Attorney-Approved Transfer-on-Death Deed Form for Florida

Misconceptions

The Florida Transfer-on-Death Deed (TOD) allows property owners to transfer real estate to beneficiaries upon their death. However, several misconceptions surround this legal form. Here are ten common misunderstandings:

- The TOD deed avoids probate entirely. While a TOD deed allows for the direct transfer of property, it does not eliminate probate for other assets or debts.

- All types of property can be transferred using a TOD deed. Only certain types of real estate can be transferred, such as residential properties. Personal property cannot be included.

- A TOD deed is irrevocable once signed. This is false. The property owner can revoke or change the TOD deed at any time before their death.

- The beneficiaries must pay taxes on the property immediately upon transfer. Beneficiaries typically do not owe taxes until they sell the property or if it generates income.

- The TOD deed can be used to transfer property to multiple beneficiaries. This is misleading. While it can name multiple beneficiaries, the property must be divided equally among them unless specified otherwise.

- There are no legal formalities required for a TOD deed. This is incorrect. The deed must be properly executed, witnessed, and recorded to be valid.

- The TOD deed overrides a will. A TOD deed does not override a will; it simply operates independently of it. If the will conflicts with the TOD deed, the deed takes precedence.

- Beneficiaries have immediate access to the property. Beneficiaries do not have access until the property owner passes away and the deed is recorded.

- A TOD deed can be used to transfer property to a trust. This is not accurate. A TOD deed cannot directly transfer property to a trust; it can only designate individuals as beneficiaries.

- The TOD deed is a one-size-fits-all solution for estate planning. This is misleading. Each individual's situation is unique, and a TOD deed may not be the best option for everyone.

Understanding these misconceptions can help property owners make informed decisions about their estate planning in Florida.

What to Know About This Form

What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed (TODD) is a legal document that allows a property owner to transfer their real estate to a designated beneficiary upon their death. This deed bypasses the probate process, making it a straightforward option for transferring property to heirs without the complexities typically associated with estate administration.

Who can use a Transfer-on-Death Deed in Florida?

Any individual who owns real property in Florida can use a Transfer-on-Death Deed. This includes homeowners, property investors, and anyone holding title to real estate. However, it is essential that the property is not subject to any liens or encumbrances that would complicate the transfer.

How does a Transfer-on-Death Deed work?

The property owner fills out the TODD form, naming one or more beneficiaries. After the owner’s death, the property automatically transfers to the beneficiaries without going through probate. The deed must be properly recorded in the county where the property is located to be effective.

Are there any limitations on who can be named as a beneficiary?

Yes, beneficiaries must be individuals or certain types of entities, such as trusts. You cannot name an estate, corporation, or partnership as a beneficiary. Additionally, if a beneficiary predeceases the property owner, their share may pass to their heirs or may be redistributed among the remaining beneficiaries, depending on how the deed is structured.

Can a Transfer-on-Death Deed be revoked or changed?

Yes, the property owner can revoke or change the TODD at any time before their death. This can be done by executing a new deed or a revocation form, which must also be recorded in the appropriate county office to be effective.

What are the tax implications of a Transfer-on-Death Deed?

Generally, property transferred via a TODD does not trigger immediate tax consequences. The property retains its tax basis, which means that the beneficiaries may benefit from a step-up in basis upon the owner's death. However, it is advisable to consult a tax professional to understand any potential tax implications fully.

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed may not be suitable for everyone. Individuals with complex estates, multiple properties, or those wishing to impose conditions on property transfer may benefit from other estate planning tools. Consulting with an estate planning attorney can help determine the best approach for your situation.

What happens if there are multiple beneficiaries named in the deed?

If multiple beneficiaries are named, the property will be divided among them according to the terms specified in the deed. If no specific division is mentioned, the property may be divided equally. Beneficiaries may need to agree on how to manage or sell the property after the transfer.

Where can I obtain a Transfer-on-Death Deed form?

Transfer-on-Death Deed forms are available through various sources, including online legal services, local county offices, and estate planning attorneys. It is important to use the correct form for Florida and ensure that it complies with state laws.

Is legal assistance necessary to complete a Transfer-on-Death Deed?

While it is possible to complete a Transfer-on-Death Deed without legal assistance, it is recommended to consult with an attorney. An attorney can help ensure that the deed is filled out correctly, complies with state laws, and meets your specific needs and circumstances.

Other Common State-specific Transfer-on-Death Deed Forms

Transfer Deed Upon Death - Make your intent clear—pass your property along with ease using this deed.

To facilitate the transfer of vehicle ownership, it is important to utilize the California Motor Vehicle Bill of Sale form, which can be easily accessed through resources like Fast PDF Templates. This document helps clarify the details of the sale, ensuring that both parties are protected during the transaction.

