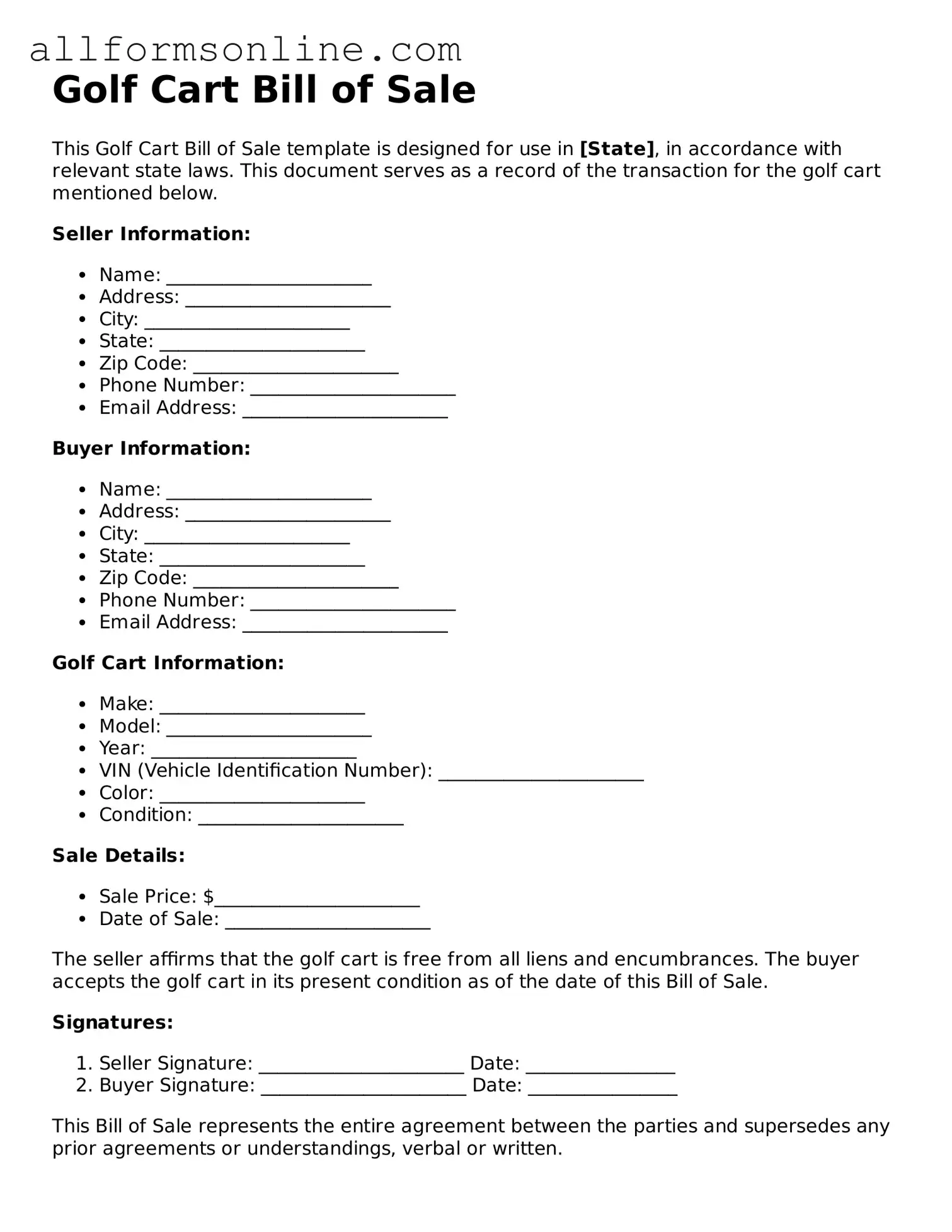

Blank Golf Cart Bill of Sale Form

Misconceptions

Misconceptions about the Golf Cart Bill of Sale form can lead to confusion for buyers and sellers alike. Understanding the facts can help ensure a smooth transaction. Here are five common misconceptions:

- 1. A Golf Cart Bill of Sale is Not Necessary. Many people believe that a bill of sale is optional when buying or selling a golf cart. However, having a written document protects both parties and serves as proof of the transaction.

- 2. The Bill of Sale is Only for New Golf Carts. Some individuals think that only new golf carts require a bill of sale. In reality, whether new or used, a bill of sale is important for any transfer of ownership.

- 3. A Verbal Agreement is Sufficient. Relying on a verbal agreement can lead to misunderstandings. A written bill of sale provides clarity on the terms of the sale, making it easier to resolve disputes if they arise.

