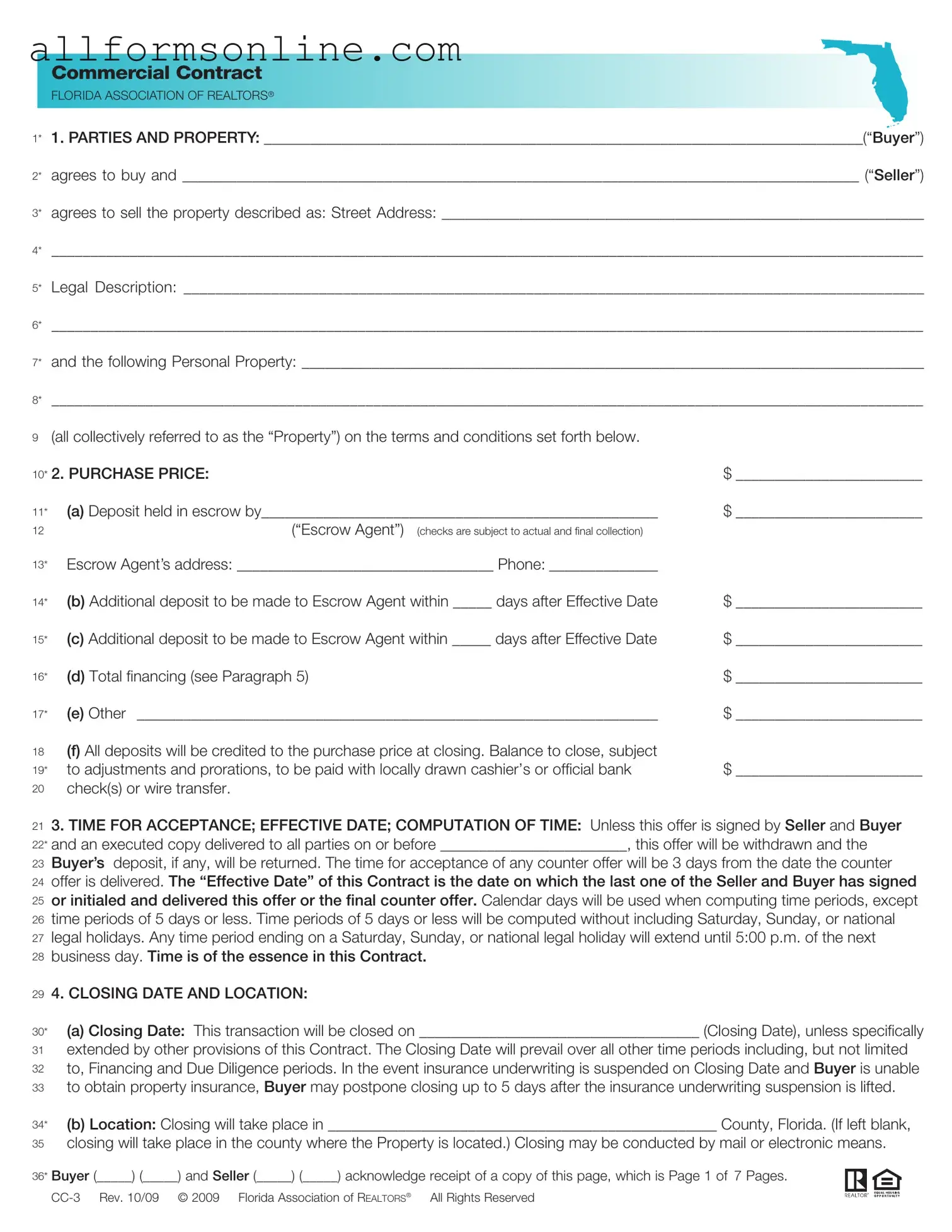

What is the Florida Commercial Contract form?

The Florida Commercial Contract form is a legal document used in real estate transactions involving commercial properties in Florida. It outlines the terms and conditions under which a buyer agrees to purchase and a seller agrees to sell a specified property. This form includes essential details such as the parties involved, purchase price, financing terms, and closing procedures.

Who are the parties involved in the contract?

