Attorney-Approved Promissory Note Form for Florida

Misconceptions

Understanding the Florida Promissory Note form is essential for anyone involved in lending or borrowing money. Unfortunately, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, the terms and conditions can vary significantly based on the agreement between the parties involved.

- A Promissory Note Must Be Notarized: While notarization can add an extra layer of authenticity, it is not a legal requirement for a promissory note in Florida. As long as both parties agree and sign, the note is valid.

- Only Written Notes Are Valid: Some think that verbal agreements are not enforceable. However, while written notes are easier to prove, verbal promissory notes can also be legally binding if there is sufficient evidence of the agreement.

- Interest Rates Are Always Required: There is a misconception that all promissory notes must include an interest rate. However, it is possible to create a note that does not charge interest, known as a "zero-interest" promissory note.

- Promissory Notes Are Only for Large Amounts: Many believe that promissory notes are only necessary for large loans. In truth, they can be used for any amount, big or small, providing clarity and protection for both parties.

- Once Signed, a Promissory Note Cannot Be Changed: Some think that once a promissory note is signed, it is set in stone. However, both parties can agree to modify the terms, provided that the changes are documented and signed.

- Promissory Notes Do Not Require a Payment Schedule: It is a common belief that a promissory note can be vague about repayment terms. However, clearly outlining a payment schedule can prevent misunderstandings and disputes.

- Defaulting on a Promissory Note Has No Consequences: Lastly, some individuals think that failing to repay a promissory note carries no serious repercussions. In reality, defaulting can lead to legal action and impact credit ratings.

By understanding these misconceptions, both borrowers and lenders can navigate the process more confidently and ensure that their agreements are clear and enforceable.

What to Know About This Form

What is a Florida Promissory Note?

A Florida Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. It includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. This document serves as a record of the loan agreement and can be used in court if disputes arise.

Who can use a Florida Promissory Note?

Any individual or business can use a Florida Promissory Note. It's commonly utilized by friends, family members, or businesses lending money to one another. Whether it's for a personal loan, a business loan, or any other financial transaction, this form is a useful tool for establishing clear terms.

