Attorney-Approved Loan Agreement Form for Florida

Misconceptions

-

Misconception 1: The Florida Loan Agreement form is only for large loans.

This is not true. The form can be used for loans of any size, whether small personal loans or larger business financing. It is designed to be flexible and applicable to various borrowing situations.

-

Misconception 2: A Florida Loan Agreement must be notarized to be valid.

While notarization can add an extra layer of security and authenticity, it is not a requirement for the agreement to be legally binding. The essential factor is that both parties agree to the terms.

-

Misconception 3: All loan agreements in Florida are the same.

This is a common misunderstanding. Loan agreements can vary significantly based on the lender's policies, the type of loan, and the specific terms negotiated between the borrower and lender. Each agreement should be tailored to the individual circumstances.

-

Misconception 4: The Florida Loan Agreement form is only for individuals.

In reality, both individuals and businesses can utilize this form. Whether you are a sole proprietor or a corporation, the agreement can accommodate your needs.

-

Misconception 5: Once signed, the terms of the loan cannot be changed.

This is misleading. While the agreement outlines the initial terms, both parties can renegotiate and amend the agreement if both sides consent to the changes. Flexibility is often possible.

-

Misconception 6: There are no legal protections for borrowers under a Florida Loan Agreement.

This is incorrect. Borrowers have rights and protections under Florida law. The agreement must comply with state regulations, ensuring that borrowers are treated fairly and that their rights are upheld.

What to Know About This Form

What is a Florida Loan Agreement form?

