Attorney-Approved Real Estate Purchase Agreement Form for Florida

Misconceptions

Understanding the Florida Real Estate Purchase Agreement is crucial for anyone involved in a real estate transaction. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- It is a legally binding contract from the moment it is signed. Many believe that signing the agreement immediately creates legal obligations. In reality, certain conditions must be met for the contract to be enforceable.

- All terms are negotiable. While many aspects can be negotiated, some terms, such as legal requirements and disclosures, are mandated by law and cannot be altered.

- It is only for residential properties. This agreement can be used for both residential and commercial real estate transactions, making it versatile.

- Once signed, the buyer cannot back out. Buyers may have the right to terminate the agreement under specific conditions, such as failing to secure financing or issues found during inspections.

- It does not require a real estate agent. While a real estate agent can provide valuable assistance, individuals can complete the agreement without one, although this may increase risks.

- All parties must be present to sign. Signatures can often be obtained electronically or through a power of attorney, allowing for flexibility in the signing process.

- It guarantees a successful closing. The agreement outlines the terms of the sale, but it does not guarantee that all conditions will be met for a successful closing.

Clarifying these misconceptions can help ensure a smoother real estate transaction. Always consider seeking professional advice when dealing with legal documents.

What to Know About This Form

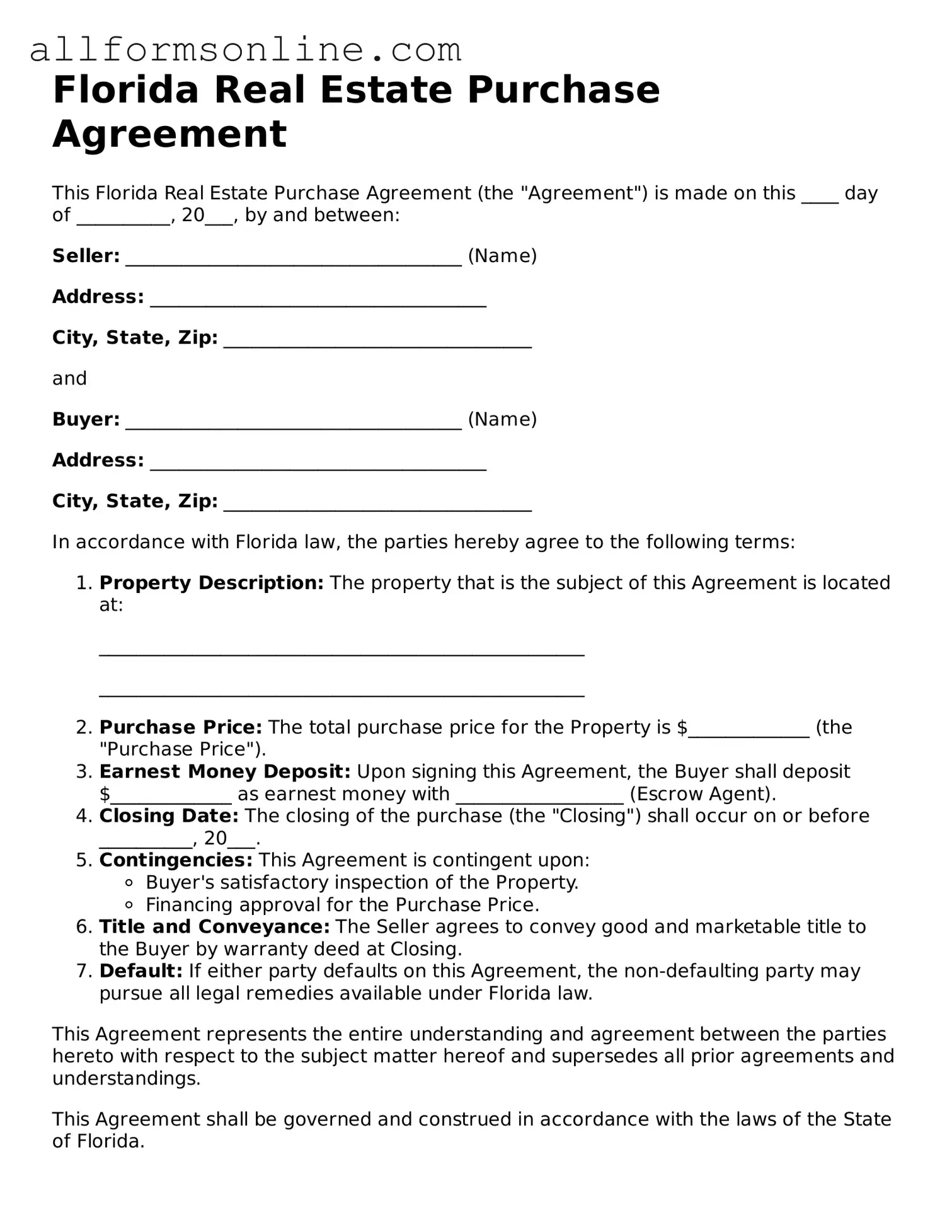

What is the Florida Real Estate Purchase Agreement form?

The Florida Real Estate Purchase Agreement form is a legal document used when a buyer wants to purchase property in Florida. This form outlines the terms and conditions of the sale, including the purchase price, closing date, and any contingencies that must be met before the sale can be finalized.

Who typically uses this form?

This form is commonly used by buyers and sellers of residential real estate in Florida. Real estate agents and attorneys may also use the form to facilitate the transaction. It serves as a clear record of the agreement between the parties involved.

What key information is included in the agreement?

The agreement includes several important details. It lists the names of the buyer and seller, the property address, the purchase price, and the earnest money deposit. Additionally, it may include contingencies such as financing, inspections, and appraisals that must be satisfied for the sale to proceed.

What are contingencies, and why are they important?

Contingencies are conditions that must be met for the sale to go through. They protect both the buyer and seller. For example, a buyer may include a financing contingency to ensure they can secure a mortgage before finalizing the purchase. If the conditions are not met, the buyer can back out without losing their deposit.

How does the closing process work?

