Free Intent To Lien Florida PDF Form

Misconceptions

Misconceptions about the Intent to Lien Florida form can lead to confusion and potential legal issues. Here are six common misunderstandings:

- It is a lien itself. Many people think that sending the Intent to Lien form automatically creates a lien on the property. In reality, it is merely a notice that a lien may be filed if payment is not received.

- It can be sent at any time. Some believe they can send this notice whenever they choose. However, Florida law requires that it be sent at least 45 days before filing a lien.

- It guarantees payment. A common misconception is that sending this notice guarantees that payment will be made. While it serves as a warning, it does not ensure that the property owner will pay.

- It is only for contractors. Some people think that only contractors can use this form. In fact, anyone who has provided labor or materials for a property improvement can issue an Intent to Lien.

- It must be notarized. There is a belief that the Intent to Lien form must be notarized to be valid. However, notarization is not a requirement for this particular notice.

- Ignoring it will resolve the issue. Some property owners think that if they ignore the notice, the problem will go away. Unfortunately, failing to respond can lead to the filing of a lien, which can result in serious financial consequences.

Understanding these misconceptions can help both property owners and service providers navigate the process more effectively.

What to Know About This Form

What is the purpose of the Intent To Lien Florida form?

The Intent To Lien form serves as a formal notification to property owners that a contractor, subcontractor, or supplier intends to file a lien against their property due to non-payment for services or materials provided. This notice is a crucial step in the lien process, allowing property owners to address payment issues before a lien is officially recorded.

Who needs to receive the Intent To Lien notice?

The notice must be sent to the property owner and, if applicable, the general contractor involved in the project. It should include their full legal names and mailing addresses. This ensures that all parties involved are informed about the potential lien and can take appropriate action to resolve the payment dispute.

What are the timeframes associated with the Intent To Lien?

The Intent To Lien notice must be served at least 45 days before the actual lien is recorded. After receiving the notice, the property owner has 30 days to respond or make payment. If no satisfactory response is received within this timeframe, the lien may be recorded against the property.

What could happen if the lien is recorded?

If the lien is recorded, the property could face foreclosure proceedings. Additionally, the property owner may be responsible for attorney fees, court costs, and other related expenses. This underscores the importance of addressing the payment issue promptly to avoid further legal complications.

How can a property owner resolve the issue before a lien is filed?

To avoid the filing of a lien, property owners should respond to the Intent To Lien notice as soon as possible. They can contact the sender to discuss payment arrangements or any disputes regarding the charges. Open communication can often resolve the issue before it escalates to a lien or legal action.

Different PDF Forms

How Do You Set Up Direct Deposit - Make payday stress-free by opting for Citibank's direct deposit.

It is essential for every Responsible Master Plumber in Texas to be aware of the requirements surrounding the Texas Certificate of Insurance, as this document not only affirms compliance with state regulations but also provides peace of mind. To facilitate this process, you can visit texasformspdf.com/fillable-texas-certificate-insurance-online and fill out your certificate efficiently, ensuring you are fully prepared to undertake your plumbing projects responsibly.

4 Point Inspection Florida Cost - Every section must be completed accurately to ensure the form is valid and acceptable for review.

Terminating Parental Rights in Sc - Affiants must indicate whether they have a court obligation for child support.

