Attorney-Approved Deed in Lieu of Foreclosure Form for Florida

Misconceptions

-

Misconception 1: A Deed in Lieu of Foreclosure eliminates all debt.

This is not accurate. While the deed transfers ownership of the property to the lender, it does not automatically erase any remaining debt. Borrowers may still be responsible for any deficiency balance unless otherwise agreed upon.

-

Misconception 2: A Deed in Lieu of Foreclosure is a quick fix.

Many believe this process will resolve their financial issues swiftly. However, it can take time to negotiate terms with the lender and finalize the transfer. Patience is essential.

-

Misconception 3: You cannot negotiate the terms of a Deed in Lieu of Foreclosure.

In reality, borrowers can negotiate various aspects, including the treatment of any remaining debt and potential relocation assistance. Open communication with the lender can lead to better outcomes.

-

Misconception 4: A Deed in Lieu of Foreclosure will not affect your credit score.

This is false. A deed in lieu of foreclosure can have a negative impact on your credit score, similar to a foreclosure. Understanding the long-term effects is crucial before proceeding.

What to Know About This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. This option can help both parties, as it allows the lender to take possession of the property without going through the lengthy foreclosure process, while the homeowner can mitigate some of the negative impacts on their credit score.

Who is eligible for a Deed in Lieu of Foreclosure?

Homeowners facing financial difficulties and unable to keep up with mortgage payments may be eligible. Typically, lenders require that the homeowner has exhausted other options, such as loan modifications or short sales, before considering a Deed in Lieu. It’s important for homeowners to communicate openly with their lender about their financial situation.

What are the benefits of a Deed in Lieu of Foreclosure?

One of the primary benefits is the potential to avoid the lengthy and costly foreclosure process. Additionally, it may result in less damage to the homeowner's credit score compared to a foreclosure. Homeowners may also have the opportunity to negotiate terms with the lender, such as the possibility of a cash incentive or relocation assistance.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are drawbacks. Homeowners will lose their property and any equity they have built up. Additionally, lenders may not accept a Deed in Lieu if there are other liens on the property. It's crucial for homeowners to fully understand the implications, including potential tax consequences, before proceeding.

How does the process work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then review the homeowner's financial situation and the property’s value. If approved, the homeowner will sign a deed transferring ownership to the lender, and the lender will release the homeowner from the mortgage obligation.

Will I still owe money after a Deed in Lieu of Foreclosure?

This depends on the agreement made with the lender. In some cases, lenders may agree to forgive any remaining debt, while in others, homeowners may still owe a deficiency balance. It is essential to clarify this with the lender before finalizing the Deed in Lieu.

How does a Deed in Lieu of Foreclosure affect my credit score?

A Deed in Lieu of Foreclosure will typically have a less severe impact on a homeowner's credit score compared to a foreclosure. However, it will still be recorded as a negative event. The exact effect will vary based on individual credit history and circumstances.

What should I do before signing a Deed in Lieu of Foreclosure?

Homeowners should consider consulting with a real estate attorney or a housing counselor to understand their rights and options. It is also advisable to review all documents carefully and ensure that all terms are clearly understood before signing any agreements.

Can I still buy a home after a Deed in Lieu of Foreclosure?

Yes, it is possible to buy another home after a Deed in Lieu, but it may take time. Lenders typically require a waiting period, which can range from two to four years, depending on the lender’s policies and the homeowner's credit history.

Where can I find the Florida Deed in Lieu of Foreclosure form?

The Florida Deed in Lieu of Foreclosure form can usually be obtained from your lender or through legal document services. Additionally, many online resources provide templates and guidelines for completing the form correctly. Always ensure that any document used complies with Florida state laws.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Mortgage - Borrowers should investigate their mortgage documents to determine if a Deed in Lieu is a permissible option.

When purchasing a motorcycle in California, having a properly executed Motorcycle Bill of Sale is essential for a smooth transaction. This document is often available through reliable sources such as Fast PDF Templates, ensuring that all necessary details about the buyer, seller, and motorcycle are accurately recorded, thereby providing legal protection and clarity for both parties involved in the sale.

California Pre-foreclosure Property Transfer - A Deed in Lieu may impact the borrower's credit score less severely than a foreclosure.

