Attorney-Approved Lady Bird Deed Form for Florida

Misconceptions

The Florida Lady Bird Deed is a powerful estate planning tool, but several misconceptions can lead to confusion. Here are four common misunderstandings:

- It completely avoids probate. Many believe that a Lady Bird Deed allows property to bypass probate entirely. While it can simplify the transfer process, it does not eliminate the need for probate in all situations.

- It only benefits elderly individuals. Some think that only seniors can use a Lady Bird Deed. In reality, anyone who owns property can utilize this deed to ensure a smoother transfer of their assets upon death.

- It is the same as a traditional quitclaim deed. A common misconception is that a Lady Bird Deed functions like a quitclaim deed. Unlike a quitclaim deed, a Lady Bird Deed allows the original owner to retain control over the property during their lifetime.

- It eliminates tax implications. Many assume that using a Lady Bird Deed means there are no tax consequences. However, property transferred through this deed may still be subject to capital gains tax and other tax considerations.

Understanding these misconceptions can help individuals make informed decisions about their estate planning options.

What to Know About This Form

What is a Lady Bird Deed in Florida?

A Lady Bird Deed is a special type of deed used in Florida that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This deed can help avoid probate, making the transfer of property smoother and more efficient after the owner passes away.

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner retains the right to live in and use the property for the rest of their life. They can sell, lease, or mortgage the property without needing the consent of the beneficiaries. Upon the owner’s death, the property automatically transfers to the named beneficiaries without going through the probate process.

What are the benefits of using a Lady Bird Deed?

One significant benefit is that it allows for a seamless transfer of property upon death, which can save time and money by avoiding probate. Additionally, the property remains part of the owner's estate for tax purposes, which can be advantageous. The owner also retains control over the property during their lifetime, ensuring they can make decisions regarding it as needed.

Are there any drawbacks to a Lady Bird Deed?

While there are many benefits, there are also some potential drawbacks. For instance, if the property owner needs to qualify for Medicaid, the property may still be counted as an asset. Additionally, if the beneficiaries do not agree on how to manage or sell the property after the owner’s death, it could lead to disputes.

Who should consider using a Lady Bird Deed?

Individuals who wish to transfer their property to family members or loved ones while retaining control during their lifetime may find a Lady Bird Deed beneficial. It is especially useful for those who want to avoid the complications and expenses associated with probate. Consulting with a legal professional can help determine if this option is suitable for your situation.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified at any time while the property owner is still alive. The owner simply needs to execute a new deed that either revokes the existing one or changes the beneficiaries. This flexibility allows property owners to adapt to changing circumstances.

Is a Lady Bird Deed valid in other states?

While the Lady Bird Deed is recognized in Florida, not all states have this type of deed. Some states may have similar options, but the rules and implications can vary significantly. It is essential to check the laws in your specific state or consult with a legal expert to understand your options.

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed typically involves filling out a specific form that includes details about the property, the owner, and the beneficiaries. It must be signed by the property owner and notarized. After that, the deed should be recorded in the county where the property is located to ensure it is legally recognized.

What if I have more questions about Lady Bird Deeds?

If you have additional questions or need guidance on creating a Lady Bird Deed, it is advisable to consult with a legal professional who specializes in estate planning. They can provide personalized advice and help ensure that your wishes are accurately reflected in the deed.

Other Common State-specific Lady Bird Deed Forms

How to File a Lady Bird Deed in Texas - This document is a compassionate choice for those wishing to minimize difficulties for their heirs after their death.

Obtaining a Doctors Excuse Note is crucial for individuals needing to validate their health-related absences, and for those looking for a reliable format, Fast PDF Templates offers easy-to-use templates to streamline this process, ensuring proper documentation is always at hand.

