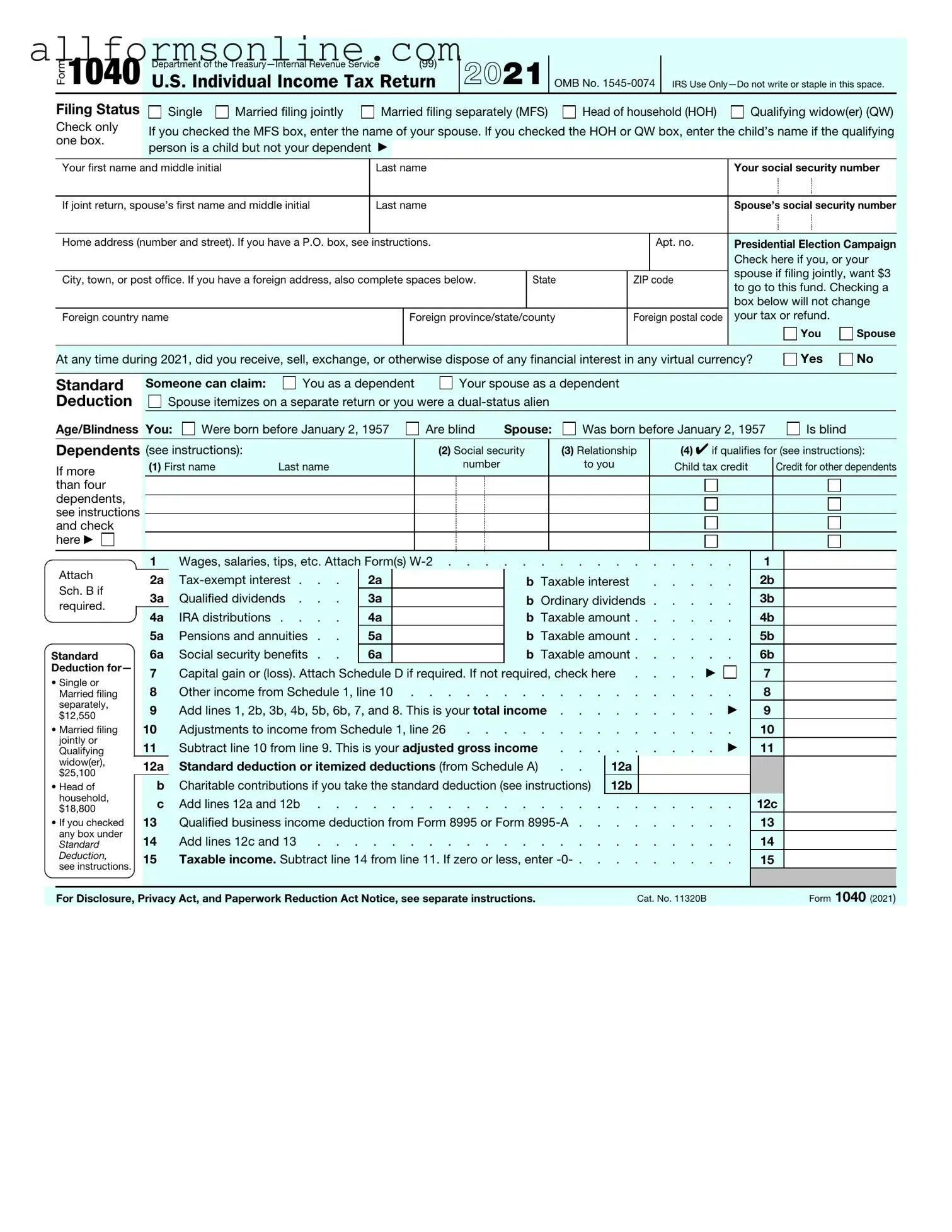

Free IRS 1040 PDF Form

Misconceptions

-

Misconception 1: Everyone has to file a 1040 form.

Not everyone is required to file a 1040 form. Your obligation to file depends on various factors, including your income level, filing status, and age. For instance, if you earn below a certain threshold, you may not need to file at all. It's crucial to check the current IRS guidelines to determine your specific filing requirements.

-

Misconception 2: You can only file a 1040 form by mail.

While mailing your 1040 form is an option, it's not the only way to file. Many people choose to file electronically through various online platforms. E-filing can be faster and may even expedite your refund. Be aware of the different methods available to ensure you choose the one that best suits your needs.

-

Misconception 3: The 1040 form is only for individual taxpayers.

This form is often associated with individual taxpayers, but it can also be used by certain types of entities, such as sole proprietorships. Understanding the various uses of the 1040 form can help you determine if it is appropriate for your specific situation.