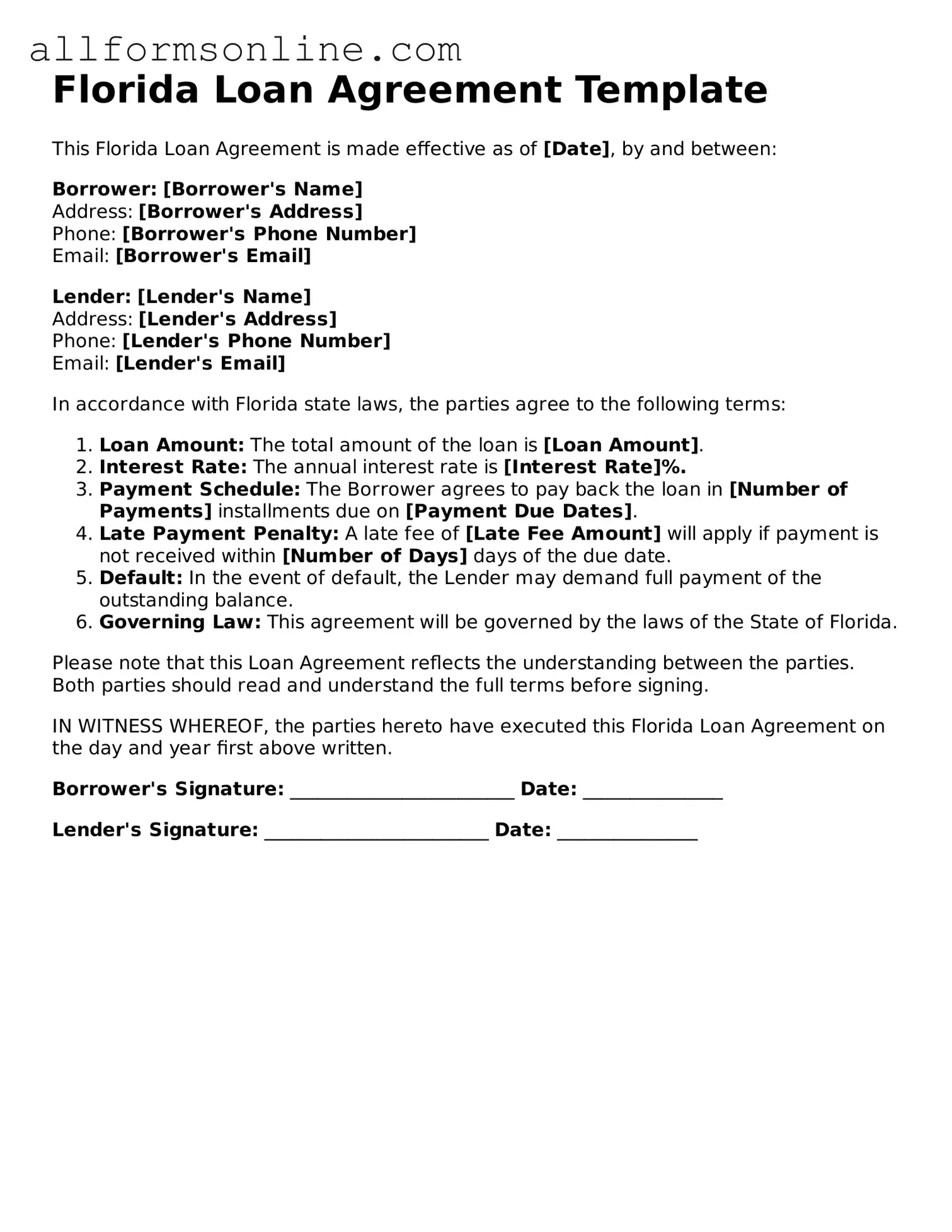

A Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies important details such as the loan amount, interest rate, repayment schedule, and any collateral involved. This form helps protect both parties by clearly defining their rights and responsibilities throughout the loan process.

Who can use a Florida Loan Agreement form?

Any individual or business in Florida looking to lend or borrow money can use this form. It is commonly utilized by private lenders, financial institutions, and individuals who wish to formalize a loan arrangement. The agreement is beneficial for both parties, as it ensures that all terms are agreed upon and documented.

What information is typically included in the form?

The Florida Loan Agreement form generally includes the names and addresses of both the lender and borrower, the loan amount, the interest rate, the repayment schedule, and any fees associated with the loan. Additionally, it may detail the consequences of default and any collateral that secures the loan. This comprehensive information helps clarify expectations and obligations.

Is it necessary to have a lawyer review the Loan Agreement?

While it is not legally required to have a lawyer review the Loan Agreement, it is highly advisable. Legal professionals can ensure that the document complies with state laws and adequately protects your interests. They can also help clarify any complex terms or conditions, providing peace of mind for both parties involved.

What happens if one party defaults on the loan?

If a borrower defaults on the loan, the lender may have several options available, depending on the terms outlined in the agreement. These options could include charging late fees, initiating collection proceedings, or seizing any collateral specified in the agreement. It is crucial for both parties to understand the consequences of default and to communicate openly to avoid such situations.

Can the terms of the Loan Agreement be modified after signing?

Yes, the terms of a Loan Agreement can be modified after signing, but both parties must agree to any changes. It is important to document any modifications in writing to ensure clarity and avoid future disputes. Both the lender and borrower should sign the amended agreement to confirm their consent to the new terms.

Is a Florida Loan Agreement form enforceable in court?

Yes, a properly executed Florida Loan Agreement form is generally enforceable in court. However, for it to hold up legally, the agreement must meet certain criteria, such as being clear, concise, and signed by both parties. If disputes arise, having a well-documented agreement can significantly strengthen a party's position in legal proceedings.

Where can I obtain a Florida Loan Agreement form?

Florida Loan Agreement forms can be obtained from various sources, including legal websites, financial institutions, or local attorney offices. It is important to ensure that the form is up-to-date and compliant with Florida laws. Many online resources offer customizable templates that can be tailored to fit specific loan arrangements.

Other Common State-specific Loan Agreement Forms

Promissory Note California - May include a section for events of force majeure affecting the loan.

Promissory Note Texas - Both parties must retain copies for their records post-signing.

To facilitate the ownership transfer process, it's advisable to utilize the California Trailer Bill of Sale form, which can be conveniently accessed through Fast PDF Templates. This form includes all necessary details that both the buyer and seller should agree upon to avoid further complications.

Promissory Note Template New York - May contain clauses for prepayment options and penalties.

How to Use Florida Loan Agreement

Completing the Florida Loan Agreement form is a crucial step in formalizing a loan arrangement. Once the form is accurately filled out, both parties can proceed with signing the document, ensuring that the terms are clear and legally binding.

- Begin by downloading the Florida Loan Agreement form from a reliable source.

- Read through the entire document to familiarize yourself with the sections that need to be filled out.

- In the first section, enter the names and contact information of both the lender and the borrower.

- Specify the loan amount in the designated field, ensuring that it is clearly written.

- Indicate the interest rate, if applicable, and the repayment schedule, including start and end dates.

- Fill in any additional terms or conditions relevant to the loan agreement.

- Review all entered information for accuracy and completeness.

- Once satisfied, print the form for signatures.

- Both parties should sign and date the document to finalize the agreement.