Attorney-Approved Power of Attorney Form for Florida

Misconceptions

Understanding the Florida Power of Attorney form can be challenging, and several misconceptions often arise. Here are seven common misunderstandings about this important legal document:

-

All Power of Attorney forms are the same.

Many people believe that all Power of Attorney forms are interchangeable. In reality, each state has its own requirements and specific forms, and Florida's Power of Attorney has unique provisions that must be followed.

-

A Power of Attorney is only for financial matters.

While many use a Power of Attorney for financial decisions, it can also be used for healthcare decisions. A specific type, called a Healthcare Power of Attorney, allows someone to make medical choices on your behalf if you cannot do so.

-

A Power of Attorney is permanent and cannot be revoked.

This is a common misconception. You can revoke a Power of Attorney at any time, as long as you are mentally competent. It’s important to follow the proper procedures to ensure the revocation is valid.

-

Only lawyers can create a Power of Attorney.

While it’s advisable to consult a lawyer, especially for complex situations, individuals can create a Power of Attorney on their own using state-approved forms. Just be sure to follow the rules for signing and witnessing.

-

Once signed, the agent has immediate control over your affairs.

This is not always the case. In Florida, a Power of Attorney can be set up to become effective immediately or only upon the principal's incapacitation, depending on how the document is drafted.

-

A Power of Attorney can be used to make decisions after the principal's death.

This is incorrect. A Power of Attorney is valid only while the principal is alive. Once the principal passes away, the authority granted to the agent ends, and the estate must be handled through probate.

-

All agents have unlimited power.

Not true. The authority granted to an agent is defined by the Power of Attorney document itself. You can specify exactly what powers you want to give your agent, whether it’s broad or limited.

By clearing up these misconceptions, you can better understand the role and importance of a Power of Attorney in Florida. Always consider seeking professional advice to ensure your document meets your needs.

What to Know About This Form

What is a Power of Attorney in Florida?

A Power of Attorney (POA) in Florida is a legal document that allows one person to give another person the authority to act on their behalf. This can include making financial decisions, managing property, or handling legal matters. The person who creates the POA is called the principal, while the person receiving the authority is known as the agent or attorney-in-fact.

Why might I need a Power of Attorney?

You might need a Power of Attorney if you want someone to handle your affairs when you are unable to do so. This could be due to illness, travel, or other reasons. Having a POA ensures that your financial and legal matters can be managed without delays or complications.

What types of Power of Attorney are available in Florida?

In Florida, there are several types of Power of Attorney. A general POA gives broad powers to the agent. A limited POA restricts the agent's authority to specific tasks or time periods. A durable POA remains in effect even if the principal becomes incapacitated. Finally, a healthcare POA allows someone to make medical decisions on your behalf if you are unable to do so.

How do I create a Power of Attorney in Florida?

To create a Power of Attorney in Florida, you must fill out a specific form. The form should clearly state your intentions and the powers you are granting. After completing the form, you need to sign it in front of a notary public and, if required, have it witnessed. This ensures that the document is valid and legally binding.

Can I revoke a Power of Attorney?

Yes, you can revoke a Power of Attorney at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions that may have a copy of the original POA. This helps prevent any future actions taken by the agent under the revoked authority.

What happens if I become incapacitated and do not have a Power of Attorney?

If you become incapacitated without a Power of Attorney, your loved ones may have to go through a court process to gain authority to make decisions on your behalf. This can be time-consuming and costly. Having a POA in place can help avoid this situation and ensure your wishes are followed.

Can my agent be held responsible for their actions?

Your agent has a fiduciary duty to act in your best interests. If they fail to do so, they can be held accountable for any losses or damages. It is important to choose someone you trust, as they will have significant control over your affairs.

Is a Power of Attorney valid in other states?

A Power of Attorney created in Florida is generally recognized in other states, but there may be specific requirements or limitations. It is advisable to check the laws of the state where the POA will be used to ensure it meets their requirements.

Can I use a Power of Attorney for healthcare decisions?

Yes, a Power of Attorney can be used for healthcare decisions, but it should be specifically designated as a healthcare Power of Attorney. This document allows your agent to make medical decisions on your behalf if you are unable to communicate your wishes. It is important to clearly outline your preferences in this document.

Other Common State-specific Power of Attorney Forms

Nys Power of Attorney - Often easier than waiting for a court-appointed guardianship.

The key Power of Attorney for a Child document serves as a vital tool for parents who need to ensure their child's welfare is managed by a trusted individual during their absence. This form is designed to facilitate important decisions related to the child's care, providing peace of mind during temporary separations.

Where Can I Get Poa Forms - Discuss your wishes with your agent to ensure alignment on important decisions.