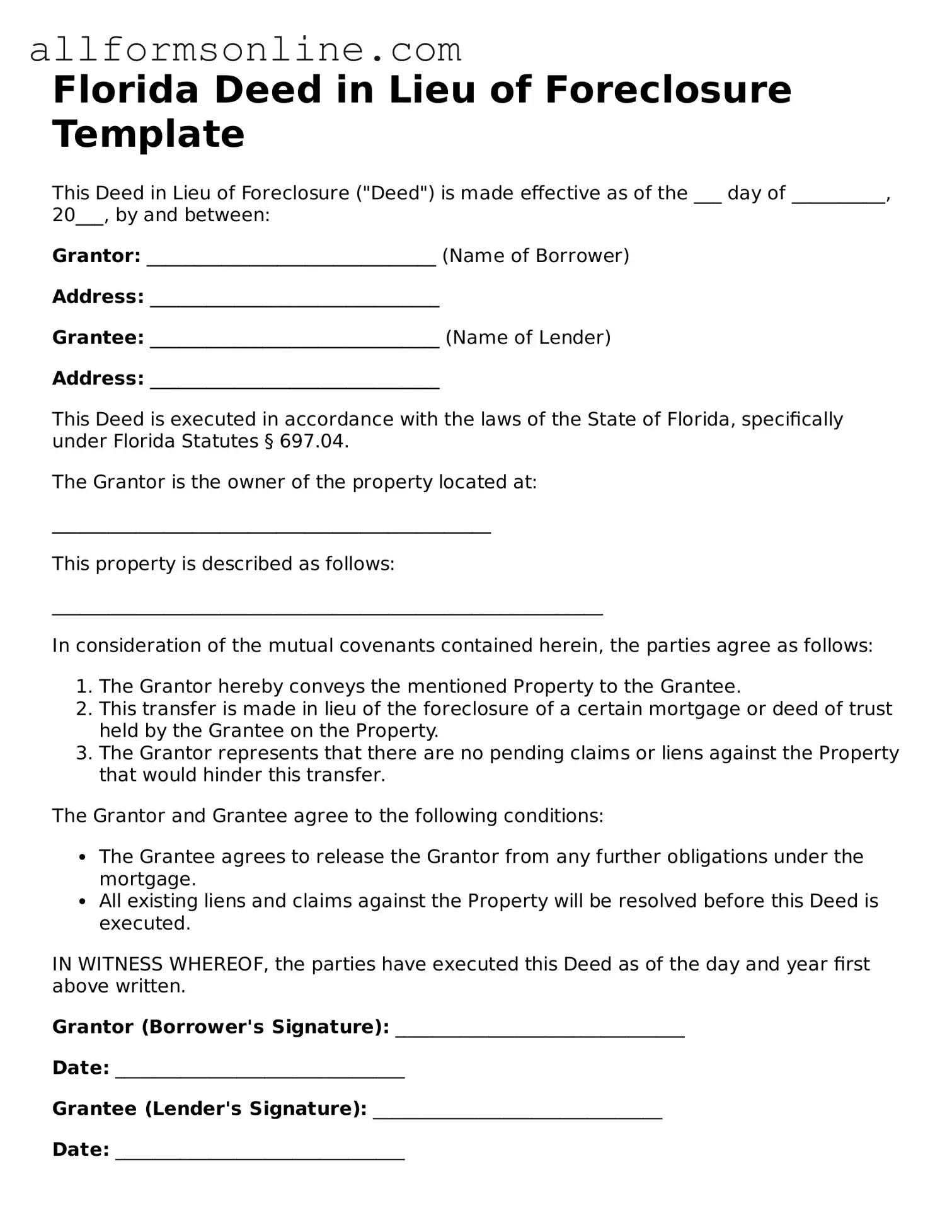

How to Use Florida Deed in Lieu of Foreclosure

Once you have decided to proceed with the Deed in Lieu of Foreclosure, it is essential to fill out the form accurately to ensure a smooth process. After completing the form, you will need to submit it to your lender, who will then review the documentation. This step is crucial, as it sets the stage for resolving your mortgage situation.

- Obtain the Florida Deed in Lieu of Foreclosure form. You can find it online or request it from your lender.

- Fill in the name of the property owner(s) at the top of the form. Ensure that all names are spelled correctly.

- Provide the legal description of the property. This can usually be found on your mortgage documents or property tax statement.

- Include the address of the property. Make sure to include the city, state, and zip code.

- List the lender’s name and address. This information should be available on your mortgage statement.

- Indicate the date of the transfer. This should be the date you are signing the document.

- Sign the form in the designated area. Ensure that all property owners sign the document.

- Have the form notarized. This step is important for validating the document legally.

- Make copies of the completed and notarized form for your records.

- Submit the original form to your lender along with any required additional documentation.