Attorney-Approved Durable Power of Attorney Form for Florida

Misconceptions

- Misconception 1: A Durable Power of Attorney is only for wealthy individuals.

- Misconception 2: A Durable Power of Attorney is the same as a will.

- Misconception 3: Once a Durable Power of Attorney is signed, it cannot be changed.

- Misconception 4: The agent has unlimited power to act on your behalf.

- Misconception 5: A Durable Power of Attorney expires when you become incapacitated.

- Misconception 6: You don’t need witnesses or notarization for a Durable Power of Attorney.

- Misconception 7: A Durable Power of Attorney can handle healthcare decisions.

This form is useful for anyone who wants to ensure their financial and legal affairs are managed if they become incapacitated, regardless of their financial status.

While a will dictates how your assets will be distributed after death, a Durable Power of Attorney allows someone to manage your affairs while you are still alive but unable to do so yourself.

You can revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent to do so.

Your Durable Power of Attorney can be tailored to limit the agent’s powers. You decide what authority to grant them.

As the name suggests, a Durable Power of Attorney remains effective even if you become incapacitated, allowing your agent to continue acting on your behalf.

In Florida, you must have your Durable Power of Attorney signed in front of two witnesses and a notary public for it to be valid.

A Durable Power of Attorney is primarily for financial matters. For healthcare decisions, you need a separate document, like a Healthcare Power of Attorney or advance directive.

