Free Generic Direct Deposit PDF Form

Misconceptions

Here are ten misconceptions about the Generic Direct Deposit form, along with clarifications for each.

- Misconception 1: The form is only for new accounts.

- Misconception 2: Only one signature is required.

- Misconception 3: The routing number can be found anywhere on the check.

- Misconception 4: The account number can include spaces or special symbols.

- Misconception 5: You do not need to contact your bank.

- Misconception 6: The effective date is not important.

- Misconception 7: The form can be signed electronically.

- Misconception 8: Only payroll deposits can be set up using this form.

- Misconception 9: The form is only valid for one-time use.

- Misconception 10: You can use a deposit slip to verify your account information.

This form can also be used to change existing direct deposit information or to cancel a direct deposit arrangement.

If the account is a joint account or in someone else's name, that individual must also sign the form to authorize the direct deposit.

It is important to verify the routing number with the financial institution, as it may not always be in the same place on every check.

When filling out the form, the account number should be entered without spaces or special symbols, but with hyphens if applicable.

It is advisable to call your financial institution to confirm that they will accept direct deposits.

The effective date indicates when the direct deposit will start or when changes will take effect, making it a crucial part of the form.

Many institutions require a physical signature on the form, so check with the financial institution for their specific requirements.

This form can be used for various types of deposits, including expense reimbursements and other payments.

The form remains valid until the depositor cancels or changes the direct deposit arrangement.

It is recommended not to use a deposit slip for verification; instead, confirm the details directly with your financial institution.

What to Know About This Form

What is the Generic Direct Deposit form used for?

The Generic Direct Deposit form is used to authorize the automatic deposit of funds into your bank account. This can include payroll payments or reimbursements. By filling out this form, you are allowing your employer or organization to deposit money directly into your specified account, making the process quicker and more convenient.