The contract involves two primary parties: the Buyer and the Seller. The Buyer is the individual or entity agreeing to purchase the property, while the Seller is the individual or entity selling the property. Both parties must sign the contract for it to be legally binding.

What are the key components of the contract?

Key components of the Florida Commercial Contract include the identification of the parties, property description, purchase price, deposit amounts, closing date and location, financing terms, and conditions regarding title and property condition. Each section is designed to clarify the obligations and rights of both parties throughout the transaction.

What happens if the Buyer cannot secure financing?

If the Buyer cannot secure financing by the specified Loan Approval Date, they have the option to either waive the financing contingency or cancel the contract. The Buyer must provide written notice to the Seller within a designated timeframe. If the Buyer fails to do so, the Seller may cancel the contract, and the Buyer’s deposit may be retained by the Seller.

How is the closing process handled?

The closing process involves transferring ownership of the property from the Seller to the Buyer. It typically occurs on a specified Closing Date. During closing, the Seller must provide necessary documents, including the deed and any relevant contracts. The Buyer is responsible for their own closing costs, while the Seller pays for costs related to curing any title defects.

What is the Due Diligence Period?

The Due Diligence Period is a specified timeframe during which the Buyer can inspect the property and assess its suitability for their intended use. During this period, the Buyer can conduct various inspections and investigations. If the Buyer determines the property is unacceptable, they must notify the Seller before the period ends to cancel the contract without penalty.

What are the implications of accepting the property "as is"?

By accepting the property "as is," the Buyer waives the right to make claims against the Seller for any defects or issues with the property. This means the Buyer accepts the property in its current condition, with no guarantees from the Seller regarding repairs or improvements.

What should parties do in case of a default?

If either party defaults on the contract, the other party must provide written notice specifying the non-compliance. The defaulting party then has a set number of days to remedy the issue. If the default is not cured, the non-defaulting party may seek remedies such as retaining the deposit or pursuing specific performance.

How are disputes resolved?

Disputes arising from the contract may be resolved through various means, including negotiation, mediation, or litigation. The prevailing party in any legal action is entitled to recover reasonable attorney's fees and costs. It is essential for both parties to keep clear records and communications to support their positions in any potential disputes.

Different PDF Forms

Downloadable Free Printable Spanish Job Application Form - The general information section asks for the position you are applying for.

Completing the Statement of Fact Texas form accurately is crucial for ensuring compliance with legal requirements, and you can find helpful resources and guidance on the process at https://texasformspdf.com/fillable-statement-of-fact-texas-online which can assist you in navigating the form submission effectively.

Roof Warranty - The certificate emphasizes MCS Roofing's dedication to offering quality roofing services.

How to Use Florida Commercial Contract

Filling out the Florida Commercial Contract form requires attention to detail. Each section must be completed accurately to ensure a smooth transaction process. Below are the steps to guide you through filling out the form.

- Identify the Parties: Write the names of the Buyer and Seller in the designated spaces.

- Describe the Property: Fill in the street address and legal description of the property being sold.

- List Personal Property: Include any personal property that will be part of the sale.

- Enter Purchase Price: Specify the total purchase price and any deposits held in escrow.

- Fill in Escrow Agent Details: Provide the name and address of the escrow agent, along with their phone number.

- Complete Time for Acceptance: Indicate the deadline for the Seller to accept the offer.

- Set Closing Date and Location: Specify the closing date and location where the transaction will take place.

- Third Party Financing: If applicable, fill in details about financing, including loan amounts and terms.

- Title Information: Indicate how the Seller will convey title and any conditions regarding the title.

- Property Condition: Choose whether the Buyer accepts the property "as is" or if there will be a due diligence period.

- Closing Procedure: Outline the responsibilities of both parties regarding possession, costs, and documents needed at closing.

- Escrow Agent Authorization: Confirm the appointment of the escrow agent and their responsibilities.

- Signatures: Ensure that both Buyer and Seller sign and date the form at the end.

After completing the form, review all sections to confirm accuracy. It is advisable to keep a copy for your records. The next steps involve submitting the contract to the appropriate parties and preparing for the closing process.