-

Misconception 4: Filing a 1040 form guarantees a refund.

Filing the 1040 form does not automatically mean you will receive a tax refund. Your refund depends on several factors, including your total income, tax deductions, and credits. It’s essential to accurately calculate your tax liability to understand whether you will owe money or receive a refund.

What to Know About This Form

What is the IRS 1040 form?

The IRS 1040 form is the standard individual income tax return used by U.S. taxpayers to report their annual income, claim tax deductions, and calculate their tax liability. It is essential for determining how much tax you owe or how much of a refund you can expect. The form accommodates various income sources, including wages, dividends, and capital gains.

Who needs to file a 1040 form?

Most U.S. citizens and residents who earn income are required to file a 1040 form. This includes individuals with a job, self-employed individuals, and those receiving income from investments or rental properties. There are specific income thresholds that determine whether you must file, which can vary based on your filing status, age, and type of income.

What are the different versions of the 1040 form?

The IRS offers several versions of the 1040 form, including the 1040-SR for seniors, which has larger print and a simplified layout. Additionally, there are shorter forms like the 1040-EZ, which was previously available for simpler tax situations, but it has been discontinued. Taxpayers should choose the version that best fits their financial circumstances and complexity of their tax situation.

What information do I need to complete the 1040 form?

To fill out the 1040 form, you will need various pieces of information, including your Social Security number, income statements (like W-2s or 1099s), any tax deductions or credits you plan to claim, and details about your dependents. Gathering this information ahead of time can streamline the filing process and help ensure accuracy.

How do I file my 1040 form?

You can file your 1040 form in several ways. Many taxpayers choose to file electronically using tax software, which often provides guidance and can help maximize deductions. Alternatively, you can fill out a paper form and mail it to the IRS. Be sure to check the mailing address specific to your state and whether you are enclosing a payment.

What is the deadline for filing the 1040 form?

The deadline for filing your 1040 form is typically April 15th of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. If you need more time, you can file for an extension, but keep in mind that this does not extend the time to pay any taxes owed.

What should I do if I owe taxes but can’t pay?

If you find yourself owing taxes and are unable to pay the full amount, it is crucial to file your 1040 form on time to avoid penalties. You can then explore payment options, such as setting up an installment agreement with the IRS or applying for an Offer in Compromise, which may allow you to settle your tax debt for less than the full amount owed.

Can I amend my 1040 form after filing?

Yes, if you discover an error or need to make changes after filing your 1040 form, you can amend your return using Form 1040-X. This form allows you to correct mistakes, such as changes in income or deductions. It’s important to file an amendment as soon as possible to avoid potential penalties and interest on any additional tax owed.

Where can I find help with my 1040 form?

There are numerous resources available for assistance with your 1040 form. The IRS website offers detailed instructions and FAQs. Additionally, you can seek help from tax professionals, such as certified public accountants (CPAs) or enrolled agents. Many community organizations also provide free tax assistance, especially for low-income individuals and seniors.

Different PDF Forms

Snuggle Buddy Application - Looking for hugs? You’ve come to the right place.

Terminating Parental Rights in Sc - Affiants must indicate their age for legal verification purposes.

The Georgia Non-disclosure Agreement form is an essential tool for businesses seeking to protect their proprietary information. For more details, you can explore our resource on the necessary Non-disclosure Agreement process, which outlines the steps for creating and implementing this vital legal document.

Well Agreement - Each party must agree to not permit unauthorized users access to the shared well water.

How to Use IRS 1040

Filling out the IRS 1040 form is an essential step in reporting your annual income and calculating your tax obligations. After completing the form, you will need to review it for accuracy and submit it to the IRS by the deadline. Here are the steps to fill out the form:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Begin with your personal information. Enter your name, address, and Social Security number at the top of the form.

- If applicable, provide information for your spouse and dependents, including their names and Social Security numbers.

- Report your income. List all sources of income on the appropriate lines, including wages, interest, and dividends.

- Calculate your adjusted gross income (AGI). This includes deductions for retirement contributions and student loan interest, if applicable.

- Determine your standard deduction or itemized deductions. Choose the option that provides the largest deduction.

- Calculate your taxable income by subtracting your deductions from your AGI.

- Use the tax tables to find your tax liability based on your taxable income.

- Account for any tax credits you may qualify for, such as the Earned Income Tax Credit or Child Tax Credit.

- Calculate your total tax owed or refund due by comparing your tax liability with the amount already withheld or paid.

- Sign and date the form. If filing jointly, your spouse must also sign.

- Make a copy of the completed form for your records before submitting it to the IRS.