- 4. The Bill of Sale Must be Notarized. While notarization can add an extra layer of security, it is not a requirement for a golf cart bill of sale in most states. A simple signed document is often sufficient.

- 5. The Bill of Sale is Only for Legal Purposes. Some believe that a bill of sale is only necessary for legal reasons. In fact, it also serves practical purposes, such as tracking ownership and providing proof of purchase for insurance purposes.

What to Know About This Form

What is a Golf Cart Bill of Sale?

A Golf Cart Bill of Sale is a legal document that records the transfer of ownership of a golf cart from one party to another. This form serves as proof of the transaction, detailing important information about the buyer, the seller, and the golf cart itself. It can help protect both parties in case of future disputes regarding ownership or the condition of the cart.

Why do I need a Golf Cart Bill of Sale?

Having a Golf Cart Bill of Sale is essential for several reasons. Firstly, it provides clear evidence of the sale, which can be crucial if any disagreements arise later. Secondly, it may be required by your local DMV or other regulatory body if you plan to register the golf cart. Lastly, it helps to document the sale price, which can be useful for tax purposes or insurance claims.

What information should be included in the Golf Cart Bill of Sale?

Key details that should be included are the names and addresses of both the buyer and the seller, the date of the sale, a description of the golf cart (including make, model, year, and Vehicle Identification Number or VIN), the sale price, and any terms or conditions agreed upon. It’s also wise to include a statement confirming that the seller has the right to sell the cart and that it is free of liens.

Is a Golf Cart Bill of Sale required by law?

While not every state mandates a Bill of Sale for golf carts, having one is highly recommended. Some states do require documentation for registration purposes, while others may not. It’s always best to check your local laws to ensure compliance and to protect your interests.

Can I create my own Golf Cart Bill of Sale?

Yes, you can create your own Golf Cart Bill of Sale. However, it’s important to ensure that it includes all necessary information and complies with your state’s requirements. Many templates are available online that can serve as a helpful starting point. Just remember to tailor it to your specific transaction.

Do I need a notary for the Golf Cart Bill of Sale?

In most cases, a notary is not required for a Golf Cart Bill of Sale. However, having it notarized can add an extra layer of security and authenticity to the document. If either party feels more comfortable with a notarized document, it can be a good idea to seek this service.

What if the golf cart has existing liens?

If the golf cart has existing liens, the seller must disclose this information to the buyer. A lien means that the cart is used as collateral for a loan, and the lender has a legal claim to it until the debt is paid. It’s crucial for the buyer to be aware of any liens before completing the sale, as they could affect ownership rights.

What should I do after completing the Golf Cart Bill of Sale?

After completing the Golf Cart Bill of Sale, both parties should keep a signed copy for their records. If applicable, the buyer may need to take the document to their local DMV or regulatory authority to register the golf cart in their name. Additionally, it’s wise to check with your insurance provider to ensure the golf cart is properly covered under your policy.

Can I use the Golf Cart Bill of Sale for other types of vehicles?

While a Golf Cart Bill of Sale is specifically designed for golf carts, many of the principles can apply to other types of vehicles. However, it’s important to use the appropriate form for the specific vehicle type to ensure all necessary information is captured and complies with local regulations.

Popular Golf Cart Bill of Sale Types:

Printable Equipment Bill of Sale - This document can help prevent future disputes by accurately recording the conditions of the sale.

Faa Aircraft Bill of Sale - The form requires a description of the aircraft’s condition at the time of sale.

Obtaining a Doctors Excuse Note is essential for those who need to substantiate their absence due to health issues, and resources like Fast PDF Templates can provide valuable templates to assist with this process. By utilizing an appropriate format, individuals can effectively communicate their medical situation to employers or schools, ensuring compliance with necessary protocols.

Free Printable Purchase Agreement for Mobile Home - Facilitates a smooth transaction when buying or selling.

How to Use Golf Cart Bill of Sale

Once you have the Golf Cart Bill of Sale form ready, you'll need to provide specific information to complete it accurately. Follow these steps carefully to ensure that all necessary details are included.

- Begin by entering the date of the sale at the top of the form.

- Next, fill in the seller's name and address. This identifies who is selling the golf cart.

- Provide the buyer's name and address. This ensures that the buyer is clearly identified.

- Describe the golf cart. Include details such as the make, model, year, color, and Vehicle Identification Number (VIN).

- Indicate the sale price of the golf cart. This should be the total amount agreed upon by both parties.

- Include any terms of the sale, such as whether the sale is "as-is" or if there are any warranties.

- Both the seller and buyer should sign and date the form to validate the transaction.

After completing the form, make copies for both the buyer and seller. This ensures that both parties have a record of the transaction. Store the original in a safe place for future reference.