Free Independent Contractor Pay Stub PDF Form

Misconceptions

When it comes to the Independent Contractor Pay Stub form, there are several misconceptions that can lead to confusion. Understanding the facts can help both contractors and businesses navigate their financial responsibilities more effectively.

- Misconception 1: Independent contractors do not need a pay stub.

- Misconception 2: Pay stubs are only for salaried workers.

- Misconception 3: Independent contractors don't have to report their income.

- Misconception 4: Pay stubs must include tax withholdings.

- Misconception 5: Independent contractors are not entitled to any benefits.

- Misconception 6: A pay stub is the same as an invoice.

- Misconception 7: All states have the same rules regarding pay stubs.

- Misconception 8: Pay stubs are not necessary for record-keeping.

Many believe that pay stubs are only for employees. However, independent contractors can benefit from having a pay stub to track earnings and expenses.

This is not true. Pay stubs can be useful for anyone receiving payment for services, including hourly workers and freelancers.

All income must be reported to the IRS, regardless of whether it comes from a traditional job or independent contracting. Failing to report can lead to penalties.

Unlike employees, independent contractors typically receive their full payment without taxes withheld. However, they should keep track of their earnings for tax purposes.

While it's true that contractors don’t receive traditional employee benefits, they can negotiate their own terms, including higher pay to offset the lack of benefits.

Although both documents relate to payment, a pay stub details earnings and deductions, while an invoice is a request for payment for services rendered.

Regulations can vary significantly from one state to another. It's important for contractors to understand the laws in their specific state.

Keeping accurate records, including pay stubs, is crucial for independent contractors. They provide a clear picture of income, which is essential for budgeting and tax preparation.

What to Know About This Form

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for independent contractors. Unlike traditional employees, independent contractors are not subject to the same tax withholding rules. This pay stub provides a clear record of payments made for services rendered, helping contractors track their income for tax purposes.

Why do independent contractors need a pay stub?

Independent contractors need a pay stub to maintain accurate financial records. It serves as proof of income, which can be crucial when applying for loans or mortgages. Additionally, having a detailed pay stub can help contractors keep track of their earnings and expenses, making tax preparation easier and more organized.

What information is typically included on a pay stub?

