Attorney-Approved Horse Bill of Sale Form for Florida

Misconceptions

Understanding the Florida Horse Bill of Sale form is essential for anyone involved in equine transactions. However, several misconceptions can lead to confusion. Here are ten common misunderstandings:

- It is not a legal document. Many believe the Horse Bill of Sale is merely a receipt. In reality, it serves as a legal record of the sale, outlining the terms agreed upon by both parties.

- It is only necessary for expensive horses. Some think that a bill of sale is only needed for high-value transactions. Regardless of the horse's price, having a bill of sale protects both the buyer and seller.

- Verbal agreements are sufficient. Some individuals assume that a handshake or verbal agreement is enough. However, written documentation is crucial to avoid misunderstandings in the future.

- It is not required by law. While not always mandated, having a bill of sale is highly recommended for legal protection. It can be essential if disputes arise later.

- It can be handwritten. Some people believe that any written note will suffice. While a handwritten bill of sale can be valid, it is best to use a standardized form to ensure all necessary details are included.

- It only benefits the seller. Many think that the seller is the only one who gains from the bill of sale. In truth, it also protects the buyer by providing proof of ownership and details about the horse.

- All bills of sale are the same. Some assume that any bill of sale will work for horse transactions. Different types of sales may require specific information, making it important to use a form tailored for equine sales.

- It does not require signatures. A common misconception is that a bill of sale can be valid without signatures. Both the buyer and seller should sign the document to validate the agreement.

- It is only for the sale of horses. Some believe the bill of sale is exclusive to horse transactions. However, it can also be used for leasing or other equine-related agreements.

- Once signed, it cannot be changed. Finally, many think that once the bill of sale is signed, it is set in stone. Amendments can be made if both parties agree and document the changes properly.

Being aware of these misconceptions can help ensure that equine transactions proceed smoothly and legally. Proper documentation protects everyone involved and clarifies expectations.

What to Know About This Form

What is a Florida Horse Bill of Sale?

