Free Goodwill donation receipt PDF Form

Misconceptions

- Misconception 1: A Goodwill donation receipt is only for tax deductions.

- Misconception 2: You must donate a large amount to receive a receipt.

- Misconception 3: The receipt automatically determines the value of donated items.

- Misconception 4: You can only get a receipt at the time of donation.

- Misconception 5: All donations are tax-deductible.

Many people believe that the only purpose of the receipt is to claim tax deductions. While it is true that you can use it for tax purposes, the receipt also serves as proof of your charitable contribution. This can be important for personal records and for understanding your giving habits.

Some think that only significant donations warrant a receipt. In reality, Goodwill provides receipts for any donation, regardless of size. Every contribution counts and is appreciated, whether it's a few items or a whole truckload.

Many assume that the receipt includes a predetermined value for their donations. However, the receipt does not assign a value. It is the donor's responsibility to determine the fair market value of the items donated for tax purposes.

Some people believe that receipts are only available immediately when donating. Goodwill allows donors to request a receipt later if they forgot to ask at the time of donation. Keeping a record of your donations is always encouraged.

Not everyone realizes that not all donations qualify for tax deductions. While most donations to Goodwill are tax-deductible, certain conditions apply. It is wise to consult a tax professional to understand what qualifies.

What to Know About This Form

What is a Goodwill donation receipt form?

