Free Gift Letter PDF Form

Misconceptions

Understanding the Gift Letter form is essential for those involved in real estate transactions or financial assistance. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about the Gift Letter form, along with clarifications.

- Gift Letters are only for home purchases. Many believe that Gift Letters are exclusively used in real estate transactions. In reality, they can also be utilized for various financial gifts, including those for education or personal expenses.

- All lenders require a Gift Letter. While many lenders do ask for a Gift Letter to confirm the source of funds, not all institutions have this requirement. It's important to check with your specific lender.

- Gift Letters must be notarized. A common misconception is that Gift Letters need to be notarized. Most lenders do not require notarization; a simple signed letter is often sufficient.

- Gift Letters are only for cash gifts. Some people think Gift Letters can only document cash gifts. However, they can also be used for non-cash gifts, such as property or assets, as long as the value is clearly stated.

- Gift Letters need to be submitted before closing. It is often believed that Gift Letters must be submitted before the closing date. In many cases, they can be provided at any point during the loan process, but it's advisable to submit them as early as possible.

- There is a limit on the amount that can be gifted. Some assume there is a strict limit on the amount that can be gifted without tax implications. While there are IRS limits on gift tax exclusions, this does not affect the use of Gift Letters in transactions.

- Gift Letters must include the donor's financial information. Many think that detailed financial information about the donor must be included in the Gift Letter. Generally, it is sufficient to state the relationship and confirm that the gift does not need to be repaid.

- Gift Letters are only for family members. Some believe that only family members can provide gifts that require a Gift Letter. However, friends or other parties can also provide gifts, and a letter is still advisable for clarity.

- Using a Gift Letter is a sign of financial instability. There is a misconception that needing a Gift Letter indicates a lack of financial stability. In fact, many buyers use gifts from family or friends as a strategic financial decision, not necessarily due to instability.

Addressing these misconceptions can help individuals navigate the Gift Letter process more effectively. Understanding the requirements and implications can lead to smoother transactions and better financial planning.

