Attorney-Approved Deed Form for Florida

Misconceptions

When dealing with property transactions in Florida, the deed form can often be misunderstood. Clarifying these misconceptions can help individuals navigate the process more effectively.

- All deeds are the same. Many people assume that all deed forms serve the same purpose. In reality, there are several types of deeds, such as warranty deeds, quitclaim deeds, and special purpose deeds. Each type has distinct legal implications and protections for the parties involved.

- A deed must be notarized to be valid. While notarization is a common requirement for deeds in Florida, it is not universally necessary. Some deeds can be valid without notarization, depending on the specific circumstances and the type of deed being used. However, notarization is generally recommended to prevent disputes.

- Once a deed is signed, it cannot be changed. This belief is misleading. While a deed, once executed, transfers property rights, it can be amended or revoked under certain conditions. For example, if both parties agree, they can create a new deed that supersedes the previous one.

- All deeds need to be recorded to be valid. Recording a deed is important for establishing public notice of ownership, but it is not a requirement for the deed's validity. A deed can still be legally binding even if it is not recorded, although failing to record it may lead to complications in asserting ownership against third parties.

- Only attorneys can prepare a deed. While it is advisable to consult with an attorney for complex transactions, individuals can prepare their own deeds. Florida law allows property owners to create and execute their own deeds as long as they meet the legal requirements. However, seeking legal advice can help avoid potential pitfalls.

What to Know About This Form

What is a Florida Deed form?