The closing process involves finalizing the sale of the property. After all contingencies are satisfied, both parties will meet to sign the necessary documents. The buyer will pay the remaining balance, and ownership will be transferred. This process typically occurs at a title company or attorney's office.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified, but both parties must agree to any changes. It is important to document any modifications in writing to avoid misunderstandings. This can be done through an amendment or addendum to the original agreement.

What happens if one party does not fulfill their obligations?

If one party does not fulfill their obligations as outlined in the agreement, the other party may have legal options. This could include seeking damages or enforcing the contract. It is advisable to consult with a legal professional to understand the best course of action in such situations.

Other Common State-specific Real Estate Purchase Agreement Forms

Real Estate Sales Contract Form - Lessee rights can be mentioned if the property is a rental or investment property.

The California Motorcycle Bill of Sale form is a crucial document that facilitates the transfer of ownership for motorcycles. By providing essential information about the buyer, seller, and the motorcycle itself, it serves as a record of the transaction. For those looking to utilize this form, resources such as Fast PDF Templates are available to assist in the process. This form not only ensures transparency but also protects both parties involved in the sale.

Texas Real Estate Contract - It can clarify how contingencies impact the closing timeline.

How to Use Florida Real Estate Purchase Agreement

Completing the Florida Real Estate Purchase Agreement form is a crucial step in the home buying process. This document outlines the terms of the sale and protects the interests of both the buyer and the seller. Follow these steps carefully to ensure that the form is filled out correctly and comprehensively.

- Start with the date: Write the date on which the agreement is being filled out at the top of the form.

- Identify the parties: Clearly list the names of the buyer(s) and seller(s). Include any middle initials or suffixes to avoid confusion.

- Property description: Provide a detailed description of the property. This should include the address, lot number, and any other identifying information.

- Purchase price: State the agreed-upon purchase price for the property. Be sure to write this clearly, including both numbers and words.

- Earnest money deposit: Specify the amount of the earnest money deposit and the deadline for submitting it. This shows the seller that the buyer is serious.

- Financing terms: Indicate whether the purchase will be financed through a mortgage or paid in cash. Include any relevant details about the financing process.

- Closing date: Agree upon a closing date, which is when the sale will be finalized. Make sure both parties are in agreement on this date.

- Contingencies: List any contingencies that must be met before the sale can proceed, such as inspections or financing approvals.

- Signatures: Both the buyer and seller must sign and date the agreement. Ensure that all signatures are legible.

- Review the document: After filling out the form, review it carefully for any errors or omissions. It may be wise to have a real estate professional or attorney review it as well.

Once the form is completed and signed, it will be ready for submission. Ensure all parties receive a copy for their records, and be prepared to move forward with the next steps in the buying process.