Attorney-Approved Operating Agreement Form for Florida

Misconceptions

Understanding the Florida Operating Agreement form is crucial for anyone involved in a limited liability company (LLC) in Florida. However, several misconceptions can lead to confusion. Below are nine common misconceptions about this important document.

- All LLCs are required to have an Operating Agreement. While it is not mandatory by law, having an Operating Agreement is highly recommended. It provides clarity on the management and operational procedures of the LLC.

- An Operating Agreement is only for multi-member LLCs. This is incorrect. Even single-member LLCs benefit from having an Operating Agreement, as it helps establish the owner's rights and responsibilities.

- The Operating Agreement must be filed with the state. In Florida, the Operating Agreement is an internal document and does not need to be submitted to the state. It should, however, be kept on file for reference.

- Once created, the Operating Agreement cannot be changed. This is a misconception. The Operating Agreement can be amended as needed, provided that all members agree to the changes.

- The Operating Agreement is the same as the Articles of Organization. These are two different documents. The Articles of Organization are filed with the state to officially form the LLC, while the Operating Agreement outlines the internal workings of the company.

- Verbal agreements can replace a written Operating Agreement. Relying on verbal agreements is risky. A written Operating Agreement provides legal protection and clarity that verbal agreements cannot offer.

- All members must sign the Operating Agreement. While it is advisable for all members to sign, it is not a legal requirement. However, having signatures can help avoid disputes later.

- The Operating Agreement is only relevant during disputes. In reality, it serves as a guide for daily operations and decision-making, not just during conflicts.

- Creating an Operating Agreement is a one-time task. This is misleading. As the business evolves, the Operating Agreement should be reviewed and updated to reflect any changes in the company structure or operations.

By addressing these misconceptions, you can better understand the importance of the Florida Operating Agreement form and ensure that your LLC operates smoothly and effectively.

What to Know About This Form

What is a Florida Operating Agreement?

