Blank Investment Letter of Intent Form

Misconceptions

Understanding the Investment Letter of Intent (LOI) is crucial for anyone considering an investment opportunity. However, several misconceptions can cloud judgment and lead to confusion. Here are nine common misconceptions about the Investment Letter of Intent form:

- It is a legally binding contract. Many believe that signing an LOI means they are entering into a legally binding agreement. In reality, an LOI typically outlines the terms of a proposed investment but is generally non-binding unless explicitly stated otherwise.

- All LOIs are the same. Each Investment LOI can vary significantly based on the specifics of the investment and the parties involved. Customization is often necessary to reflect the unique terms of the deal.

- It guarantees the investment. Signing an LOI does not guarantee that the investment will proceed. It merely indicates an intention to negotiate further and explore the possibility of an investment.

- Only large investors need an LOI. Smaller investors can also benefit from an LOI. It helps clarify intentions and expectations, regardless of the investment size.

- An LOI is only for equity investments. While LOIs are commonly associated with equity investments, they can also apply to debt financing and other types of financial arrangements.

- Once signed, it cannot be changed. An LOI can be amended or revised as negotiations progress. Flexibility is often a key aspect of the investment process.

- It replaces due diligence. An LOI does not eliminate the need for due diligence. Investors should still conduct thorough research and analysis before finalizing any investment.

- Only lawyers can draft an LOI. While legal expertise can be beneficial, many investors draft their own LOIs. Clear communication of intentions is what matters most.

- LOIs are only used in large deals. Investment LOIs can be used in transactions of any size. They serve as a useful tool for establishing terms and expectations in various investment scenarios.

Being aware of these misconceptions can empower investors to approach the Investment Letter of Intent with clarity and confidence. Understanding its purpose and limitations is key to making informed decisions.

What to Know About This Form

What is an Investment Letter of Intent?