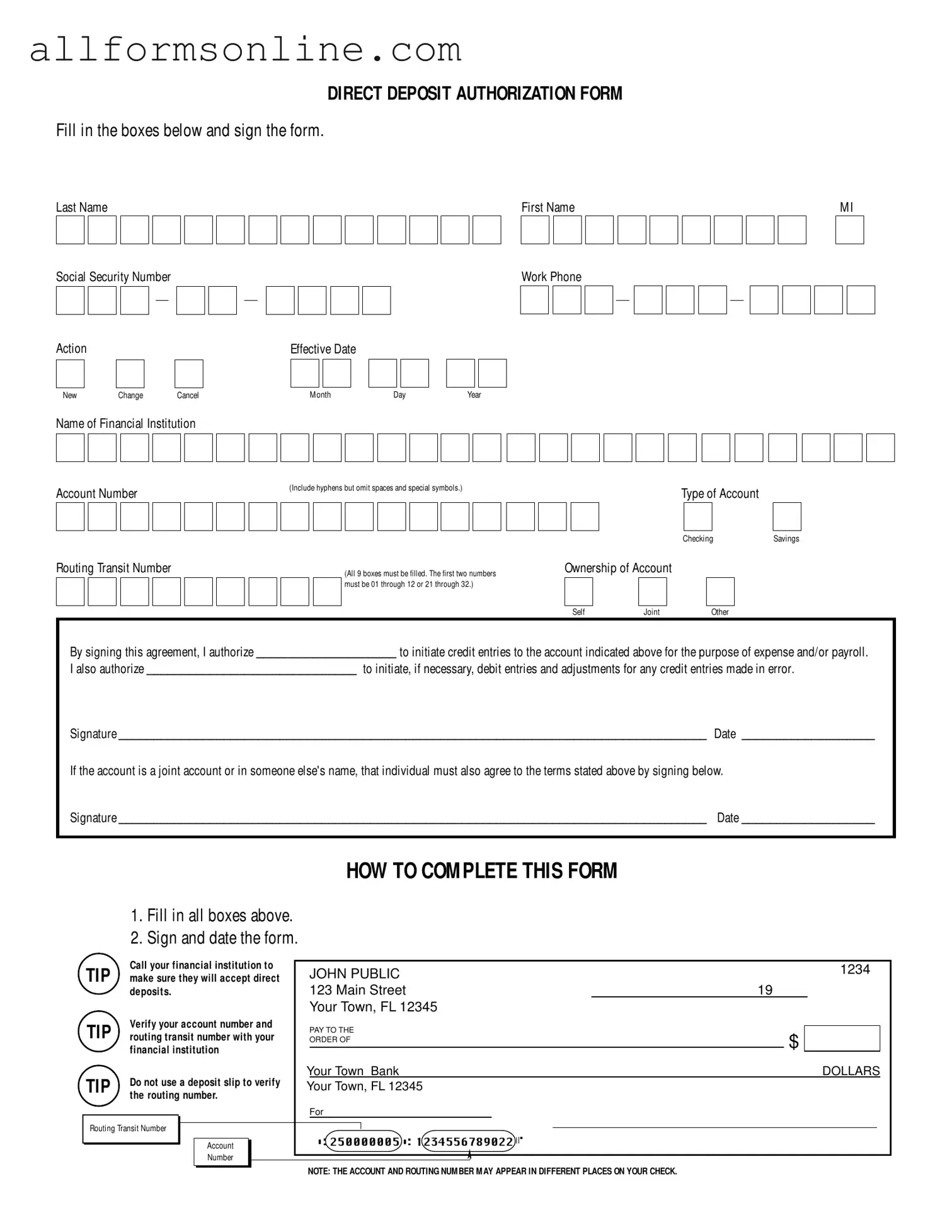

How do I complete the Generic Direct Deposit form?

To complete the form, fill in all the required boxes with accurate information. This includes your name, Social Security number, contact details, and banking information such as your account number and routing transit number. Make sure to sign and date the form at the bottom. After filling it out, it’s a good idea to double-check with your bank to ensure they accept direct deposits.

What should I do if I need to change my direct deposit information?

If you need to change your direct deposit information, you can use the same Generic Direct Deposit form. Simply select the "Change" option when prompted and fill in the new account details. Remember to sign and date the form again. Submit it to your employer or the relevant organization to ensure the updates take effect.

What if I have a joint account?

If you have a joint account, both account holders must agree to the terms of the direct deposit. The other account holder needs to sign the form as well. This ensures that both parties are aware and consent to the deposits being made into the joint account.

Can I use a deposit slip to verify my account information?

No, it is not recommended to use a deposit slip for verifying your routing transit number. Instead, contact your financial institution directly to confirm your account and routing numbers. This helps avoid any errors that could delay your direct deposit.

What should I do if I make a mistake on the form?

If you notice a mistake after you have filled out the form, it’s best to start over with a new form. Correctly fill in the information and sign it again. Submit the new form to replace the incorrect one. This ensures that your banking details are accurate and your direct deposit proceeds smoothly.

Different PDF Forms

Affidavit of Death of Joint Tenant California - Helps in property title adjustments following the death of a co-owner.

The process of obtaining an Emotional Support Animal Letter is crucial for individuals looking to enhance their well-being through the companionship of an animal. By securing this letter from a qualified mental health professional, one can access important accommodations that facilitate both housing and travel needs. To better understand how this process works and access template resources, you can visit Fast PDF Templates, which offers valuable information and tools for navigating the requirements associated with this supportive documentation.

State Disability California - Applicants are advised to keep a copy of the DE 2501 for their records.

How to Use Generic Direct Deposit

After completing the Generic Direct Deposit form, you will submit it to your employer or payroll department. They will process your request and set up the direct deposit for your salary or other payments. Make sure to double-check all information for accuracy before submission.

- Fill in your Last Name, First Name, and M I in the designated boxes.

- Enter your Social Security Number in the format of XXX-XX-XXXX.

- Select the Action by marking either New, Change, or Cancel.

- Provide the Effective Date using the format Month, Day, Year.

- Input your Work Phone number in the format XXX-XXX-XXXX.

- Write the Name of Financial Institution where you hold your account.

- Fill in your Account Number, including hyphens, while omitting spaces and special symbols.

- Choose the Type of Account by marking either Savings or Checking.

- Enter the Routing Transit Number, ensuring all 9 boxes are filled correctly.

- Indicate the Ownership of Account by selecting Self, Joint, or Other.

- Sign the form in the designated area and include the Date of signing.

- If applicable, have the other account holder sign below your signature and include their Date as well.

Remember to verify your account and routing numbers with your financial institution before finalizing the form. Avoid using a deposit slip for this verification.