How to Use Florida Power of Attorney

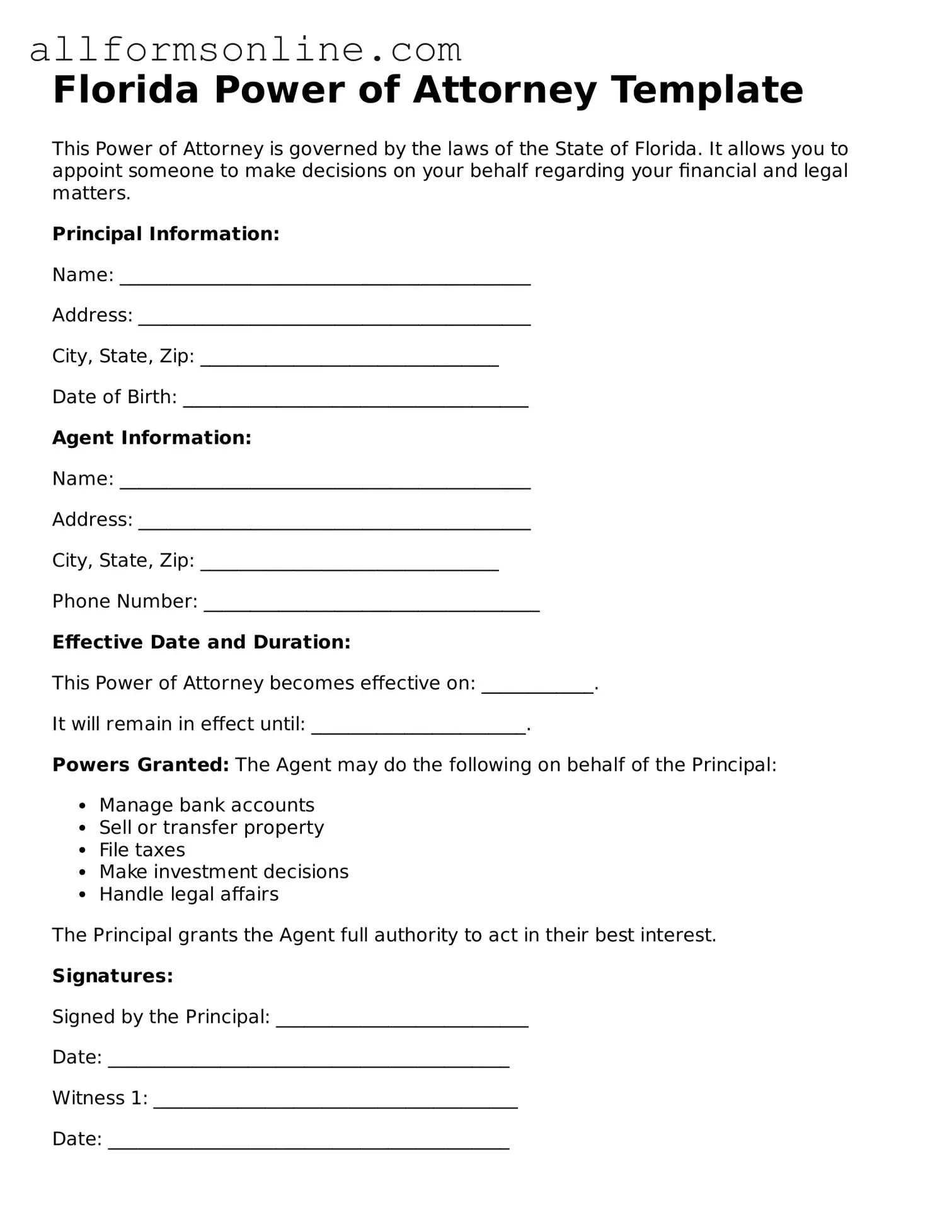

Filling out the Florida Power of Attorney form is an important step in designating someone to act on your behalf in financial or legal matters. After completing the form, you will need to ensure it is properly signed and witnessed to make it legally binding.

- Obtain the Form: Download the Florida Power of Attorney form from a reliable source or visit a local legal office to get a hard copy.

- Read the Instructions: Carefully review any instructions provided with the form to understand what information is required.

- Fill in Your Information: Start by entering your full name, address, and contact information in the designated sections.

- Select the Agent: Choose the person you wish to designate as your agent. Provide their full name and address.

- Specify Powers Granted: Indicate the specific powers you are granting to your agent. This could include managing finances, handling real estate transactions, or making healthcare decisions.

- Set the Duration: Decide if the Power of Attorney will be effective immediately or only under certain conditions. Specify any expiration date if applicable.

- Sign the Form: Sign and date the form in the appropriate section. Your signature must match the name you provided at the beginning.

- Witness Requirements: Have at least two witnesses sign the form, if required. Ensure they provide their names and addresses as well.

- Notarization: If necessary, take the completed form to a notary public for notarization. This step may add an extra layer of validity.

- Distribute Copies: Make copies of the completed form for your records and provide copies to your agent and any relevant institutions.