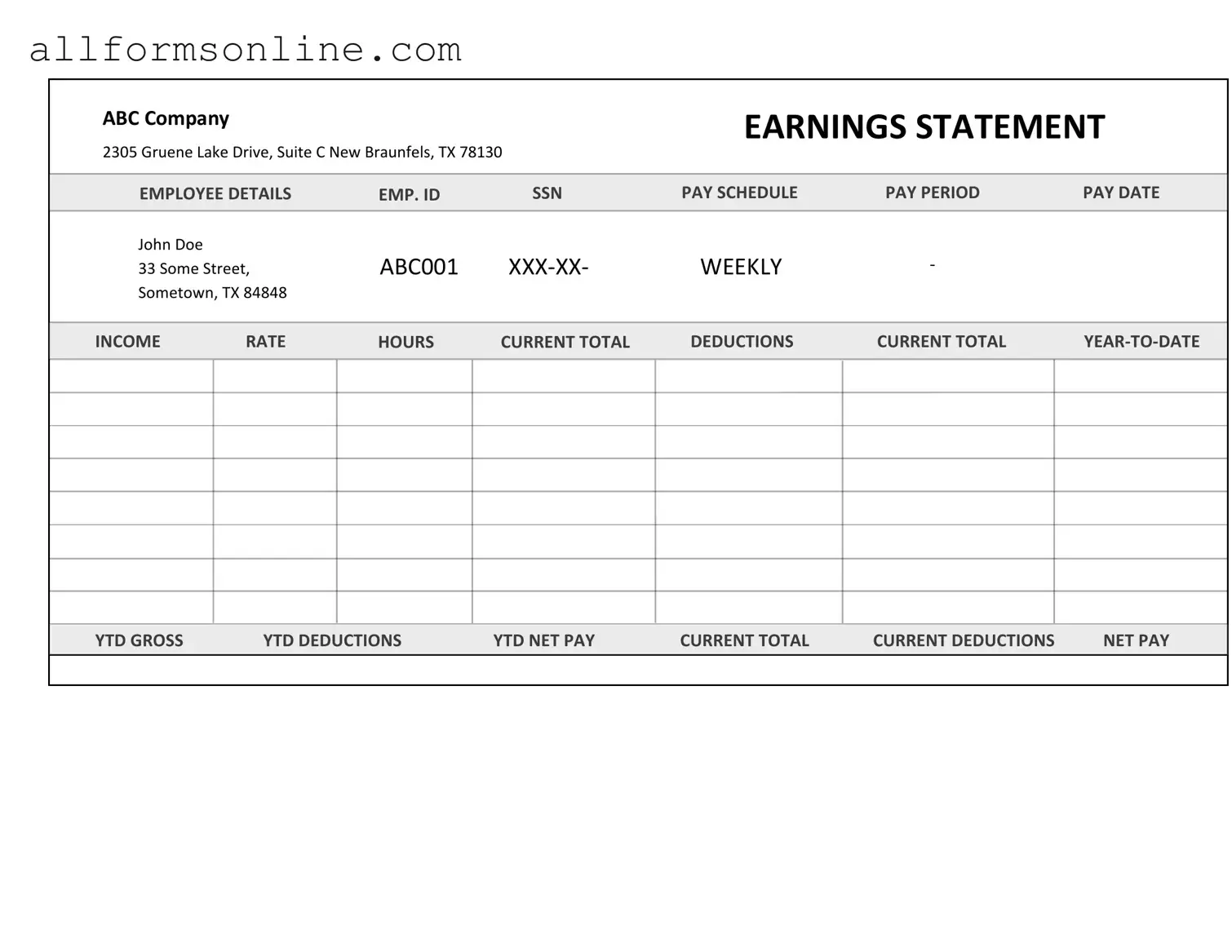

A standard Independent Contractor Pay Stub includes the contractor's name, address, and tax identification number. It also lists the payment period, total earnings, any deductions, and the net amount paid. Some pay stubs may also include the client's information and a brief description of the services provided.

How can I create an Independent Contractor Pay Stub?

Creating a pay stub is straightforward. You can use online templates or software designed for this purpose. Input your personal information, the payment details, and any deductions. Ensure that all information is accurate to avoid confusion during tax season. If you're unsure, consulting with a financial professional can provide additional guidance.

Are there legal requirements for providing a pay stub?

While there are no federal laws requiring independent contractors to receive a pay stub, it is considered a best practice. Some states may have specific regulations regarding payment documentation. It’s important to check local laws to ensure compliance and maintain transparency with clients.

What should I do if I notice an error on my pay stub?

If you find an error on your pay stub, address it promptly. Contact the client or company that issued the pay stub to discuss the mistake. Provide any necessary documentation to support your claim. It's crucial to resolve these issues quickly, as they can impact your tax filings and overall financial records.

Different PDF Forms

Dekalb County Water Application - Completing this application helps expedite your water service request.

Bpo Template - Provides a total estimation of necessary repairs for decision-making.

To ensure a successful transaction, it’s important to be aware of the necessary documentation. This includes understanding the steps involved in completing the essential Motorcycle Bill of Sale form effectively, which acts as a crucial proof of ownership transfer between the involved parties. For further information, you can refer to the guidelines for the Motorcycle Bill of Sale process.

Honoring Choices Health Care Directive - Your agent is responsible for making decisions aligned with your wishes.

How to Use Independent Contractor Pay Stub

Once you have the Independent Contractor Pay Stub form in front of you, it's time to fill it out accurately. Completing this form is essential for documenting payments made to independent contractors. Ensure you have all necessary information ready before you begin.

- Start by entering the contractor's name in the designated field at the top of the form.

- Next, provide the contractor's address, including street, city, state, and ZIP code.

- Fill in the date of payment in the appropriate section.

- Indicate the payment period covered by this pay stub. This usually includes the start and end dates of the work performed.

- Enter the total amount paid to the contractor for the specified period.

- If applicable, list any deductions taken from the payment, such as taxes or fees.

- Finally, sign and date the form to confirm the payment details are accurate.

After completing the form, ensure that it is distributed to the contractor and kept for your records. This documentation is vital for both parties involved.