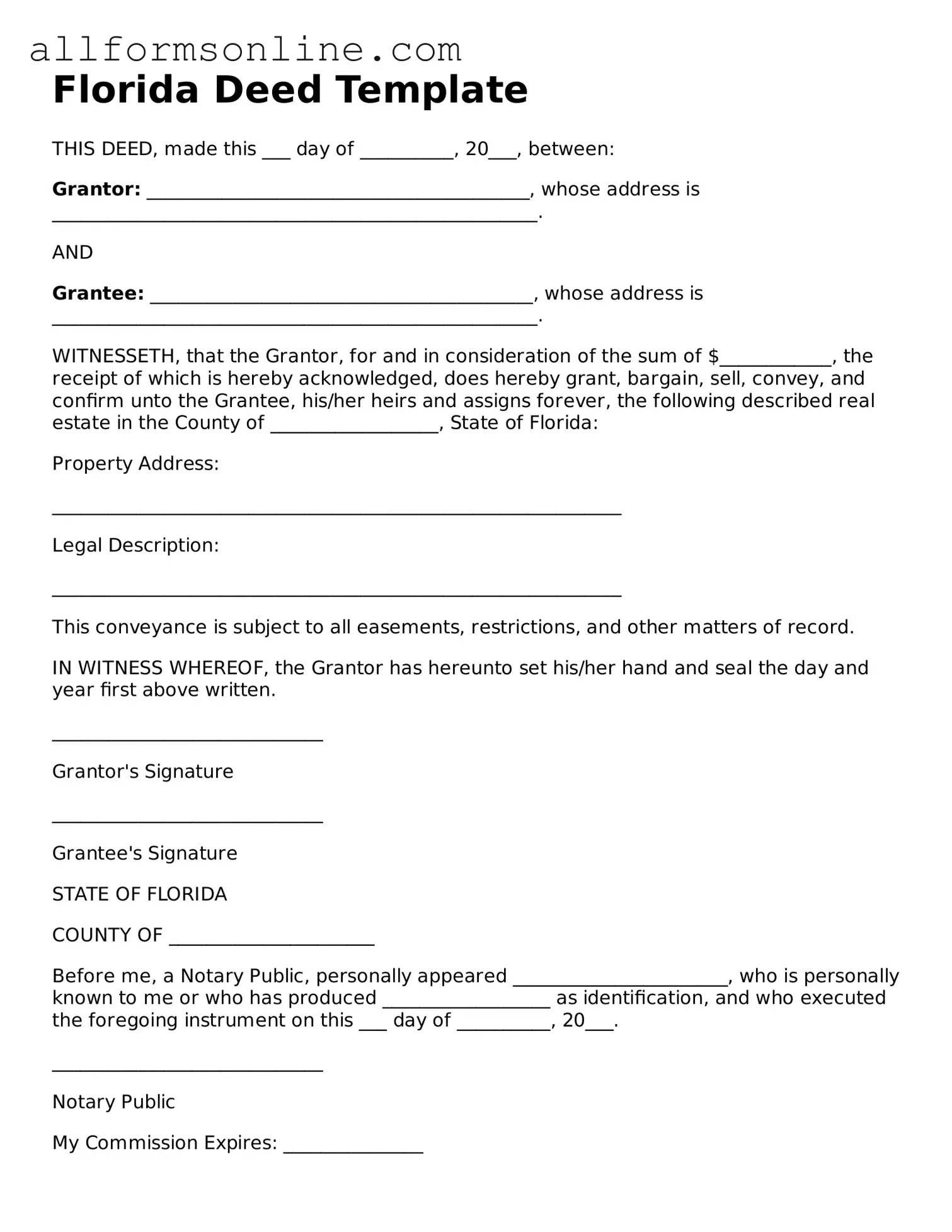

A Florida Deed form is a legal document used to transfer ownership of real property in the state of Florida. It outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions or restrictions related to the transfer. Various types of deeds exist, such as warranty deeds and quitclaim deeds, each serving different purposes in property transactions.

Who needs to use a Florida Deed form?

Anyone involved in the sale, transfer, or donation of real estate in Florida will need to use a Florida Deed form. This includes property owners selling their property, individuals gifting property to family members, or entities transferring property as part of a business transaction. It is essential for the deed to be properly executed to ensure the transfer is legally recognized.

How do I complete a Florida Deed form?

To complete a Florida Deed form, gather the necessary information, including the names of the grantor (seller) and grantee (buyer), a legal description of the property, and any applicable terms of the transfer. Fill out the form accurately, ensuring all required fields are completed. Afterward, the deed must be signed by the grantor in the presence of a notary public. Some forms may also require witnesses, depending on the type of deed.

Where do I file a Florida Deed form?

A Florida Deed form must be filed with the county clerk’s office in the county where the property is located. It is important to file the deed after it has been signed and notarized to make the transfer official. There may be a filing fee, so it is advisable to check with the local clerk’s office for specific requirements and costs associated with filing.

What happens if a Florida Deed form is not properly executed?

If a Florida Deed form is not properly executed, the transfer of property may be deemed invalid. This can lead to disputes over ownership and may complicate future transactions involving the property. To avoid issues, it is crucial to ensure that the deed is completed accurately, signed, and notarized according to state requirements.

Other Common State-specific Deed Forms

House Ownership Document - This form is crucial for ensuring a legal property transfer.

Grant Deed California - A Deed form is a legal document that transfers ownership of property from one party to another.

The California Release of Liability form is a legal document that helps protect individuals and organizations from being held responsible for injuries or damages that may occur during certain activities. Typically used in recreational settings or events, this form outlines the risks involved and requires participants to acknowledge and accept those risks. For those interested in utilizing this form, resources like Fast PDF Templates can provide valuable templates and guidance. Understanding this form is crucial for anyone seeking to participate in activities where liability concerns may arise.

Pennsylvania Deed Form - Understanding the implications of signing a Deed is crucial for all parties.

How to Use Florida Deed

After obtaining the Florida Deed form, you will need to complete it carefully to ensure that all necessary information is accurately provided. Once filled out, the form will need to be signed and may require notarization before it can be filed with the appropriate county office.

- Begin by entering the date at the top of the form. This should be the date you are filling out the deed.

- Next, provide the name of the grantor, which is the person or entity transferring the property. Ensure that the name is spelled correctly.

- Include the address of the grantor. This should be a complete address, including city, state, and zip code.

- Now, list the name of the grantee, the person or entity receiving the property. Double-check the spelling here as well.

- Fill in the address of the grantee with the same level of detail as you did for the grantor.

- Describe the property being transferred. This includes the legal description, which can often be found on previous deeds or property tax statements.

- If applicable, indicate any consideration, which is the value exchanged for the property. This could be a monetary amount or other forms of value.

- Sign the form in the designated area. If you are the grantor, your signature is required to validate the deed.

- Have the deed notarized. This step may be necessary to ensure the deed is legally binding.

- Finally, file the completed deed with the appropriate county clerk's office. Ensure you keep a copy for your records.