What to Know About This Form

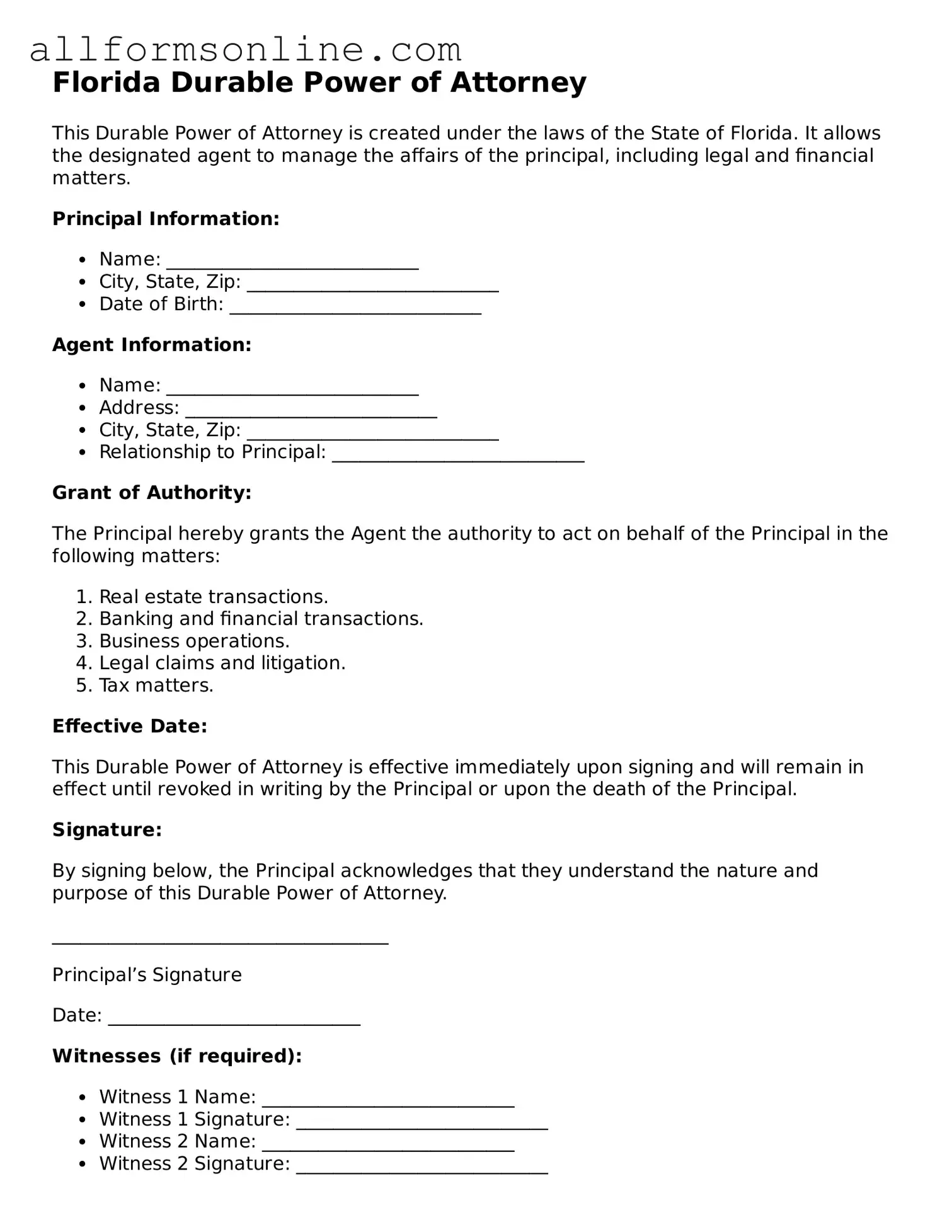

What is a Florida Durable Power of Attorney?

A Florida Durable Power of Attorney is a legal document that allows you to appoint someone to act on your behalf in financial and legal matters. This authority remains in effect even if you become incapacitated. It is crucial for ensuring that your financial affairs are managed according to your wishes when you are unable to do so yourself.

Who can be appointed as an agent in a Durable Power of Attorney?

You can appoint any competent adult as your agent. This can be a family member, friend, or a trusted professional, such as an attorney. It's essential to choose someone you trust implicitly, as they will have significant control over your financial decisions.

What powers can be granted through a Durable Power of Attorney?

The powers granted can be quite broad or limited, depending on your preferences. Common powers include managing bank accounts, paying bills, buying or selling property, and making investment decisions. You can specify which powers your agent will have, ensuring that they align with your specific needs and wishes.

Do I need to have my Durable Power of Attorney notarized?

Yes, in Florida, a Durable Power of Attorney must be signed in the presence of a notary public to be valid. This notarization adds an extra layer of security and ensures that the document is recognized by financial institutions and other entities.

Can I revoke my Durable Power of Attorney?

Absolutely. You can revoke your Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you should provide a written notice of revocation to your agent and any institutions that may have relied on the original document. This ensures that your wishes are clear and legally binding.

Other Common State-specific Durable Power of Attorney Forms

Blank Durable Power of Attorney - This document can be a crucial part of a broader strategy to manage legal and financial challenges effectively.

The importance of properly executing a document in Ohio cannot be overstated, and the Notary Acknowledgement form serves as a vital tool in this process, ensuring that all signatures are verified and authentic, while also guaranteeing that signers fully comprehend what they are endorsing.

Durable Power of Attorney Pdf - When executed properly, it holds significant power and legal weight.

Financial Power of Attorney Form Texas - It helps alleviate the burden on family members during emergencies.

How to Use Florida Durable Power of Attorney

Filling out the Florida Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are handled according to your wishes. Once completed, this form allows you to designate someone you trust to act on your behalf. Follow these steps carefully to complete the form accurately.

- Obtain the Florida Durable Power of Attorney form. You can find it online or at legal offices.

- Read the form thoroughly to understand the sections you need to complete.

- In the first section, fill in your name and address as the principal. This is the person granting the power.

- Next, provide the name and address of the agent you are appointing. This person will act on your behalf.

- Indicate the powers you wish to grant your agent by checking the appropriate boxes. You can choose specific powers or general powers.

- Include any limitations or specific instructions for your agent in the designated section.

- Sign and date the form in the presence of a notary public. Your signature must be notarized for the form to be valid.

- Have your agent sign the form as well, acknowledging their acceptance of the responsibilities.

- Make copies of the completed form for your records and for your agent.

After completing these steps, keep the original form in a safe place and provide copies to your agent and any relevant financial institutions or healthcare providers. This ensures that your wishes are clear and can be acted upon when necessary.