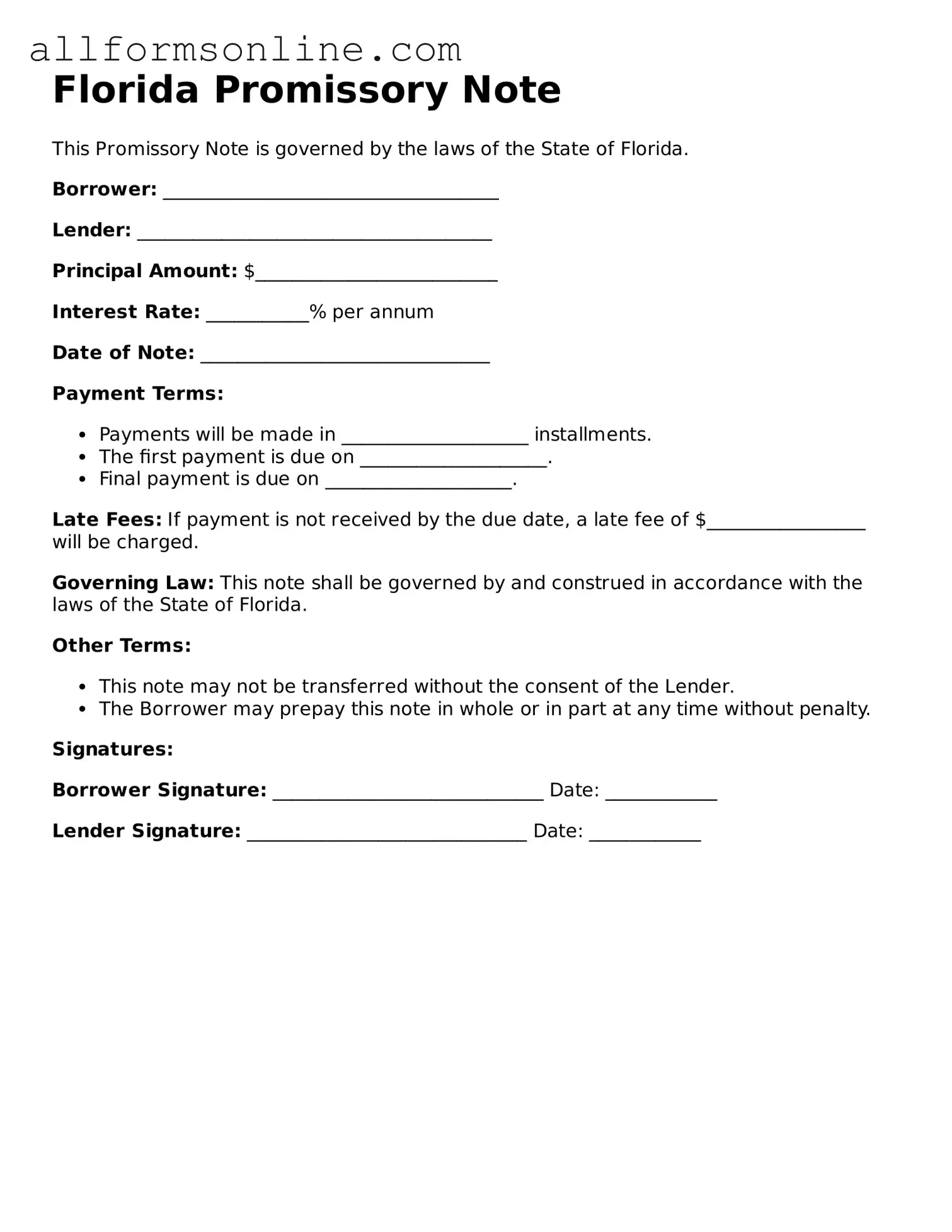

What information is required to complete the form?

To complete a Florida Promissory Note, you'll need to provide the following information: the names and addresses of the borrower and lender, the loan amount, the interest rate (if applicable), the repayment schedule, and the due date. Additionally, if there's any collateral involved, it should be described in detail.

Is it necessary to have the Promissory Note notarized?

While notarization is not strictly required for a Florida Promissory Note to be valid, having it notarized can add an extra layer of protection. A notary public verifies the identities of the parties involved and witnesses the signing of the document. This can help prevent disputes about the authenticity of the agreement later on.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. The Promissory Note serves as evidence of the debt, making it easier for the lender to pursue collection. Depending on the terms outlined in the note, the lender may also be able to claim any collateral specified in the agreement.

Can the terms of a Promissory Note be modified after it's signed?

Yes, the terms of a Florida Promissory Note can be modified after it is signed, but both parties must agree to the changes. It's best to document any modifications in writing and have both parties sign the revised agreement. This helps ensure that everyone is on the same page and reduces the risk of future misunderstandings.

Other Common State-specific Promissory Note Forms

New York Promissory Note - It may specify whether the borrower can request a loan extension.

For those looking to ensure a clear transfer of ownership, the necessary documentation can be found in the comprehensive Motorcycle Bill of Sale form offered at formsgeorgia.com. This form not only establishes legal proof of sale but also details important information including the motorcycle's specifications.

How to Write a Promissory Note Example - Legal requirements for promissory notes include proper identification of parties involved and clear terms.

How to Use Florida Promissory Note

After obtaining the Florida Promissory Note form, you will need to complete it accurately to ensure it serves its intended purpose. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form. This should reflect the date when the note is being executed.

- In the first blank space, write the name of the borrower. This is the individual or entity who is receiving the loan.

- Next, enter the borrower's address in the designated area. Include the street address, city, state, and zip code.

- Proceed to fill in the name of the lender in the next blank. This is the individual or entity providing the loan.

- Enter the lender's address, similar to the borrower's address format.

- In the section for the loan amount, write the total sum being borrowed. Ensure this is clearly stated in both numerical and written form.

- Specify the interest rate applicable to the loan. This should be clearly indicated as a percentage.

- Detail the repayment terms. Include how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Provide any additional terms or conditions in the space provided. This could include information about late fees or prepayment options.

- Finally, both the borrower and lender should sign and date the form at the bottom. Ensure that signatures are clear and legible.

Once the form is completed and signed, it is advisable to keep copies for both parties. This ensures that everyone has a record of the agreement, which can be useful in case of any disputes or misunderstandings in the future.