Blank Gift Deed Form

Gift DeedDocuments for Particular States

Misconceptions

Understanding the Gift Deed form is essential for anyone considering making a gift of property. However, several misconceptions can lead to confusion. Here are four common misconceptions:

-

A Gift Deed is the same as a Will.

Many people believe that a Gift Deed operates like a Will, transferring property upon death. In reality, a Gift Deed transfers ownership during the donor's lifetime. Once executed, the recipient immediately holds the title to the property.

-

Gifts made through a Gift Deed are always tax-free.

While gifts can be exempt from certain taxes, this is not universally true. The IRS allows an annual exclusion amount, but gifts exceeding this limit may incur gift tax. It's crucial to understand the tax implications before proceeding.

-

A Gift Deed cannot be revoked.

Some individuals think that once a Gift Deed is signed, it cannot be undone. However, under certain circumstances, a donor may revoke the deed. The ability to revoke often depends on state laws and specific conditions outlined in the deed itself.

-

A Gift Deed requires no formalities.

While a Gift Deed may seem simple, it often requires specific formalities to be valid. Many states require the deed to be in writing, signed by the donor, and sometimes witnessed or notarized. Failing to adhere to these requirements can render the deed ineffective.

What to Know About This Form

What is a Gift Deed?

A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another person without any exchange of money. This type of deed is commonly used for real estate, personal property, and financial assets.

Who can create a Gift Deed?

Any person who has the legal capacity to transfer property can create a Gift Deed. This typically includes adults who are mentally competent. The donor, or the person giving the gift, must be the legal owner of the property being transferred.

What properties can be transferred using a Gift Deed?

Various types of properties can be transferred through a Gift Deed, including real estate, vehicles, bank accounts, and personal belongings. However, some restrictions may apply depending on state laws and the nature of the property.

Is a Gift Deed revocable?

In general, a Gift Deed is considered irrevocable once it has been executed and delivered. However, the donor may retain certain rights or conditions that could allow for revocation under specific circumstances. It is essential to consult legal advice for clarity on this matter.

Do I need witnesses for a Gift Deed?

Most states require that a Gift Deed be signed in the presence of one or more witnesses to ensure its validity. Additionally, notarization may also be necessary to provide an extra layer of legal protection and authenticity.

Are there tax implications for a Gift Deed?

Yes, there can be tax implications associated with gifting property. The donor may be subject to gift tax if the value of the gift exceeds a certain threshold set by the IRS. It is advisable to consult a tax professional to understand the specific implications related to your situation.

How do I execute a Gift Deed?

To execute a Gift Deed, the donor must complete the deed form, sign it, and have it witnessed and notarized if required. The deed should then be recorded with the appropriate government office, such as the county clerk or recorder, to provide public notice of the transfer.

Can a Gift Deed be contested?

Yes, a Gift Deed can be contested in court. Common grounds for contesting a Gift Deed include lack of capacity, undue influence, or fraud. If someone believes that the deed was not executed properly or that the donor was not of sound mind, they may challenge the validity of the deed.

What happens if the recipient of the gift dies before the deed is recorded?

If the recipient of a Gift Deed dies before the deed is recorded, the property may become part of their estate. The transfer may not be recognized until the deed is properly executed and recorded, which could complicate the distribution of assets according to the deceased's will or state laws.

Popular Gift Deed Types:

Does California Have a Transfer on Death Deed - This form can be an essential part of a comprehensive estate plan.

What Is Deed in Lieu of Foreclosure - Lenders may require a financial review before accepting a Deed in Lieu to ensure eligibility.

In addition to its importance in securing ownership transfer, the California Motorcycle Bill of Sale form can be easily obtained from resources like Fast PDF Templates, ensuring that both buyers and sellers have access to the tools necessary for a smooth transaction.

How to File a Lady Bird Deed in Michigan - The Lady Bird Deed is recognized in various states and provides a unique way to manage property titles effectively.

How to Use Gift Deed

After obtaining the Gift Deed form, you will need to provide specific information about the donor, the recipient, and the property being gifted. This process requires careful attention to detail to ensure that all necessary information is accurately captured.