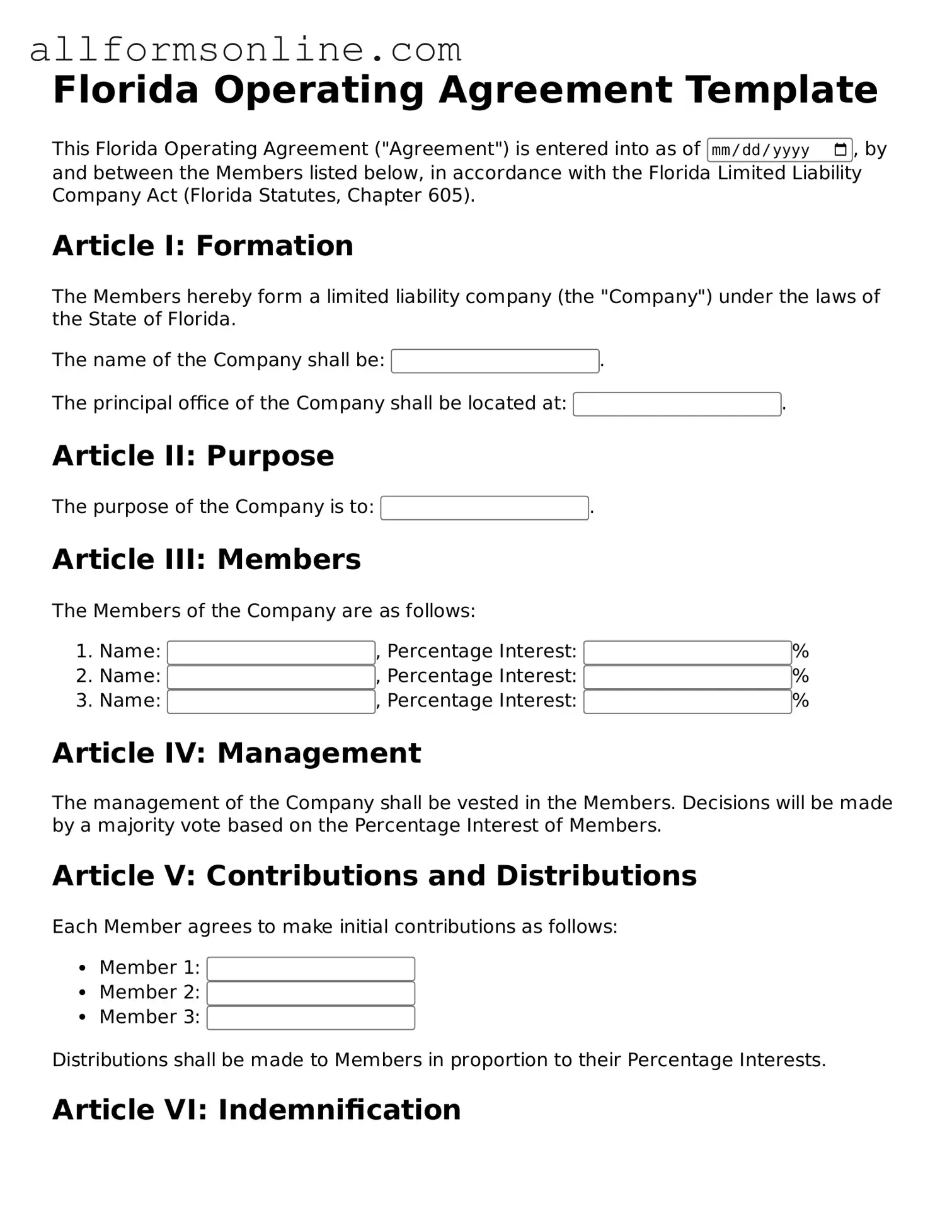

A Florida Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Florida. It serves as an internal guideline for the members of the LLC, detailing how the company will be run, how profits and losses will be distributed, and how decisions will be made. This agreement is crucial for preventing misunderstandings among members and providing a clear framework for operations.

Is an Operating Agreement required in Florida?

No, Florida does not legally require LLCs to have an Operating Agreement. However, having one is highly recommended. Without an Operating Agreement, the LLC will be governed by Florida's default LLC laws, which may not align with the members' intentions. An Operating Agreement helps establish the rights and responsibilities of the members, offering protection and clarity.

Who should draft the Operating Agreement?

The members of the LLC can draft the Operating Agreement themselves, or they may choose to hire an attorney for assistance. While it is possible to find templates online, it is advisable to customize the agreement to fit the specific needs of the business and its members. This ensures that all relevant issues are addressed and that the document complies with state laws.

What should be included in the Operating Agreement?

Key elements of an Operating Agreement typically include the LLC's name and address, the purpose of the business, the names of the members, their ownership percentages, and how profits and losses will be shared. Additionally, the agreement should outline the management structure, decision-making processes, and procedures for adding or removing members. It may also address dispute resolution methods and the process for dissolving the LLC.

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. The process for making changes should be outlined in the agreement itself. Typically, amendments require the consent of a certain percentage of the members. It is important to document any changes in writing and to keep the updated version with the original Operating Agreement to ensure that all members are aware of the current terms.

What happens if there is no Operating Agreement?

If there is no Operating Agreement, the LLC will be governed by Florida's default laws. This may lead to unexpected outcomes in terms of profit distribution, management decisions, and member rights. Disputes among members may arise more easily without a clear framework. Having an Operating Agreement can help avoid these issues and provide a clear process for resolving conflicts.

How does an Operating Agreement protect the members?

An Operating Agreement protects the members by clearly defining their roles, responsibilities, and rights within the LLC. It helps establish the rules for how the business operates, which can prevent disputes and misunderstandings. Additionally, it can provide liability protection by reinforcing the separation between personal and business assets, which is a key benefit of forming an LLC.

Other Common State-specific Operating Agreement Forms

How to Get Llc - The agreement may outline the expected level of participation from each member.

Pennsylvania Llc Operating Agreement - The Operating Agreement can facilitate smoother succession planning.

To effectively manage sensitive information in your business dealings, consider utilizing the Georgia Non-disclosure Agreement that outlines essential terms and protections. This non-disclosure agreement form is crucial for ensuring confidentiality and fostering trustworthy relationships in professional settings. For your convenience, you can access a detailed template of this important document here: a reliable Georgia non-disclosure agreement.

Llc Operating Agreement Texas - The Operating Agreement protects against external claims by proving structure.

Does Llc Need Operating Agreement - The agreement can specify how to handle the dissolution of the LLC if necessary.

How to Use Florida Operating Agreement

Once you have gathered the necessary information and documentation, you can proceed to fill out the Florida Operating Agreement form. This document will serve as an essential framework for your business, outlining the management structure and operational guidelines. Follow these steps to ensure that you complete the form accurately.

- Title the Document: At the top of the form, write "Operating Agreement" to clearly identify the purpose of the document.

- Identify the LLC: Fill in the full legal name of your Limited Liability Company (LLC) as registered with the state.

- List the Members: Provide the names and addresses of all members involved in the LLC. Ensure that this information is accurate and complete.

- Define Ownership Percentages: Specify the ownership percentage for each member. This reflects their stake in the LLC.

- Outline Management Structure: Indicate whether the LLC will be member-managed or manager-managed. Provide details as necessary.

- Detail Voting Rights: Describe how voting will be conducted among members, including any specific rules or procedures.

- Address Profit and Loss Distribution: Clarify how profits and losses will be allocated among members.

- Include Additional Provisions: If there are any specific rules or conditions that apply to your LLC, include them in this section.

- Sign and Date: All members must sign and date the agreement to validate it. Ensure that each member has a copy for their records.

After completing the form, review it carefully to ensure all information is correct. Once satisfied, keep the signed copies in a safe place, as they will be important for the operation of your LLC.