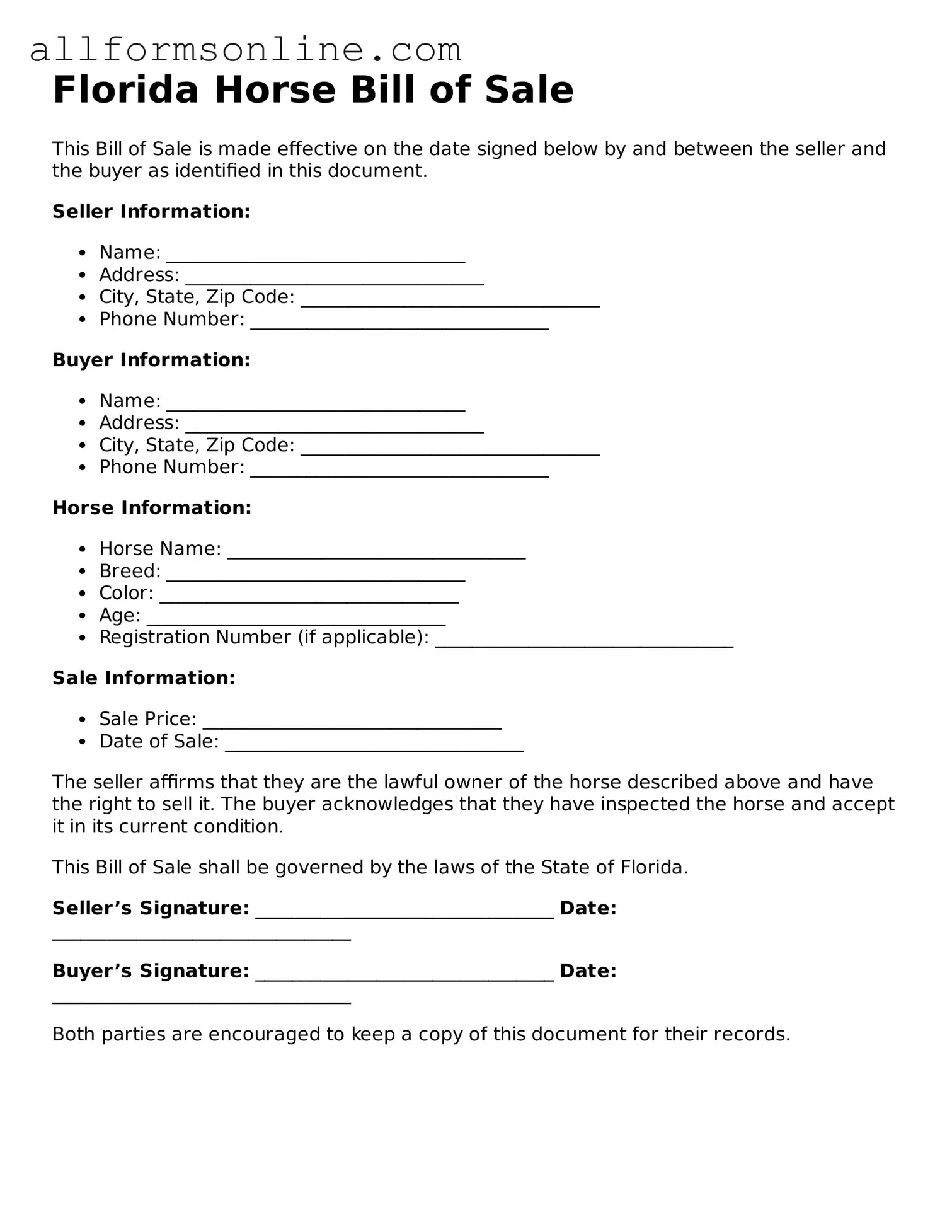

A Florida Horse Bill of Sale is a legal document that records the sale and transfer of ownership of a horse. This form includes important details such as the buyer's and seller's names, the horse's description, and the sale price. It serves as proof of the transaction and protects both parties involved.

Why do I need a Horse Bill of Sale?

This document is essential for several reasons. First, it provides legal protection by establishing ownership. If any disputes arise later, having a written record can help clarify who owns the horse. Additionally, it may be required for registration with breed associations or for insurance purposes.

What information should be included in the form?

The Horse Bill of Sale should include the seller's and buyer's full names and addresses, a detailed description of the horse (including breed, color, age, and any identifying marks), the sale price, and the date of the transaction. Both parties should sign the document to validate the sale.

Is the Horse Bill of Sale required by law in Florida?

No, a Horse Bill of Sale is not legally required in Florida. However, it is highly recommended. Having this document helps ensure that both parties are clear about the terms of the sale and can prevent misunderstandings in the future.

Can I create my own Horse Bill of Sale?

Yes, you can create your own Horse Bill of Sale as long as it includes all the necessary information. However, using a standard form can save time and ensure that you don’t miss any important details. Many templates are available online that you can customize to fit your needs.

What if I have more questions about the Horse Bill of Sale?

If you have additional questions, consider reaching out to a legal professional or a local equine association. They can provide guidance specific to your situation and help you understand the best practices for completing and using a Horse Bill of Sale.

Other Common State-specific Horse Bill of Sale Forms

Equine Bill of Sale Pdf - Ensures that both parties agree on the terms of the sale.

For those looking to navigate the sale process effectively, a reliable resource is the detailed Motorcycle Bill of Sale form guide, which offers essential information on documentation and requirements for a successful transaction.

How to Use Florida Horse Bill of Sale

Completing the Florida Horse Bill of Sale form is an important step in ensuring a smooth transaction between the buyer and seller. This document serves as a record of the sale and provides necessary details about the horse being sold. Below are the steps to guide you through the process of filling out this form correctly.

- Obtain the Form: Start by acquiring the Florida Horse Bill of Sale form. This can typically be found online or at local equestrian centers.

- Seller Information: In the designated section, fill in the seller's full name, address, and contact information. Ensure that all details are accurate to avoid any future complications.

- Buyer Information: Next, provide the buyer's full name, address, and contact information. Like the seller's details, accuracy is crucial here as well.

- Horse Description: Describe the horse being sold. Include important details such as the horse's name, breed, age, color, and any identifying marks or registration numbers.

- Sale Price: Clearly state the sale price of the horse. This should be a specific dollar amount.

- Payment Terms: Indicate the terms of payment. Specify whether the payment will be made in full at the time of sale or if there are any installment agreements.

- Signatures: Both the seller and buyer must sign and date the form. This signifies that both parties agree to the terms outlined in the document.

- Witness or Notary: Depending on your preference or local requirements, consider having a witness or notary public sign the document to add an extra layer of authenticity.

Once the form is completed, both parties should keep a copy for their records. This will help ensure that there is a clear understanding of the transaction and can assist in resolving any potential disputes in the future.