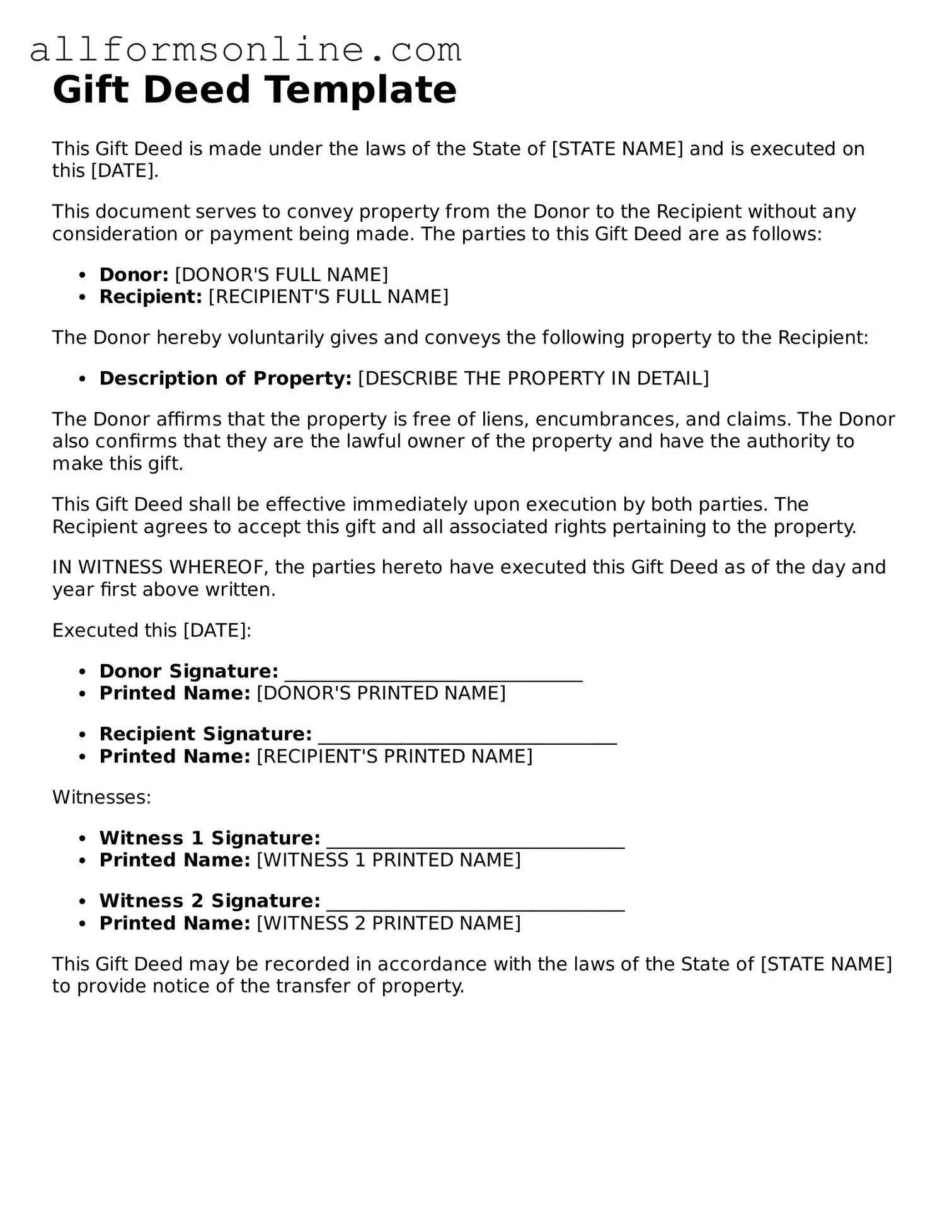

- Obtain the Gift Deed form. Ensure you have the correct version for your state, as requirements may vary.

- Fill in the donor's information. Include the full name, address, and contact details of the person giving the gift.

- Provide the recipient's details. Enter the full name, address, and contact information of the person receiving the gift.

- Describe the property. Clearly outline the property being gifted, including its address and any legal descriptions that apply.

- State the intent to gift. Include a statement indicating that the donor intends to give the property as a gift without expecting anything in return.

- Sign the form. The donor must sign the form in the designated area to validate the gift.

- Have the signature notarized. A notary public should witness the signing of the document to ensure its legality.

- Submit the form. Depending on your state’s requirements, file the completed Gift Deed form with the appropriate local government office, such as the county recorder's office.