What to Know About This Form

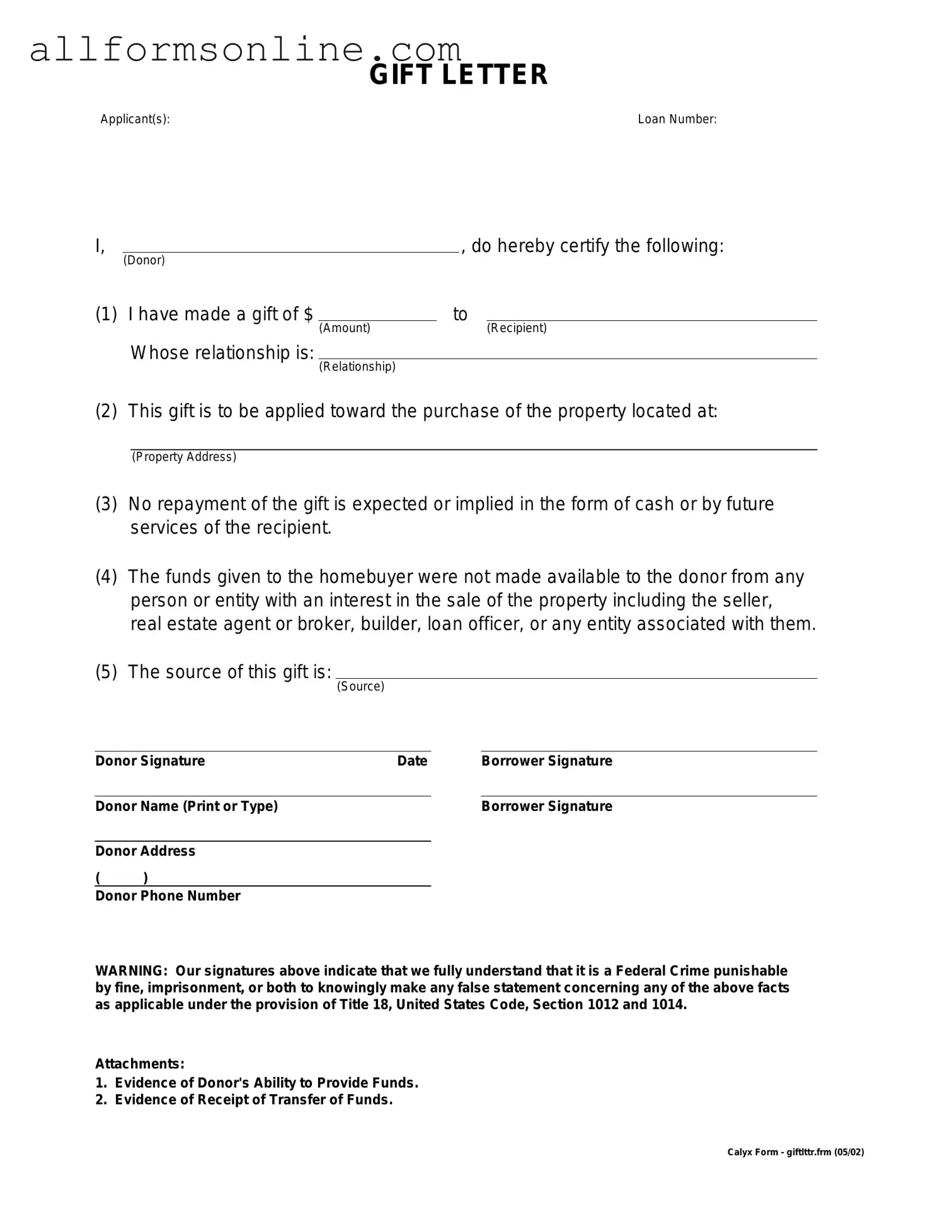

What is a Gift Letter form?

A Gift Letter form is a document used to confirm that a monetary gift has been given to an individual, often for the purpose of assisting with a down payment on a home. This form helps clarify that the funds are a gift and not a loan, which is important for lenders assessing a borrower’s financial situation.

Who typically needs a Gift Letter form?

Individuals who receive financial gifts to help with purchasing a home usually need this form. Lenders often require it to ensure that the funds do not create additional debt obligations. This includes first-time homebuyers receiving assistance from family members or friends.

What information is included in a Gift Letter form?

A typical Gift Letter form includes the donor's name, address, and relationship to the recipient. It also specifies the amount of the gift and states that the funds are a gift with no expectation of repayment. Additionally, the donor may need to sign the letter to validate the information provided.

How does a Gift Letter affect the mortgage application process?

Providing a Gift Letter can positively impact the mortgage application process. It assures lenders that the borrower is not taking on additional debt, which can improve the chances of loan approval. It also provides transparency about the source of funds, which is crucial for compliance with lending regulations.

Is there a limit on the amount that can be gifted?

While there is no specific limit on the amount that can be gifted for a home purchase, the IRS does impose annual gift tax exclusions. As of 2023, an individual can gift up to $17,000 per recipient without incurring gift tax. However, amounts exceeding this may require the donor to file a gift tax return.

Can a Gift Letter be used for other purposes besides home purchases?

Yes, a Gift Letter can be utilized for various purposes beyond home purchases. It can also be used for funding education, covering medical expenses, or any other financial support where clarity about the nature of the funds is necessary. However, its primary use remains in real estate transactions.

Different PDF Forms

Reg 256 Ca Dmv - Applicants must provide their full legal name and contact information.

When engaging in a transaction involving a motorcycle, utilizing a reliable form can simplify the process significantly. Our guide offers insights on the necessary elements of a motorcycle bill of sale, ensuring both parties are well-informed. For a detailed understanding, you can access our thorough motorcycle bill of sale form overview.

Clean Up Batter - Enhance organizational flow with this comprehensive sheet.

How to Use Gift Letter

Completing the Gift Letter form is an important step in the process of documenting a financial gift. This form helps clarify the nature of the gift and ensures that all parties involved have a clear understanding of the transaction. Follow these steps carefully to fill out the form accurately.

- Begin by entering the date at the top of the form. This should reflect the date you are completing the letter.

- In the first section, provide the name and address of the donor, the person giving the gift. Ensure that all details are accurate.

- Next, fill in the recipient's information. This is the person receiving the gift. Include their name and address.

- Clearly state the amount of the gift in the designated space. Be specific and accurate to avoid any misunderstandings.

- In the following section, describe the relationship between the donor and the recipient. This could be familial or another type of relationship.

- Sign and date the form at the bottom. The donor’s signature is crucial for validation.

- If required, provide any additional documentation or identification that may be necessary to accompany the form.

Once you have completed the Gift Letter form, review it for accuracy. Make sure all information is clear and legible. This step is essential to ensure that the gift is properly documented and understood by all parties involved.