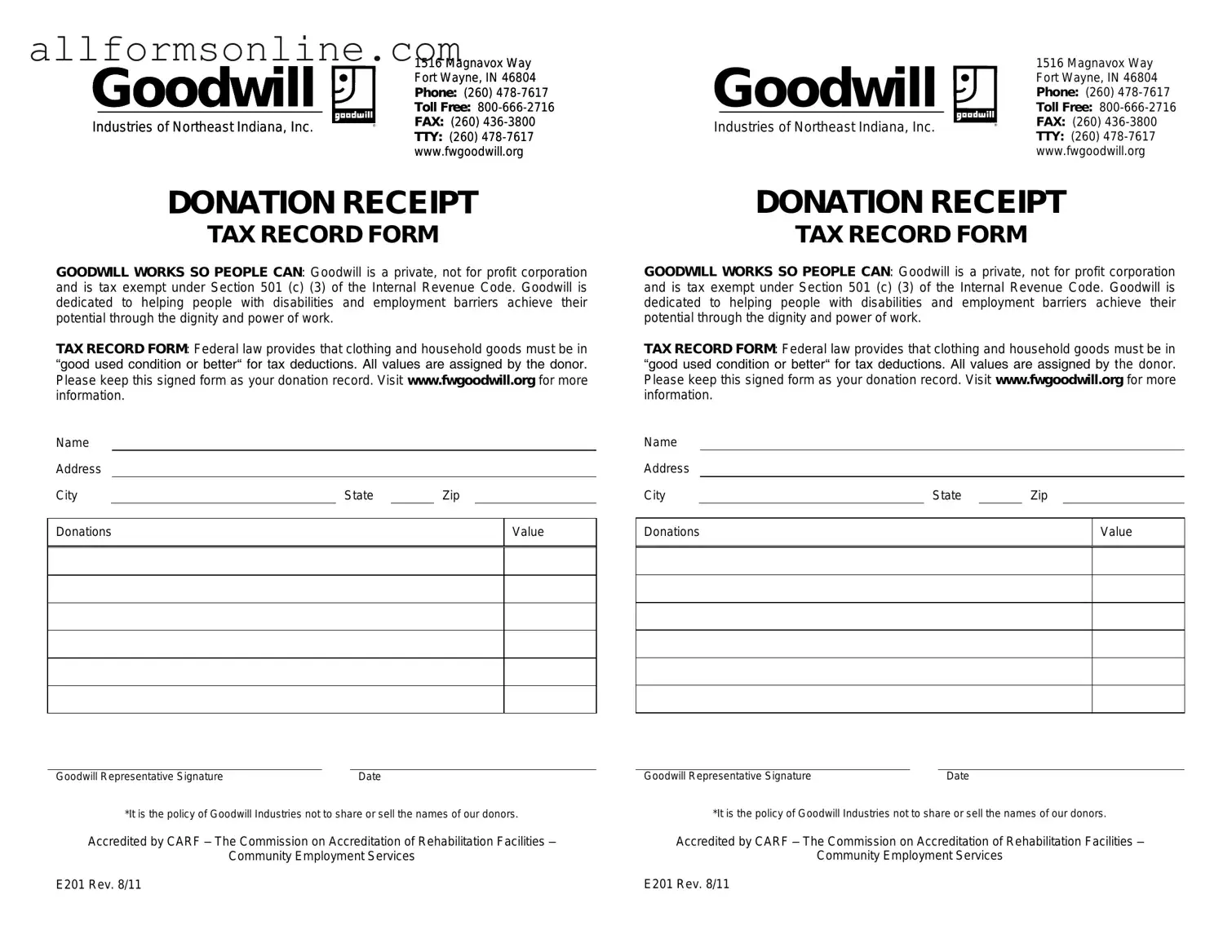

A Goodwill donation receipt form is a document provided by Goodwill Industries to donors who contribute items to their stores or programs. This form serves as proof of your donation, which can be useful for tax purposes. It typically includes details such as the date of the donation, a description of the items donated, and the donor's name and address.

How do I obtain a Goodwill donation receipt?

To obtain a Goodwill donation receipt, simply ask for one at the time of your donation. When you drop off your items, a staff member will usually provide you with a receipt immediately. If you forget to ask, you can still request a receipt by contacting the specific Goodwill location where you made your donation.

Can I claim my Goodwill donations on my taxes?

Yes, you can claim your Goodwill donations on your taxes, provided you have the necessary documentation. The donation receipt acts as proof of your contribution. Make sure to keep it with your tax records. The IRS allows you to deduct the fair market value of the items you donated, so it's important to assess the value of your items accurately.

What information should I include on the receipt?

The receipt should include your name, the date of the donation, a description of the items, and the estimated value of those items. While Goodwill does not assign a specific value, it is your responsibility to determine the fair market value based on the condition and type of items donated.

What if I lose my donation receipt?

If you lose your Goodwill donation receipt, you can contact the Goodwill location where you made the donation. They may be able to provide a duplicate receipt or help you reconstruct the details of your donation. However, keep in mind that it’s always best to keep a copy of your receipts in a safe place for future reference.

Are there limits on how much I can deduct for my donations?

Yes, there are limits on how much you can deduct for charitable donations, including those made to Goodwill. Generally, you can deduct contributions up to 60% of your adjusted gross income, but this can vary based on the type of donation and your tax situation. It’s advisable to consult with a tax professional to understand the specific limits that apply to your situation.

Different PDF Forms

Navpers 1336 3 - Documenting your travel plans helps to facilitate smoother processing of your request.

When engaging in a trailer sale, it's crucial to utilize the appropriate documentation to prevent misunderstandings. The California Trailer Bill of Sale form, which you can find through Fast PDF Templates, serves as an official record that facilitates the transfer of ownership and outlines vital details about the buyer, seller, and the trailer, ensuring a legally compliant transaction.

Ncoer Order of Signatures - The form allows for multiple rater comments, providing a rounded view of the NCO's performance.

How to Use Goodwill donation receipt

After gathering your items for donation, you’ll need to complete the Goodwill donation receipt form. This form serves as a record of your donation and can be useful for tax purposes. Follow these steps to ensure that you fill it out correctly.

- Begin by writing the date of your donation at the top of the form.

- Next, enter your name in the designated field. Make sure to provide your full name as it appears on official documents.

- Fill in your address, including street, city, state, and zip code. This information helps Goodwill verify your identity if needed.

- In the section labeled "Items Donated," list each item you are donating. Be specific about the condition of each item, whether it's new, gently used, or in need of repair.

- Next, estimate the fair market value of each item. This is the price you believe someone would pay for it in its current condition.

- After listing all items, review the total number of items donated. Write this number in the appropriate box.

- Finally, sign and date the form at the bottom to confirm your donation.

Once you have completed the form, keep a copy for your records. This will be helpful when filing your taxes or if you need to reference your donation in the future.