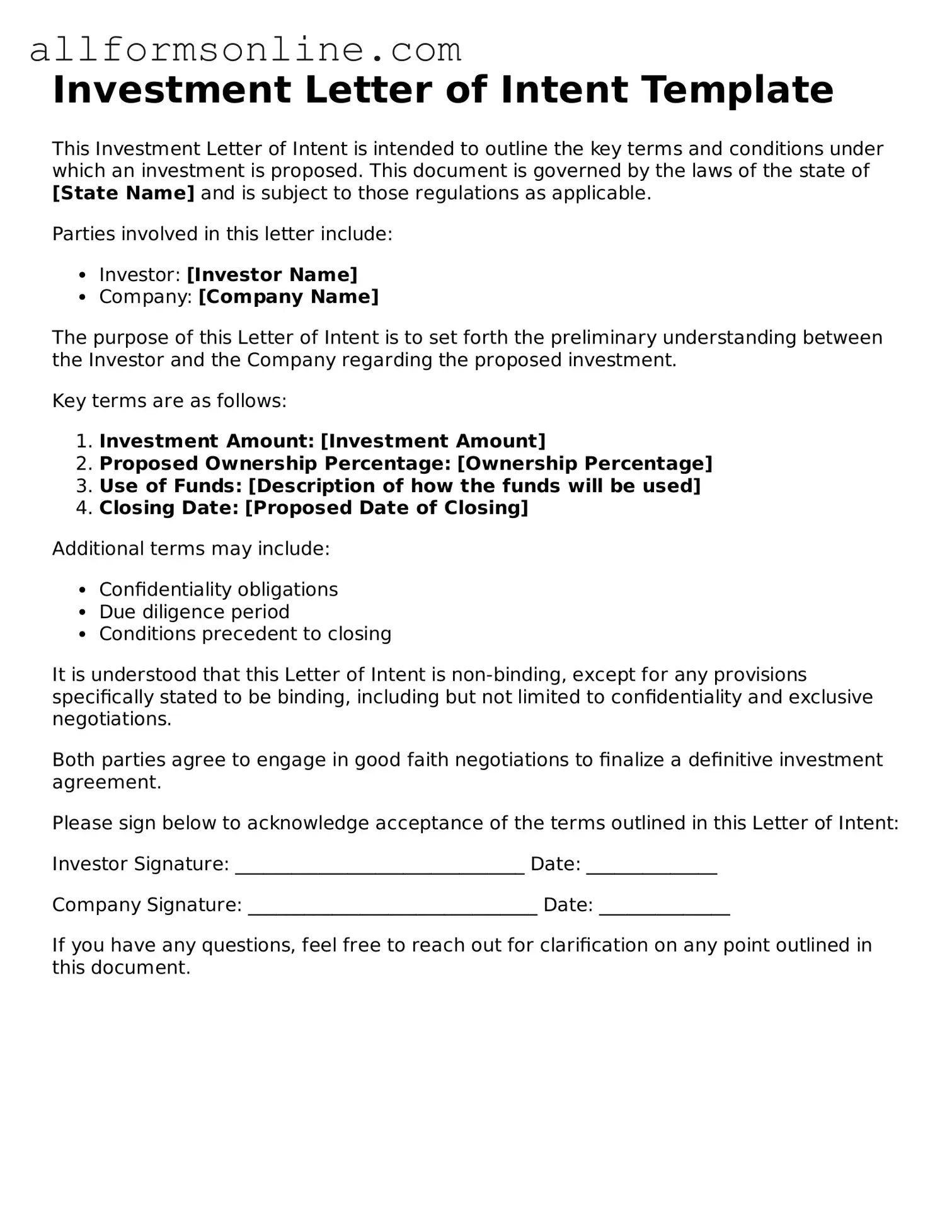

An Investment Letter of Intent (LOI) is a preliminary document that outlines the terms and conditions under which an investor intends to make an investment in a business or project. It serves as a formal expression of interest, paving the way for further negotiations and the drafting of a more detailed agreement. While it is not legally binding, it sets the stage for the investment process.

Why is an Investment Letter of Intent important?

This document is crucial because it clarifies the intentions of both parties involved. By detailing the proposed investment amount, timeline, and other essential terms, it helps prevent misunderstandings later on. It also demonstrates the investor's commitment, which can be beneficial for the business seeking funding.

What should be included in an Investment Letter of Intent?

An effective Investment Letter of Intent typically includes several key components: the names of the parties involved, the amount of the proposed investment, the purpose of the investment, any conditions that must be met before the investment is finalized, and a timeline for the transaction. Additionally, it may outline confidentiality agreements and exclusivity terms, ensuring that both parties are protected during negotiations.

Is an Investment Letter of Intent legally binding?

Generally, an Investment Letter of Intent is not legally binding. It is meant to express intent rather than create enforceable obligations. However, certain sections, such as confidentiality agreements or exclusivity clauses, may carry legal weight. It’s important to specify which parts of the LOI are binding and which are not to avoid confusion.

How does an Investment Letter of Intent affect negotiations?

The LOI serves as a foundation for negotiations. It provides a clear starting point, allowing both parties to discuss specific terms and conditions in detail. By establishing mutual understanding upfront, it can streamline the negotiation process and help avoid potential disputes down the line.

Can an Investment Letter of Intent be modified?

Yes, an Investment Letter of Intent can be modified. As negotiations progress, either party may request changes to the terms outlined in the LOI. It’s important to document any modifications in writing to ensure that both parties are on the same page. Clear communication during this phase can lead to a smoother final agreement.

Popular Investment Letter of Intent Types:

Letter of Intent to Homeschool - Some states may require additional information regarding educational materials or curricula in this form.

Letter of Intent for Lease - This document can detail penalties for breach of terms prior to the formal lease signing.

How to Use Investment Letter of Intent

Completing the Investment Letter of Intent form is an important step in the investment process. This form serves as a preliminary agreement outlining the intentions of the parties involved. After filling out the form, you will typically submit it to the relevant parties for review and further action.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your current address, including city, state, and zip code.

- Next, indicate your email address and phone number for contact purposes.

- In the investment details section, specify the amount you intend to invest.

- Identify the type of investment you are interested in, such as equity or debt.

- Include any relevant information about the investment opportunity, such as the name of the company or project.

- Review the terms and conditions outlined in the form carefully.

- Sign and date the form to confirm your agreement and understanding of the contents.

- Finally, submit the completed form to the designated recipient as instructed.