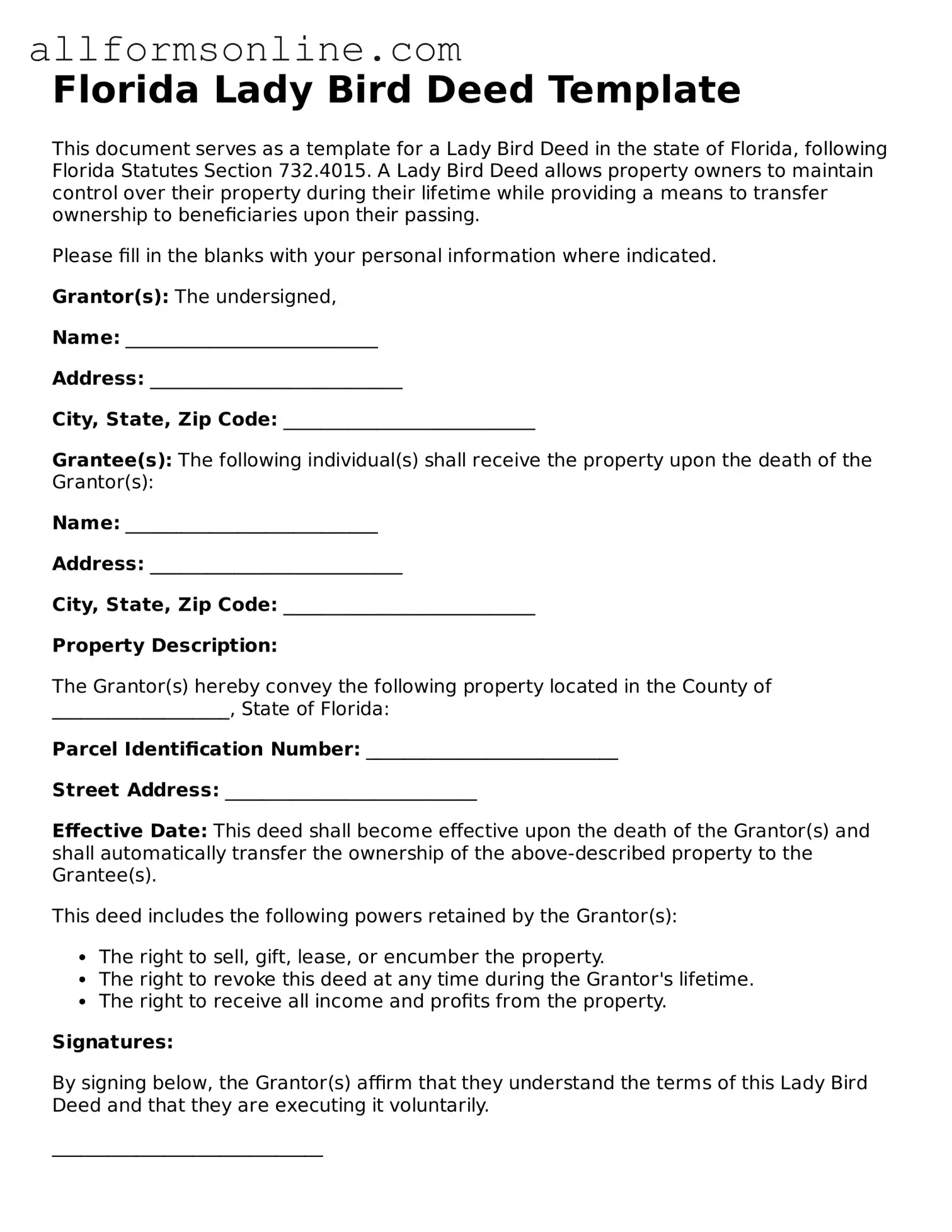

How to Use Florida Lady Bird Deed

Once you have the Florida Lady Bird Deed form in front of you, it’s time to fill it out carefully. Each section requires specific information to ensure the document is valid. Follow these steps to complete the form correctly.

- Title the Document: At the top of the form, write “Lady Bird Deed.”

- Identify the Grantor: In the designated space, enter your full name as the current owner of the property.

- Provide the Grantee’s Information: List the names of the individuals who will receive the property after your passing.

- Describe the Property: Include the legal description of the property. This can usually be found on your property deed or tax records.

- State the Intent: Clearly state your intention to retain the right to live in and control the property during your lifetime.

- Sign the Document: Sign the form where indicated. Make sure to date it as well.

- Get Witnesses: Have two witnesses sign the document. They should also print their names next to their signatures.

- Notarize the Document: Take the completed form to a notary public to have it notarized.

- File the Deed: Finally, file the notarized deed with the county clerk’s office where the property is located.

After completing these steps, your Lady Bird Deed will be ready for filing. Make sure to keep a copy for your records. If you have questions, consider seeking assistance from a legal professional.