How to Use Intent To Lien Florida

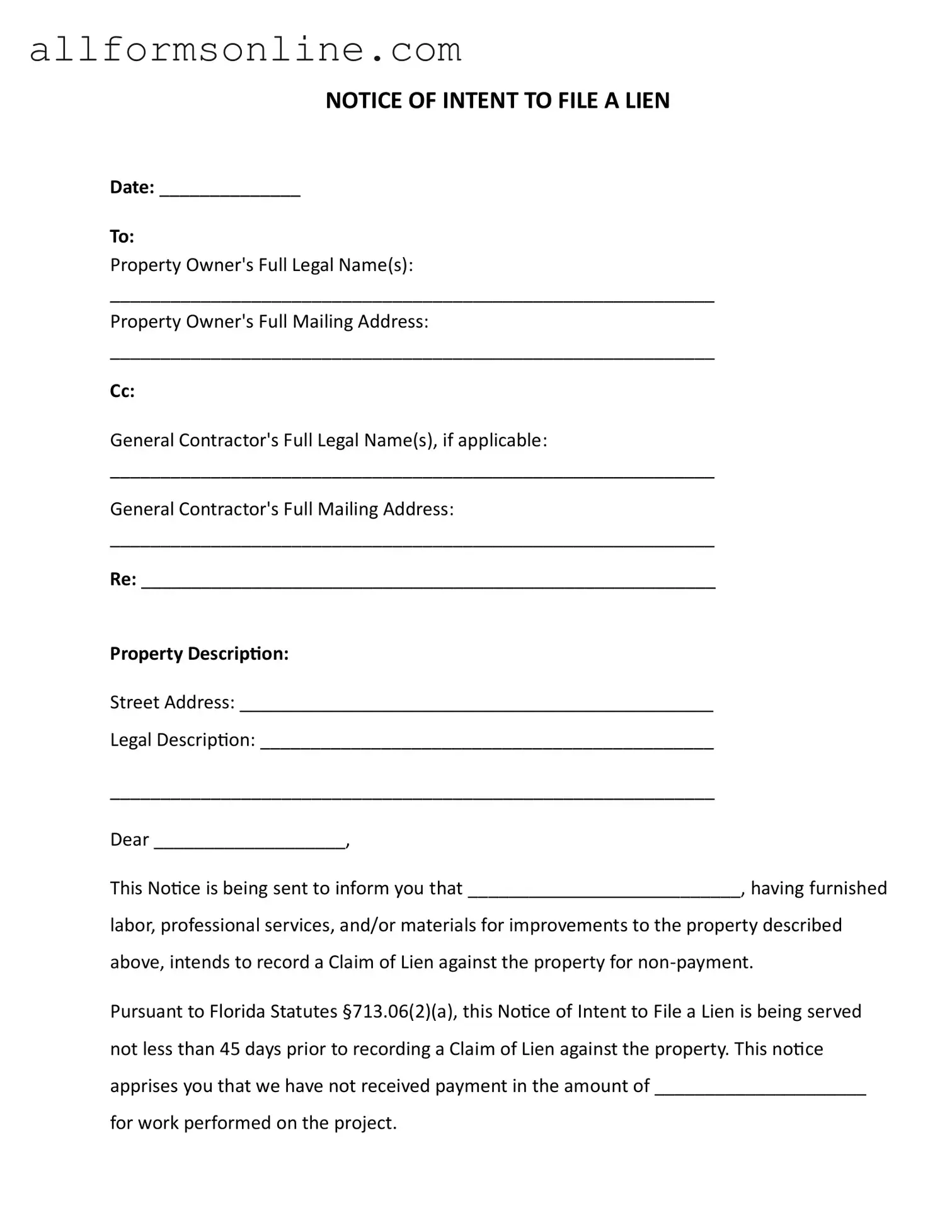

After completing the Intent to Lien form, the next step involves ensuring that it is served correctly to the property owner and, if applicable, the general contractor. Proper service is crucial to maintain compliance with Florida statutes and to protect your rights regarding the lien.

- Date: Fill in the date when you are completing the form.

- Property Owner's Name: Enter the full legal name(s) of the property owner(s).

- Property Owner's Mailing Address: Provide the full mailing address for the property owner(s).

- General Contractor's Name: If applicable, include the full legal name(s) of the general contractor.

- General Contractor's Mailing Address: Fill in the full mailing address for the general contractor.

- Property Description: Specify the street address of the property.

- Legal Description: Include the legal description of the property.

- Notice Content: State your name and the nature of the work performed. Clearly mention the amount owed for the work.

- Signature: Sign the form and include your printed name, title, phone number, and email address.

- Certificate of Service: Complete this section by filling in the date of service and the name and address of the person served.

- Service Method: Check the appropriate box to indicate how the notice was served (e.g., Certified Mail, Hand Delivery).

- Signature: The person serving the notice should sign and print their name.