Avoiding Probate in California - This form provides a valuable alternative to traditional transfer methods, offering privacy and simplicity.

How to Use Florida Transfer-on-Death Deed

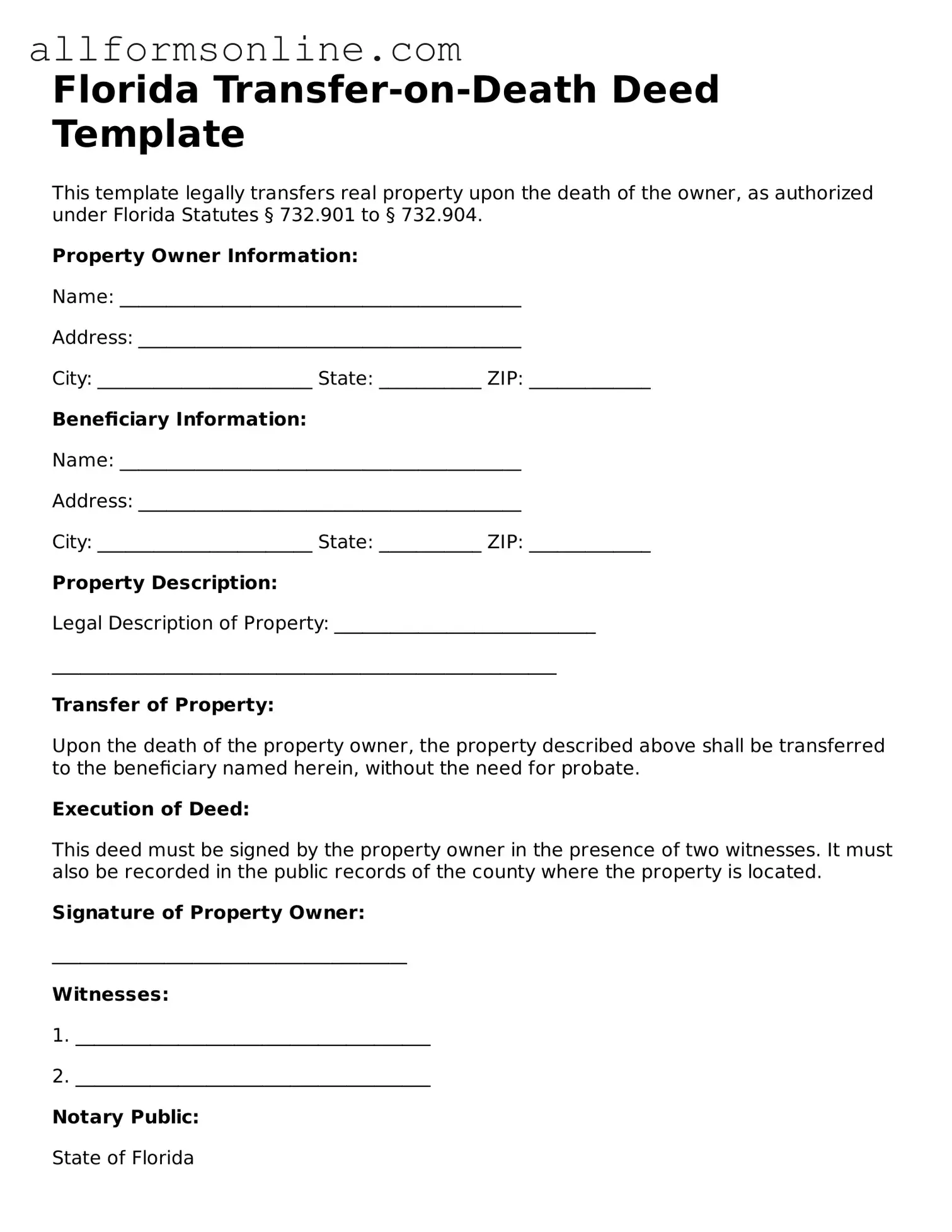

After you have gathered all necessary information, you can proceed to fill out the Florida Transfer-on-Death Deed form. This form allows you to designate a beneficiary for your property, ensuring a smooth transfer upon your passing. Follow the steps carefully to complete the form accurately.

- Begin by entering the date at the top of the form.

- Provide your name as the property owner in the designated section.

- List the property address, including the street number, street name, city, and zip code.

- Include a legal description of the property. This can usually be found on your property tax bill or deed.

- Identify the beneficiary by providing their full name and relationship to you.

- Include the beneficiary's address, ensuring it is complete and accurate.

- Sign the form in the presence of a notary public. The notary will then sign and stamp the document.

- Make copies of the completed form for your records.

- File the original form with the county clerk's office in the county where the property is located.